Personalization and Hyper-personalization in Banking

Personalized finance is all about meeting consumers where they are, across the tools and platforms they regularly use. For instance, Buy Now Pay Later (BNPL), also known as real-time installment lending, is now effortlessly incorporated into the shopping process. New features in banking apps now allow clients to link accounts from multiple banks, making it easier to monitor all their financial accounts in one place. Similarly, integrating banking details with investment apps now provides users with a clear view of their funds, enabling them to determine how much they can invest.

These are just a few examples of how personalized finance empowers consumers, giving them more control and visibility over their financial decisions. With the help of AI/ML development, banks can perhaps finally reach the levels of hyper-personalized services they have long strived for.

Personalization in Banking

Banks have long utilized customer microsegmentation to develop tailored offerings. For years, this approach successfully enabled them to differentiate, enhance customer engagement, and secure a competitive edge. However, this advantage is diminishing as retailers and tech-driven companies, such as Netflix, which prioritize personalization at the core of their business strategies, are surpassing banks. These organizations excel in scaling personalization to achieve notable performance improvements.

In modern banking, every interaction should feel relevant, timely, and specifically tailored to each individual. Personalized banking focuses on delivering exactly that. It focuses on gaining a deeper understanding of customers' financial aspirations, spending behavior, and risk tolerance. By utilizing customer data and advanced analytics, banks can deliver customized solutions that

- improve the customer experience

- foster loyalty

- unlock new revenue opportunities.

Note: The true potential of personalization in retail banking lies in moving beyond simple targeted marketing and next-best offers. Financial orgs need to create relevant end-to-end journeys for their customers. To achieve this, banks need to adopt a new perspective on personalization and redefine their strategic priorities.

Why is Personalization Important?

User experience drives modern banking forward, with personalization serving as the guiding principle.

A prime example of effective personalization is creating experiences that align with significant customer milestones. Imagine a young couple opening a joint checking account. This is not just a transactional process but the beginning of an evolving financial relationship. Their next steps could include buying a home (introducing the need for a mortgage), starting a family (potentially requiring a HELOC or car loan), and saving for their children's education (through college savings plans). Anticipating these needs and crafting personalized solutions ensures smart wealth management, where banks are trusted financial partners.

Empathy is at the heart of this approach. By understanding diverse customer archetypes and mapping out their financial journeys, banks demonstrate that they genuinely care about their customer's success. This empathetic, customer-focused strategy builds trust and loyalty, fostering stronger emotional connections. Modern banking websites capture the same human touch traditionally found in branch visits. They then extend it through apps for an impactful experience.

Note: Empathy is a vital component of the digital experience offered by financial institutions, helping customers form deeper connections with the brands they interact with. Modern banking websites, like traditional in-person branches, must prioritize empathy and personalization to foster trust and loyalty. While functional requirements remain critical, connecting with the audience on an emotional level is equally essential in creating a meaningful experience.

Hyper-Personalization in Banking

Hyper-personalization centers on a comprehensive understanding of each customer's distinct needs, preferences, and behaviors. By utilizing advanced data and analytics, banks can create services and products specifically tailored to individual customers. This fosters a more engaging and satisfying customer experience. Essentially, hyper-personalization is delivering highly precise, near-real-time messaging that processes recent customer behaviors, events, and real-time signals.

Despite growing customer demand for hyper-personalized experiences, creating them is not a simple task. The Maximizing Digital Engagement report by Infosys Finacle and Qorus shows that 71% of banks run personalized campaigns and communications. However, fewer than half of them are leveraging

- enterprise-level customer data management

- proactive advice and recommendations

- microsegmentation driven by data insights

- AI-powered and human-augmented sales strategies.

A recent Deloitte report reveals that customers now expect banks to deliver the same level of sophistication, immediacy, and personalization they experience in other industries (yes, we mean entertainment providers like Netflix). Many are even open to sharing their personal data if it leads to tailored services.

