Best Practices for Digital Customer Onboarding for Financial Institutions

Onboarding used to be an underfunded and overlooked area in the global banking arena. That partly changed when the pandemic hit the world (yes, it does seem like COVID-19 left its imprint in every industry), bringing more consumers online than ever before. David Malpass, President of the World Bank Group, states that the digital transformation changed people’s perception of their personal finance management. Millennials and Gen Z consumers dominate digital markets, thereby driving major changes. This audience is tech-savvy and prefers user-friendly digital interactions, especially when it comes to onboarding. So, this transformation is ongoing.

The onboarding phase sets the tone for the client-bank relationship. When the process is inefficient or frustrating, it can result in lost customers, diminished revenue, and damage to the bank's reputation. But how can financial institutions simplify the digital onboarding experience? What fintech software excels in this regard?

We’ve researched current industry efforts and opportunities for improvement. Read on for a step-by-step guide to optimizing customer onboarding in banking.

Customer Onboarding in Banking

The customer onboarding process, essentially the step where a new customer registers, is one of the most significant phases for any business. After dedicating resources to marketing and communication and following all the hard work of the sales team, this step marks the culmination of the entire sales effort.

For banks and financial institutions, the equivalent of completing the sales process is opening a new account. At this point, customers who choose to purchase a financial product already have expectations about their satisfaction with the product and their future relationship with the institution they've selected. Optimizing onboarding is all about meeting those expectations and establishing the groundwork for a long-lasting and mutually beneficial customer relationship.

The customer onboarding process plays a pivotal role in banking for several reasons:

- It forms the customer’s first real interaction with the bank, serving as the foundation for a strong, long-term relationship.

- A seamless onboarding experience helps customers quickly grasp and utilize the bank’s services. This enhances satisfaction and fosters greater customer loyalty, retention, and overall lifetime value.

- It ensures compliance with essential regulatory requirements like Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures, reducing the risk of fraud and meeting legal obligations.

- By thoroughly verifying new customers, banks can identify and minimize risks, safeguarding their operations.

- A transparent and secure onboarding process instills trust between the bank and its customers.

- Onboarding offers banks valuable insights through customer data, enabling them to deliver tailored product recommendations and boost revenue through cross-selling or upselling opportunities.

- A well-executed onboarding process can set a bank apart in a competitive market, acting as a key differentiator.

Note: it’s a common perception that opening an account at many banks has become more complex over time. Heightened regulatory requirements, strict compliance standards, and growing control measures have added layers to the process. Modern banks now gather more customer information than ever, implement more steps during onboarding, and maintain rigorous oversight throughout the service lifecycle. On the flip side, digital platforms—from e-commerce and ridesharing to P2P payment apps and online lenders—have simplified and streamlined account setups. This shift in ease and efficiency has begun reshaping customer expectations, particularly for Millennials, who are accustomed to seamless digital experiences.

Why Should Banks Enhance the Digital Client Onboarding Process?

A seamless account opening experience is crucial for banks to stay competitive and foster customer loyalty. When customers feel that the account opening process at their bank could be improved, they are more likely to consider switching to another financial institution. These dissatisfied customers are also less inclined to purchase additional services or recommend the bank to friends and family.