So, hyper-personalization has been a long-standing topic of discussion in banking. Yet, financial institutions are still unable to meet customer demand for the experiences they desire.

Here are five significant ways hyper-personalization is being applied in the banking sector:

- Customized product recommendations. Banks utilize customer data to offer personalized product suggestions that align with individual profiles and needs. This approach mirrors the personalized shopping experience of the top e-commerce platforms. It ensures customers receive recommendations relevant to their financial goals.

- Dynamic pricing and exclusive offers. First, the analysis of transaction history, credit scores, and spending patterns is conducted. Then, banks can offer dynamic pricing on loans, credit cards, and other financial products. Customers may also receive personalized rewards and special promotions tailored to their financial behaviors.

- Personalized financial guidance. Hyper-personalization enables banks to deliver bespoke financial advice. This may include investment strategies, savings plans, optimized budgeting tips, etc.

- Predictive and proactive customer service. Advanced analytics can help banks anticipate customer needs before they arise. For instance, by examining past interactions and preferences, financial institutions can refine their service. This can improve client responsiveness.

- Enhanced fraud detection and prevention. Hyper-personalization strengthens security measures by analyzing typical customer behavior patterns. Deviations from these patterns are flagged in real time. Banks thus can swiftly detect and prevent fintech fraud.

What Role Does AI Play in Hyper-Personalized Banking Services

The core of hyper-personalization lies in AI and ML. They empower financial institutions to process extensive structured and unstructured data. Technologies thus enable the creation of highly accurate, customer-centric insights. For instance, AI might recognize transaction patterns indicating a customer is preparing for a significant purchase, such as a car or home. This allows banks to proactively offer tailored financing options at precisely the right time.

AI-powered tools like chatbots and virtual assistants enable conversational banking and refine personalization further. By analyzing queries, transaction histories, and individual goals, these systems can deliver tailored financial forecasts, improving both efficiency and user satisfaction. In addition, with the adoption of cloud infrastructures, banks have significantly boosted data processing speeds. This advancement minimizes latency, ensuring the advice is delivered seamlessly and improving the overall user experience.

Real-Time Analytics and Channel Management for Personalized Communications

Delivering hyper-personalized customer experiences depends heavily on leveraging real-time analytics and effective channel management:

- Real-time analytics allow banks to make immediate decisions using up-to-the-minute customer data. This involves detecting changes in spending habits, identifying key life events, or monitoring browsing activity. Banks can act promptly to offer tailored solutions, advice, or promotions that resonate with customers in the context of their current needs.

- Equally important is ensuring these personalized engagements happen on the customer’s preferred communication channels. Whether through mobile app notifications, SMS, email, or personalized web experiences, successful channel management ensures messages reach customers where they’re most likely to engage.

Personalized Banking Examples

There are always forward-thinking institutions that recognize the critical need for constant innovation and flexible strategies to align with their clients' evolving financial journeys. Here's how some leading financial organizations utilize cutting-edge fintech software and technologies to deliver hyper-personalized experiences.