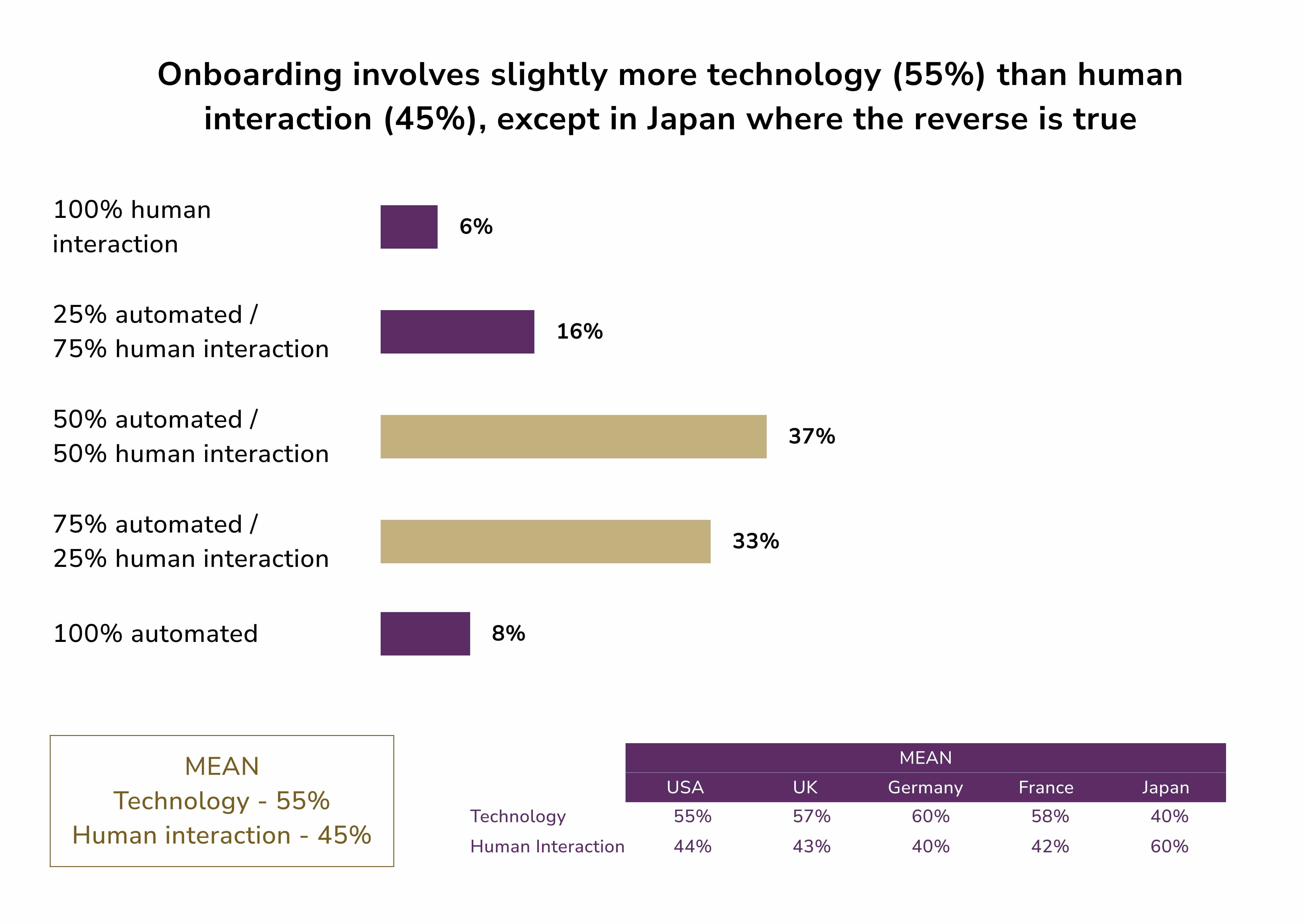

But what exactly does a better account opening experience entail? The primary factor is speed. The faster the process, the less room there is for dissatisfaction. No less important is personalization in banking. Customers expect banks to utilize existing information to not only expedite the process but also tailor product recommendations to meet their needs. Additionally, banks should provide clear, step-by-step instructions during the account opening process and follow up with customers to ensure they’re satisfied and have no unresolved questions.

How can banks achieve this? By investing in both advanced digital interfaces and tools for their frontline staff, banks can create a more empathetic and efficient customer experience. Equipping staff with the right technology helps them address customer needs more effectively while maintaining a human touch. Furthermore, banks should leverage regulations in their messaging strategies, emphasizing security and reliability. This approach not only ensures regulatory compliance but also builds customer trust in the institution's commitment to safety and rigor.

Who Needs an Improved Account Opening Experience?

To explore how various factors influence the account opening process for retail banking customers, Deloitte conducted a survey of over 3,000 individuals who had recently opened bank accounts in three product categories (refer to the appendix for the survey methodology).

What did the survey reveal? Several noteworthy findings emerged. First, consumers generally view the account opening process at banks more positively compared to registration processes in other industries. Additionally, a significant number of customers, including Millennials, are aware of the regulations around account opening and consider these regulations beneficial.

Most importantly, however, while customers across all age groups are largely satisfied with the account opening process, a sizable portion wishes for improvements. Notably, Millennials, mobile banking users, and recently acquired existing customers are the groups that most strongly advocate for a better account opening experience.