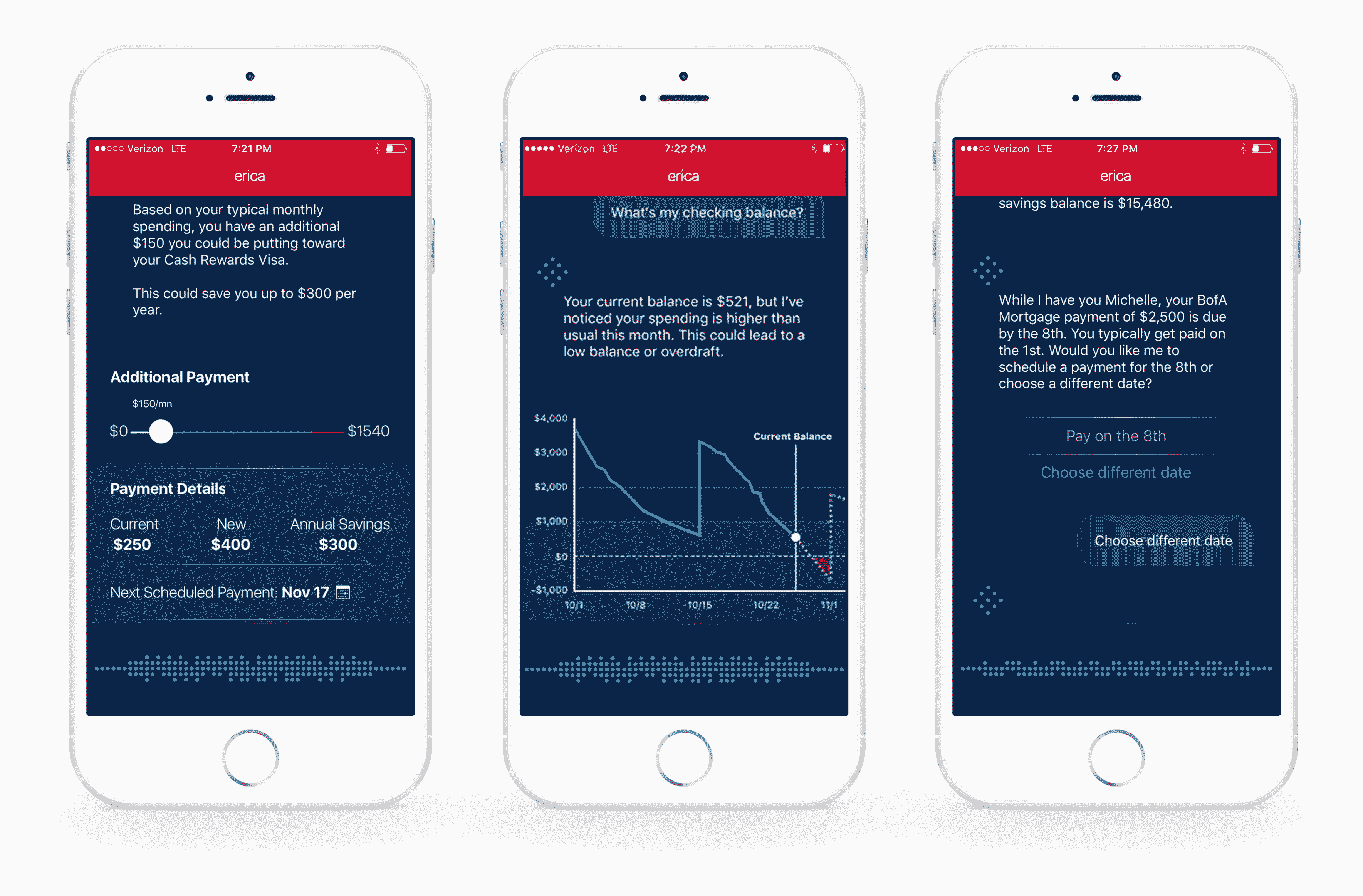

Virtual Financial Assistant by Bank of America

Bank of America's virtual financial assistant, Erica, engages customers with highly personalized, dynamic, and predictive interactions. It analyzes data such as account balances, transaction histories, spending patterns, payment alerts, and duplicate transactions. Then, Erica delivers tailored insights and advice based on individual needs, enhancing the overall customer experience.

Life Stage Segmentation with Ally Bank

Ally Bank uses age segmentation to support customers through various life milestones, such as getting married, purchasing a car, buying a home, saving for children's education, or planning for retirement. By understanding the distinct needs of younger urban clients compared to older non-city dwellers, Ally creates finely tailored product offerings. Their use of AI to divide customer information into smaller, more specific segments allows them to provide services that feel custom-designed for every individual.

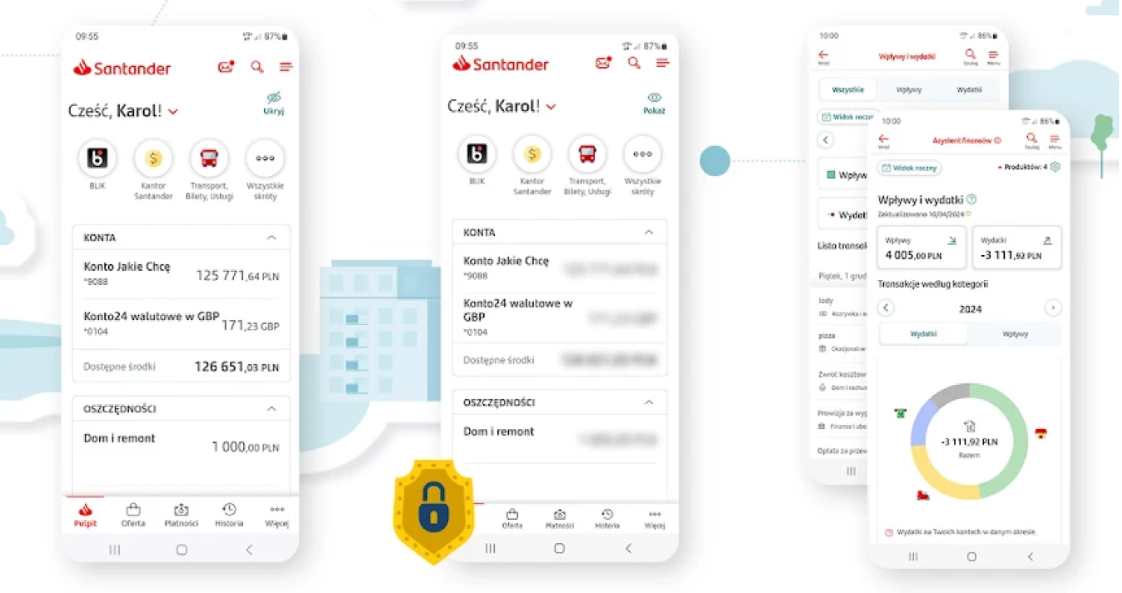

Understanding Customers with Santander Bank Polska

Santander Bank Polska's "Neo Intelligence" initiative enhances personalization through the analysis of client activities on social networks. This approach enables the bank to better understand customer motivations and preferences. By leveraging social media insights, Santander can offer customized financial products starting at the digital customer onboarding stage.

Eco-Friendly Banking by Mitto

Mitto, an innovative neobank, combines sustainability with financial services by supporting customers in making environmentally conscious purchases. Customers can receive discounts on eco-friendly brands, view the carbon footprint of their transactions, and support causes that align with their environmental values. This approach not only encourages sustainable living but also embeds Mitto into the customers' daily decision-making process.

Enhanced Personalization at the Bank of Ireland

The Bank of Ireland has significantly upgraded its customer experience by combining online and offline data for improved personalization. Using advanced tagging and monitoring techniques, the bank customizes its messaging to individual customers. This approach has led to a remarkable 278% increase in application submissions across all channels, showcasing the profound impact of tailored content on customer engagement.