Bottlenecks of Digital Customer Onboarding in Corporate Banking

The customer experience in corporate banking often hides an underappreciated opportunity for banks to differentiate themselves, boost efficiency, and drive revenue growth. According to McKinsey, corporate clients are projected to drive a significant annual growth of 9% in global banking revenues by 2025. Much of this growth is expected to stem from fee-based services, including digital and real-time domestic payments, as well as beyond-banking solutions such as spend analytics and cash flow forecasting.

However, the onboarding process for a new corporate client can take as long as 100 days on average, with variability depending on the products offered and the geographical regions involved.

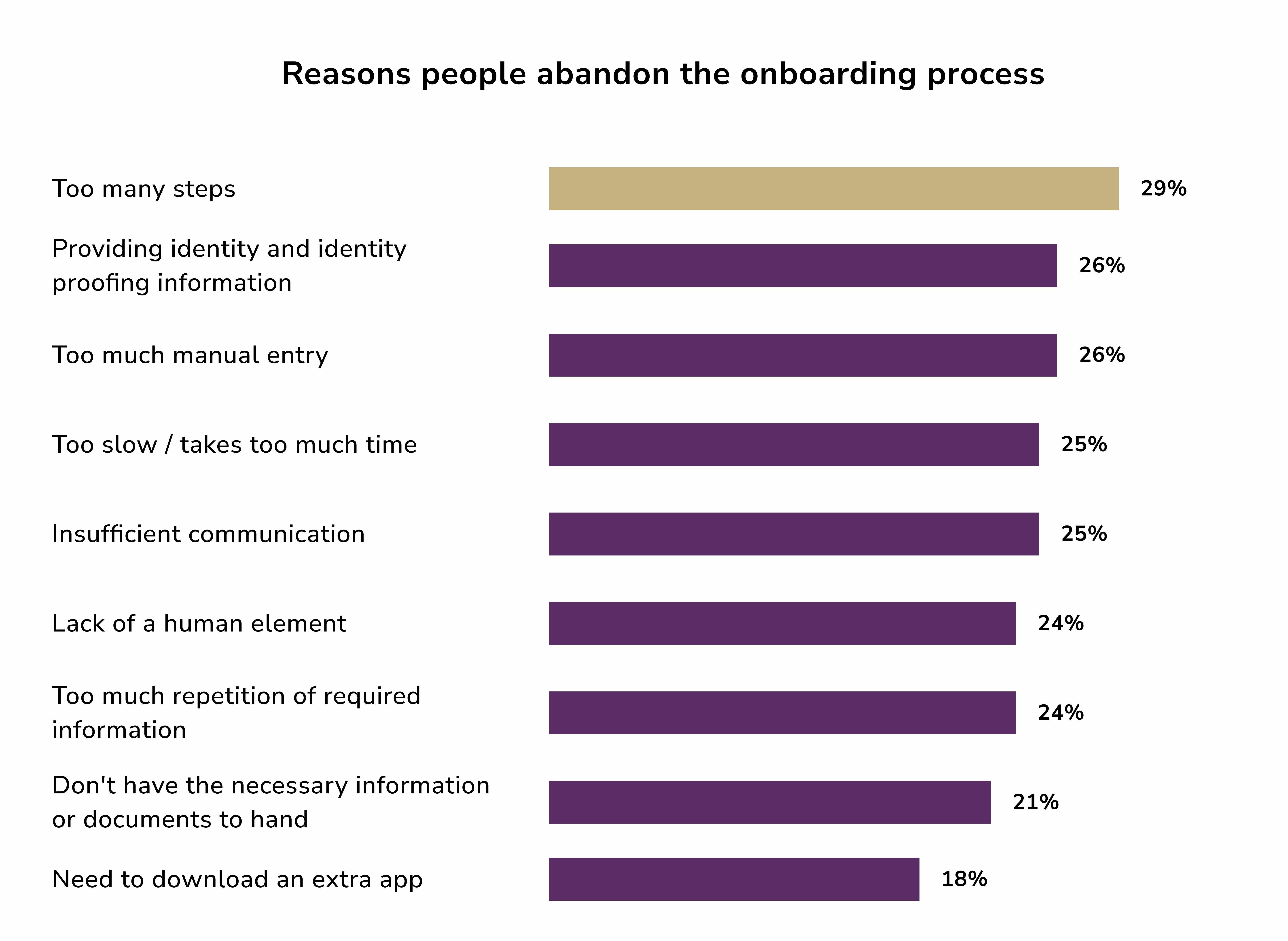

Corporate clients, much like retail banking customers, value seamless, intuitive digital access to services. Yet, too often, their expectations go unmet. Instead of streamlined, user-friendly processes, corporate customers often find themselves navigating onboarding procedures that are slow, redundant, and overly complicated. This complexity can result in customer drop-offs or dissatisfaction among existing clients.

Enhancing Digital Customer Onboarding in Corporate Banking

For banks, rethinking and refining the process of opening new corporate accounts means ensuring their position among major industry players.

1. A Unified Client Experience

McKinsey research indicates that corporate clients prefer having a centralized, self-service portal to interact with their bank. To make such portals effective, they should include intelligent intake interfaces that adapt to individual clients by asking only the most relevant questions, using prior answers to personalize future interactions. Top-performing banks continuously enhance these platforms with client feedback.

Essential features for these portals include:

- Real-time status updates.

- Automated document uploads.

- Multifactor biometric authentication.

- AI-powered chatbots for conversational banking.

- E-signature capabilities.

Advanced additions, like prepopulated data sourced publicly and prefilled approval-ready documents, further streamline the process. For corporate clients who manage multiple banking relationships, having seamless API integrations to access banking services directly through their existing financial systems is an added benefit.

2. Prioritizing Speed and Transparency

To meet client expectations, leading banks set clear onboarding timelines for various products conveyed through checklists or service-level agreements. Speed during onboarding is not just about client satisfaction—it directly impacts the time it takes to generate revenue, a key metric for many banks (typically ranging from 30 to 100 days). By closely monitoring and addressing delays in this timeline, banks can optimize this critical process driver.

3. Processes Enhanced with Technology

Case managers and onboarding teams often face challenges due to limited transparency in their workflows. This is where the latest digital banking trends introduce intelligent workflow systems come into play. Banks are investing in low- or no-code software solutions that can be customized to their needs. These systems automate case assignments based on a client’s risk profile, streamline progress tracking, and provide real-time alerts about outstanding documentation.

To enhance these processes further, top banks are integrating artificial intelligence. AI is used to:

- Resolve duplicate documents.

- Identify anomalies and inconsistencies in data.

- Enforce business rules automatically.

- Digitize and organize client-provided documentation.

4. Data-Driven Solutions

Onboarding often requires case managers to collect up to 100 documents and input data across 150 fields. Leading banks are cutting down this workload by utilizing centralized databases that auto-upload existing client records and prepare prefilled templates for new accounts. Additionally, these banks use transaction data for real-time credit scoring and predictive analytics to refine pricing on treasury products.

Beyond expediting onboarding, banks can use client data to fuel innovation. With customer consent, transaction data and KYC records can generate comprehensive 360-degree customer profiles. These profiles enable banks to create new, targeted services and customized product offerings. For example, some banks deploy embedded wizard tools to calculate their share of a client’s wallet, improving upselling efforts.

5. Investment in Skilled Teams

To deliver the fast, tech-enabled onboarding experiences clients expect, banks need case managers with a broad understanding of the entire workflow, from technology tools to data analytics. This calls for significant investment in training and upskilling staff to build expertise. While technology can mitigate data-quality challenges and streamline operations, it may also reduce the number of required personnel over time, leading to more expertise-focused career paths for remaining staff.

Digital Onboarding Process Transformation

To succeed, banks must approach onboarding with both an operational and strategic mindset. Below are several most important aspects to take into consideration.

Simplify Registration with Fast, Easy-to-Complete Forms

When designing a registration experience, it needs to be simple, intuitive, visually appealing, and above all—quick. Today’s users are used to immediacy, and nowhere is this more important than in the financial sector. Whether someone wants to sign up for a bank account or access financial services, they prefer a process that is both swift and secure. The faster they can complete it (and start using the service), the better.

To achieve this, registration forms should prioritize ease of completion. Start by requesting only the most essential information. Additional details can be collected later through a process known as progressive profiling—after the primary sign-up phase is complete.