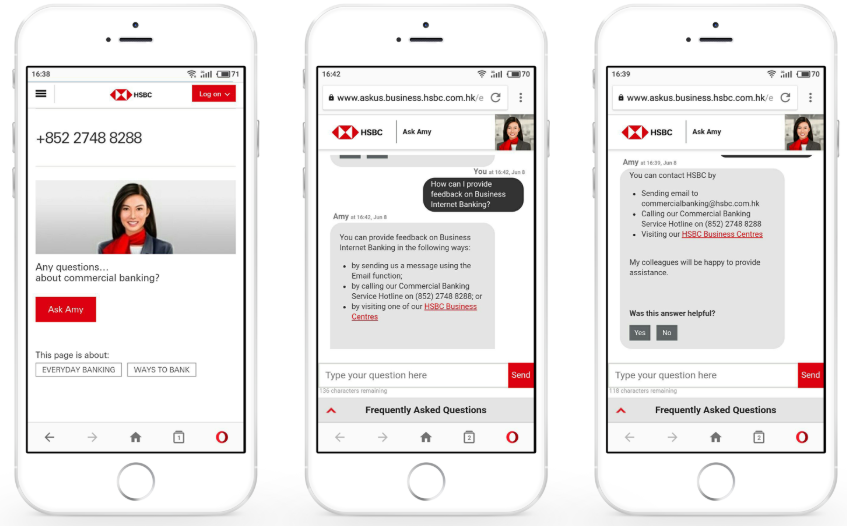

HSBC's AI Chatbot for Corporate Banking Support

Amy is an advanced AI chatbot designed specifically for corporate banking customer support at HSBC Bank in Hong Kong. Amy has proven instrumental in enhancing HSBC's customer support capabilities, especially as one of the busiest banks in the Chinese market. Although she doesn’t yet cover all possible customer questions, Amy excels at handling frequently asked questions, straightforward inquiries, and common customer requests. For issues that fall outside her current expertise, Amy seamlessly connects customers with a live consultant, ensuring a smooth and efficient support experience.

ImaginBank's Chatbot for Personalized Promotions

ImaginBank has introduced Gina, a chatbot available through Messenger. Gina offers users personalized promotions based on their location, preferences, and interests, making banking more interactive and convenient. Users can set financial goals, such as defining a savings target or setting a timeline to repay a loan. By analyzing this data, Gina provides tailored solutions, which include discounts on entertainment and other expenses.