Offer Comprehensive Customer Support Throughout the Process

Providing excellent customer support is crucial during the entire onboarding process. This can include real-time assistance through chatbots and live chats with human representatives to address any questions or concerns potential clients may have. Additionally, it’s essential to offer support through other channels such as phone lines, email, and even social media platforms. This multi-channel approach ensures users can easily reach out and resolve any issues quickly, improving their overall experience.

Use and Analyze User-Generated Data

Gathering insights from user-generated data during the registration process is a valuable way to continuously improve it. For instance, tracking metrics like the time it takes to complete registration or pinpointing stages where users commonly drop off can highlight areas for improvement. Utilizing tools such as heatmaps can further provide details on navigation behaviors, such as mouse or finger movements on the registration form. These insights can be leveraged to optimize the process and increase completion rates.

Adopt a Service Design Approach

Achieving meaningful changes in client onboarding often hinges on adopting a service design approach. This method prioritizes creating value for both the client and the internal user while ensuring a seamless, end-to-end experience throughout the onboarding process.

Service design operates on two levels—front stage and backstage. On the front stage, it focuses on shaping the experience that clients and internal users interact with directly. Backstage, it orchestrates every element required to deliver this experience, encompassing processes, people, technology, tools, and policies. A key principle of service design is breaking down organizational silos to promote cross-functional collaboration.

Without this mindset and methodology, organizations risk creating inwardly focused solutions that fail to address pain points and continue delivering subpar experiences for clients. Recognizing this, corporate and investment banks are ramping up their efforts by building new service design capabilities and launching dedicated teams to implement such frameworks.

Ensure Seamless Digital KYC

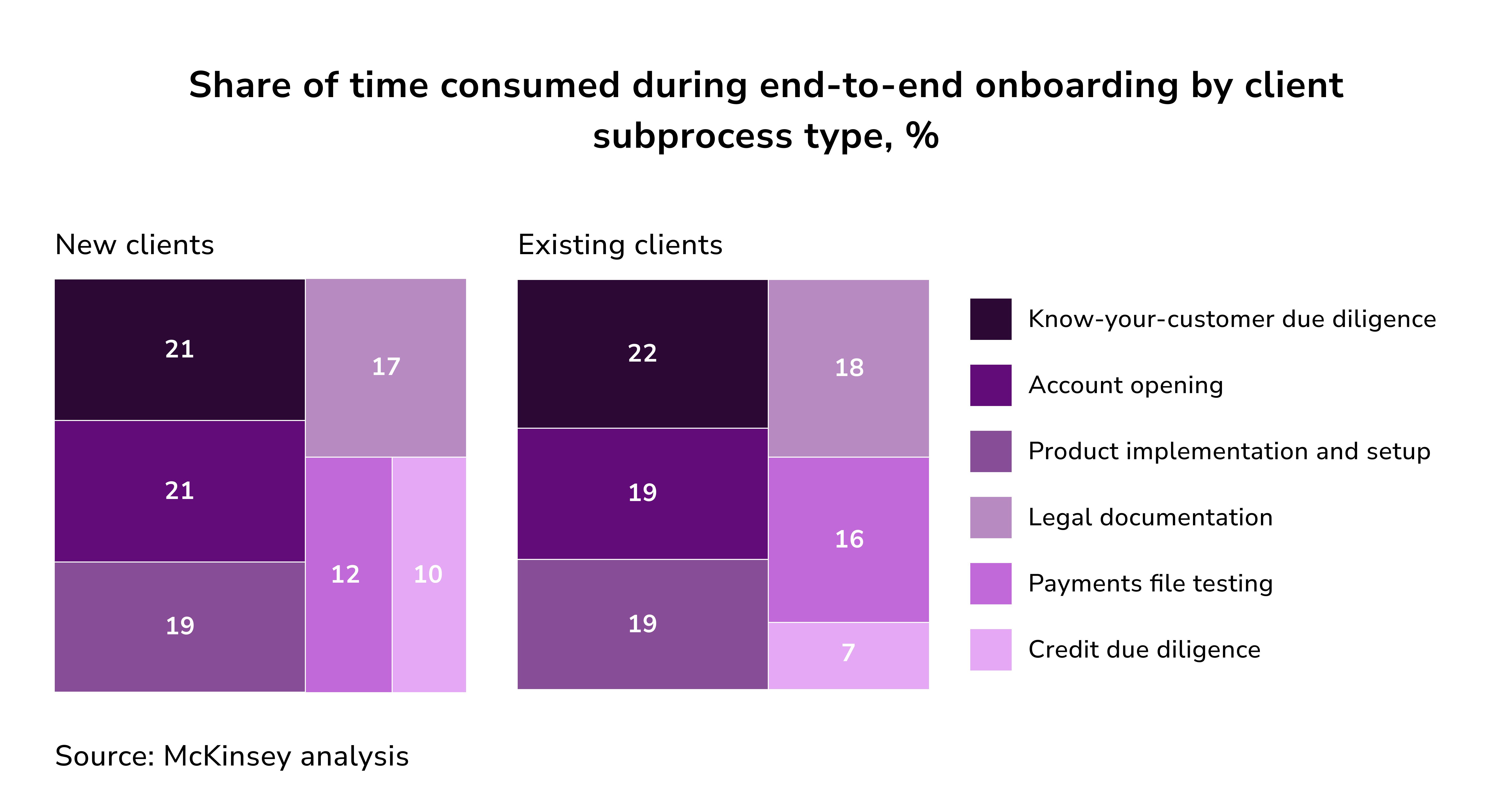

The processes of Know-Your-Customer (KYC) due diligence and account opening make up over 40% of the time spent during onboarding. These are critical yet complicated steps due to fragmented, manual workflows and disconnected internal systems. For example:

- KYC due diligence often involves variations in local regulations requiring individually tailored client contracts, adding layers of complexity. Automating data aggregation from public sources, utilizing existing customer data, and eliminating redundant fields on forms can simplify this process.

- Account opening delays are largely caused by manual data entries and poor system integration. Streamlining these steps can significantly cut down overall onboarding times.

The best client onboarding experiences are easy, efficient, and entirely digital. It shouldn’t feel like a burden for either the customer or the bank.

At its core, every client onboarding process revolves around managing data. Delays during this stage often stem from the "know your customer" (KYC) compliance process. However, the real roadblock lies in gathering and processing the KYC-related data and documentation. Streamlining how this information is collected, evaluated, and assessed for risk is crucial for creating a smooth onboarding experience within financial services.

Tips for Safer Onboarding in Banking

In the ever-evolving landscape of banking, where digital interactions are becoming the norm, ensuring the security and integrity of onboarding processes is paramount. Here are several strategies that financial institutions can adopt to enhance their onboarding protocols and mitigate risks associated with fraud and identity theft.

Trace Users' Digital Steps

Understanding the digital footprints of users is crucial in creating a secure onboarding experience. By tracing users' digital steps, banks can gather valuable insights into their behavior and intent. This can be accomplished through various analytical tools that monitor how users navigate the onboarding platform—from their initial visit to the final submission of their applications.

For instance, by implementing session replay technologies, banks can observe interactions in real-time, tracking mouse movements, clicks, and scrolling patterns. This data not only helps in identifying potential bottlenecks in the onboarding process but can also flag unusual or suspicious activities. If a user exhibits erratic behavior—such as sudden changes in IP addresses during the onboarding session or frequently changing input information—it can trigger alerts for further verification.

Analyze Users' Browsing Behavior

In addition to tracing users' digital steps, analyzing browsing behavior provides deeper insights into user intent and authenticity. By employing advanced analytics and behavioral biometrics, banks can gain a comprehensive view of how users interact with their online platforms.

For example, patterns such as the frequency of visits, time spent on specific pages, and the types of devices used can reveal potential red flags. A new user who spends an unusually long time on the "Submit Documents" page or a user who jumps from one section to another without completing the required fields may warrant closer scrutiny.

Incorporate IP Checks into KYC

In the context of Know Your Customer (KYC) regulations, integrating IP checks into the onboarding process is an essential safeguard. By verifying the geographic location of a user's IP address, banks can assess the legitimacy of the application.

For example, if a user claims to reside in one country but is accessing the platform from a different region, this discrepancy can trigger further investigation. Utilizing geolocation technology can help banks identify users operating from high-risk jurisdictions known for cybercrime or money laundering activities.

Note: To foster trust and thrive in the financial services sector, the onboarding process must seamlessly blend speed, security, and convenience. Customers today have little tolerance for subpar digital experiences, gravitating instead toward services that cater to their needs with minimal effort. To prevent losing potential clients, KYC checks should be both efficient and thorough, ensuring full compliance while being completed in mere minutes.