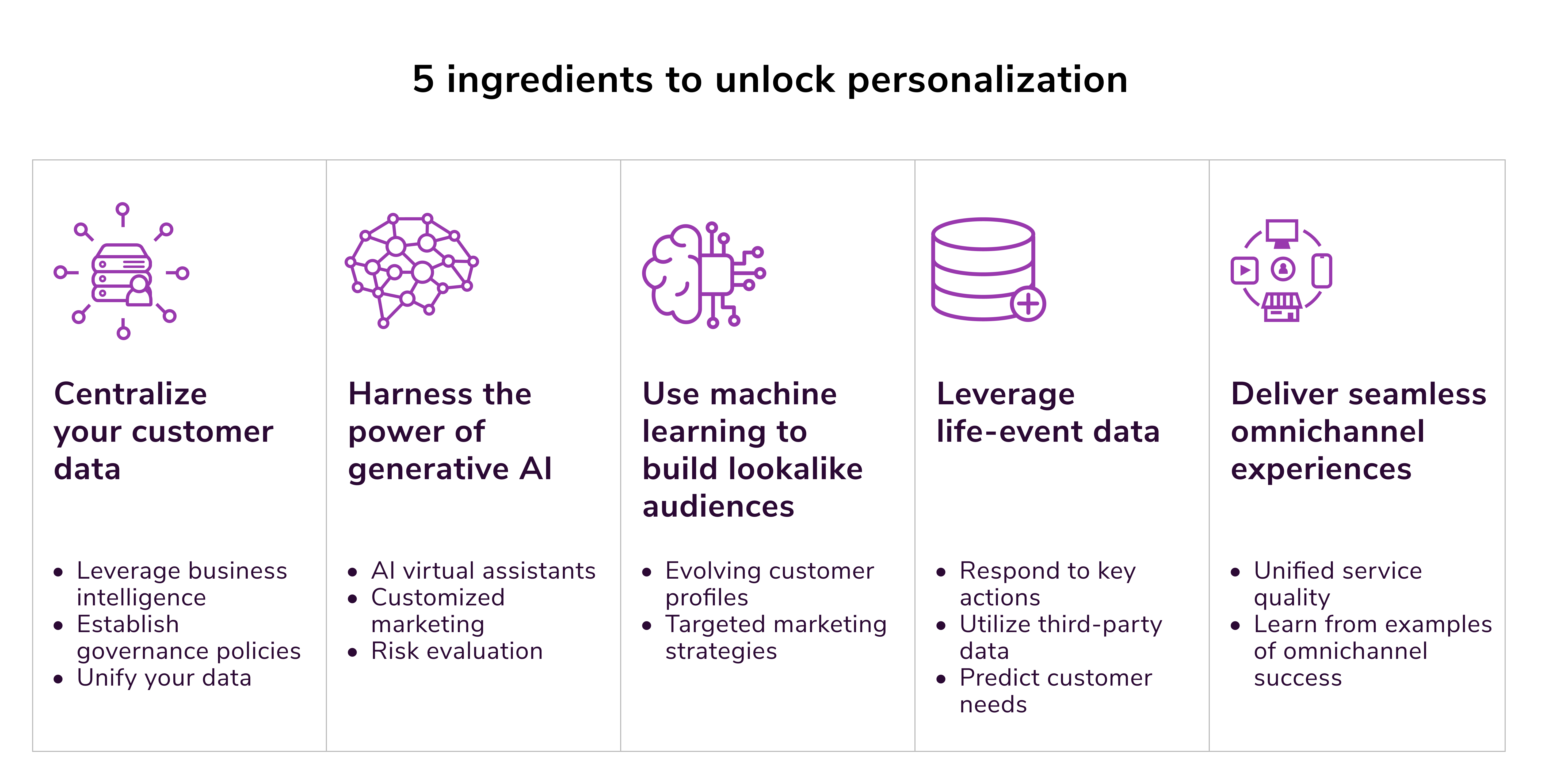

How to Unlock Hyper-Personalization

Personalization is delivering tailored services, relevant information, and timely advice across every stage of the journey. These regular, meaningful interactions—not occasional sales pitches—are what ultimately define the customer's banking experience. Despite this, many banks still prioritize personalization efforts within the sales domain.

Achieving personalization at scale requires several key capabilities. It depends on

- continuous learning from data

- a comprehensive, unified view of the customer

- the ability to design a personalized "curriculum" of interactions aimed at influencing customer behaviors.

With this in mind, hyper-personalization can be unlocked in three stages.

Know Your Customer (KYC)

An in-depth understanding of customers extends far beyond basic demographic data. Organizations can achieve this by

- tapping into external sources such as social media

- analyzing past customer interactions

- creating customer data platforms that aggregate insights from multiple institutions.

Another effective strategy is adopting a "customer genome" approach, where customer models are created based on demographic attributes like age, gender, ethnicity, and life stages. These models provide valuable insights into customers and enable proactive addressing of their needs. This strategy can also accelerate go-to-market timelines by enabling the creation of dynamic, boundaryless data platforms that deliver personalized experiences. For instance, the growing popularity of BNPL services showcases how credit decisions are rapidly made using customer creditworthiness derived from an array of data points.

Understanding and Analyzing Customer Data

Customer data provides three essential types of insights that banks can leverage:

- Descriptive insights. These focus on explaining and illustrating the intricate details of a customer's financial activity, such as transaction history, spending habits, asset holdings, and portfolio performance. They create a clear snapshot of past behaviors and current conditions.

- Diagnostic insights. Diagnostic insights address the "how" and "why" behind customer behavior, offering banks a deeper comprehension of financial patterns and helping to explain the reasons behind specific outcomes or trends.

- Predictive insights. Predictive insights allow banks to anticipate a customer's financial future. They can provide early warnings for potential issues like cash flow shortages, penalties, or unplanned significant payments, as well as highlight opportunities, such as early loan closures. By identifying patterns within customer data, predictive analytics helps banks proactively meet their customers' needs and prevent fraudulent activities.

To harness these insights effectively, banks need a robust foundation supported by advanced technologies, including AI, ML, and cloud computing. A critical part of this process is the establishment of an asset library composed of four key layers:

- Data layer: Consolidates and standardizes raw data for easy access and analysis.

- Analytics layer: Processes and interprets data to uncover actionable insights.

- Decision-making layer: Guides informed, data-driven strategies.

- Execution-and-measurement layer: Implements actions and measures their effectiveness to ensure continuous improvement.

By leveraging an asset library, banks can streamline and modularize data and analytics while seamlessly integrating decision-making and execution processes. Scaling these operations effectively requires adopting cloud computing solutions, which provide the infrastructure needed to support AI and ML at a larger scale. According to a BCG report, approximately 86% of banks are exploring cloud-based options such as SaaS and PaaS for their next-generation CRM platforms.

Leveraging Insights

Deep customer insights, paired with a clear understanding of desired outcomes, empower banks to guide customers toward making informed financial decisions. These nudges can be customized and scaled for each individual by leveraging insights to recommend actions such as completing tasks via the next best action, integrating with lifestyle journeys, or facilitating automated savings.

Achieving hyper-personalization for large populations demands the use of advanced conversational AI. By employing chatbots and voice assistants, banks can offer real-time, round-the-clock personalized interactions. These tools not only enhance customer experiences but also proactively identify when human support is needed, ensuring seamless handoffs to appropriate representatives, reducing wait times, and improving overall satisfaction.

Monzo, a leading challenger bank in the UK, uses behavioral data to pinpoint customer pain points, enabling their support teams to address 85% of daily queries without involving their data specialists.

Technologies Enabling Hyper-Personalization in Banking

Hyper-personalization in banking is possible due to advanced technologies. Let us name a few.

Predictive Analytics

Modern banks harness advanced analytics to understand customer behavior and anticipate needs. By analyzing transaction patterns, product usage, and channel preferences, these tools suggest personalized solutions like investment products, budgeting tools, or payment reminders. For example, booking a flight may lead to timely offers for travel insurance or rewards credit cards.

Customer Data Platforms (CDPs)

CDPs consolidate data from all customer interactions, such as mobile app activity, online behavior, branch visits, and service calls. By breaking down silos, CDPs provide a comprehensive view of each customer, enabling personalized services across all channels. For instance, with a 360-degree customer profile, banks can recommend relevant products, enhance support interactions, and deliver valuable alerts.

Smart Terminals and Kiosks

Self-service kiosks and smart terminals go beyond providing simple services like balance checks. These systems recognize returning customers, offer personalized shortcuts, and tailor offerings based on language or past transactions. Such tools help improve branch efficiency.

Appointment Management Systems

Efficient queue management and appointment booking systems are vital for optimizing in-branch experiences. These systems direct customers to the appropriate staff members based on their needs, such as loans or credit card inquiries, while reducing wait times. They also integrate with customer profiles, enabling staff to prepare for interactions in advance.

Chatbots

NLP technology enables chatbots to communicate naturally with customers, offering personalized support based on user intent and history. For instance, a bot can respond to loan status inquiries or guide users to the appropriate department, all while maintaining a conversational tone.

Common Obstacles to Successful Banking Personalization

While financial institutions are investing heavily in the vision, the so-called "Netflix of banking" has yet to emerge. This is primarily because true end-to-end personalization demands the development of several complex capabilities. It involves

- offering consistent cross-channel experiences

- fostering collaboration across the entire organization

- maintaining a unified customer profile

- establishing advanced technology infrastructure.

These are significant challenges, and few banks have fully mastered them so far.