Digital Onboarding Solutions for Banks

Here’s an in-depth look at five prominent onboarding solutions: Whatfix, Backbase, Moxo, Fenergo, and Q2 Gro.

1. Whatfix

Whatfix is a dynamic digital adoption platform designed to simplify user onboarding through interactive guides and contextual assistance. By providing step-by-step walkthroughs, Whatfix enables banks to educate customers during their initial interaction with banking applications, significantly reducing the learning curve.

Key Features:

- Self-service Guidance: Users can access tutorials and onboarding flows without needing direct support, empowering them to navigate digital banking services at their own pace.

- In-app Messaging: Banks can send targeted messages based on user behavior, ensuring timely assistance and engagement.

- Analytics and Insights: Whatfix offers detailed analytics that help banks understand user engagement levels, allowing them to refine content and enhance the onboarding experience continuously.

2. Backbase

Backbase provides a comprehensive digital banking platform that emphasizes customer engagement and seamless onboarding. Its solutions are designed to unify customer interactions across various channels, making banking simpler and more accessible.

Key Features:

- Omnichannel Experience: Backbase ensures a cohesive experience whether customers interact via mobile apps, web interfaces, or in-branch services.

- Instant Account Opening: With pre-filled forms and KYC (Know Your Customer) compliance checks, customers can open accounts quickly and efficiently.

- Customizable Dashboards: Banks can tailor onboarding flows that reflect their unique brand identity and customer needs, facilitating an engaging introduction to services.

3. Moxo

Moxo is a customer experience platform that focuses on enhancing client engagement through secure and collaborative environments. Its onboarding solutions cater specifically to financial institutions, addressing the need for compliance and security while ensuring a user-friendly experience.

Key Features:

- Secure Client Portal: Moxo provides a highly secure communication channel for sharing documents, facilitating conversations, and managing tasks, all within a controlled environment.

- Collaboration Tools: Teams can collaborate on client projects in real-time, enhancing service delivery and responsiveness.

- Document Management: Automated workflows streamline document submissions and approvals, simplifying the onboarding process.

4. Fenergo

Fenergo specializes in client lifecycle management (CLM) solutions, particularly for the onboarding of institutional and corporate clients. It tackles the complexities of regulatory compliance while enhancing the overall onboarding experience.

Key Features:

- Regulatory Compliance Automation: Fenergo automates the process of KYC, AML (Anti-Money Laundering), and other regulatory checks to ensure compliance without sacrificing speed.

- Workflow Management: Its robust workflow tools streamline the onboarding process, allowing banks to efficiently manage client interactions and documentation.

- Integration Capabilities: Fenergo seamlessly integrates with existing banking systems, enabling banks to leverage their current technology stack effectively.

5. Q2 Gro

Q2 Gro combines cutting-edge technology with a focus on community banking to provide a holistic onboarding solution that engages customers from the outset. The platform emphasizes personalization and responsiveness in its onboarding processes.

Key Features:

- Customizable User Journeys: Q2 Gro allows banks to design personalized onboarding experiences tailored to individual customer needs and preferences.

- Integrated Communication Channels: The platform supports various communication methods, ensuring that customers can reach out for help however they prefer.

- Data-Driven Insights: With robust analytics tools, banks can track onboarding progress and customer interaction metrics, enabling continuous improvement.

Final Word

The banking sector stands at a pivotal moment in its transformation, with onboarding processes shifting into high gear. By learning from fintechs’ flexibility and customer-first mindset, banks can elevate onboarding into a differentiator, not just a transaction. The result? Loyal clients, streamlined workflows, and a significant competitive edge in an evolving industry.

The emphasis on enhancing corporate client onboarding has swiftly risen to the top of many banks' agendas. By improving this often-overlooked aspect of customer experience, banks have an opportunity to achieve competitive differentiation, enhance process efficiency, and unlock potential revenue growth. The current backdrop of rising global interest rates and the growing preference for fee-based transactions—which minimize capital risk—only adds further urgency to prioritize onboarding in the realm of Global Transaction Banking (GTB). This environment also makes it a focal point for additional investments by both leading banks and fintech innovators.

Roman Zomko

Other articles