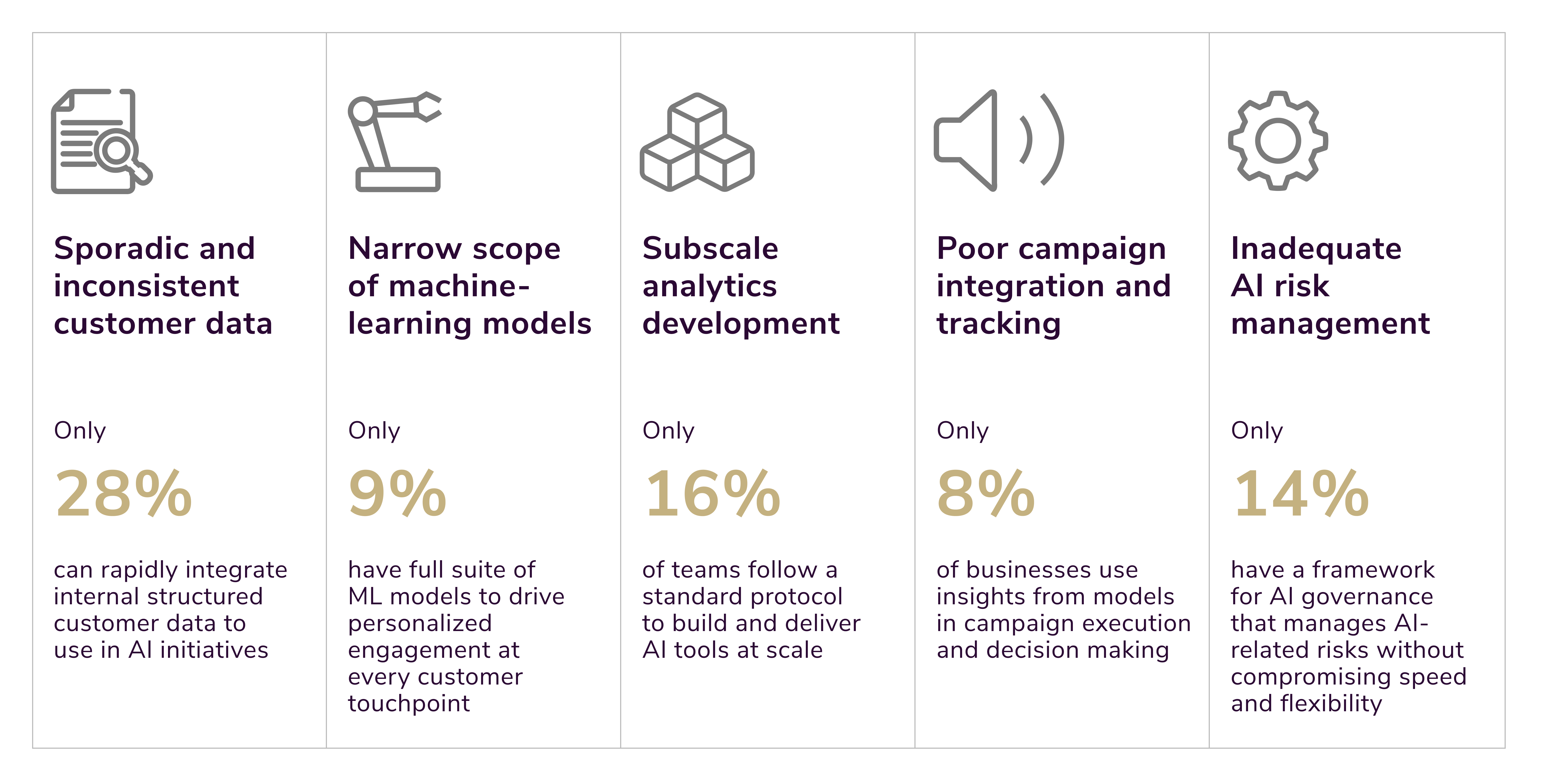

The image below illustrates common obstacles to implementing personalized banking services, as per McKinsey.

Indeed, fragmented databases within banks often hinder the ability to organize information efficiently and create comprehensive 360-degree customer profiles. This limitation can result in customers with varied needs and preferences being offered identical products. Marketing strategies in banks frequently stick to outdated, rigid calendar-based frameworks or feature conflicting product lines competing for prominence.

Additionally, legacy IT systems often struggle to measure campaign effectiveness or recommend next-best actions, while organizational silos and complex structures restrict coherence and alignment. Consequently, while many banks aim to develop personalized marketing tactics, they often overlook the broader strategic opportunity for meaningful differentiation.

Roman Zomko

Other articles