Financial Forecasting and AI

Financial models can sometimes be as fragile as a house of cards, with a network of assumptions holding the business together. AI might not immediately come to mind for modeling, but fintech is much closer to making it the go-to solution than many realize. Why?

Accurate forecasting is the foundation for business decision-making. Traditional financial models often fall short. They rely heavily on past trends and limited data, leading to inaccurate predictions. This is where the outburst of AI solutions development can bring value. AI's predictive analytics considers a broader range of variables than traditional approaches. It enables real-time adjustments, using natural language for complex report creation. It then pinpoints trends, risks, and opportunities that might otherwise be overlooked.

Let’s explore more of AI's strengths in forecasting.

What is Financial Forecasting?

Financial forecasting involves predicting future financial conditions based on historical data and analysis. This process helps businesses manage risks and build growth strategies. They can make informed decisions about investments, expenses, and revenue generation. In short, companies can predict challenges and opportunities by studying past trends.

Traditional financial forecasting methods have three pressing problems:

- They rely on quantitative methods. They use statistical tools to analyze historical financial data. These methods don't always consider sudden market shifts or unprecedented events.

- They require a significant amount of manual labor. Gathering financial data and verifying it for errors is just the beginning. Models need to be painstakingly constructed from scratch or from templates. This introduces numerous potential issues. Updating these models is equally time-consuming.

- According to the European Spreadsheets Risk Group, over 90% of spreadsheets have errors. In large organizations, a minor mistake could result in a substantial financial loss.

Yet, despite these limitations, financial forecasting remains a foundational component of strategic planning.

Financial Forecasting Methods

Common approaches include qualitative and quantitative methods. They can be combined to create comprehensive forecasts.

- Qualitative methods combine expert opinions and market research to predict future trends. This approach is practical when historical data is limited or when the market is volatile. Qualitative forecasting can provide insights into trends and shifts in consumer behavior. It leverages industry expertise to generate outcomes.

- Quantitative methods rely on mathematical models to analyze data and identify patterns. Techniques like time series and regression analysis form the backbone of quantitative forecasting. These approaches offer a more data-driven outlook for spotting long-term trends and cycles.

Choosing between methods depends on the industry, available data, and the forecast's purpose. However, businesses don’t have to limit themselves to just one of these. Merging the two techniques can provide a better view. So, consider using both. It will help you make decisions based on a mix of data and expert judgment.

Note: today's markets change so fast it's nearly impossible to keep up. Trading strategies don't perform well forever. They usually decline over time, some faster than others. Occasionally, a strategy may work well, lose its edge, and then bounce back. That is why algorithms are so essential for new and improved planning.

AI for Financial Forecasting

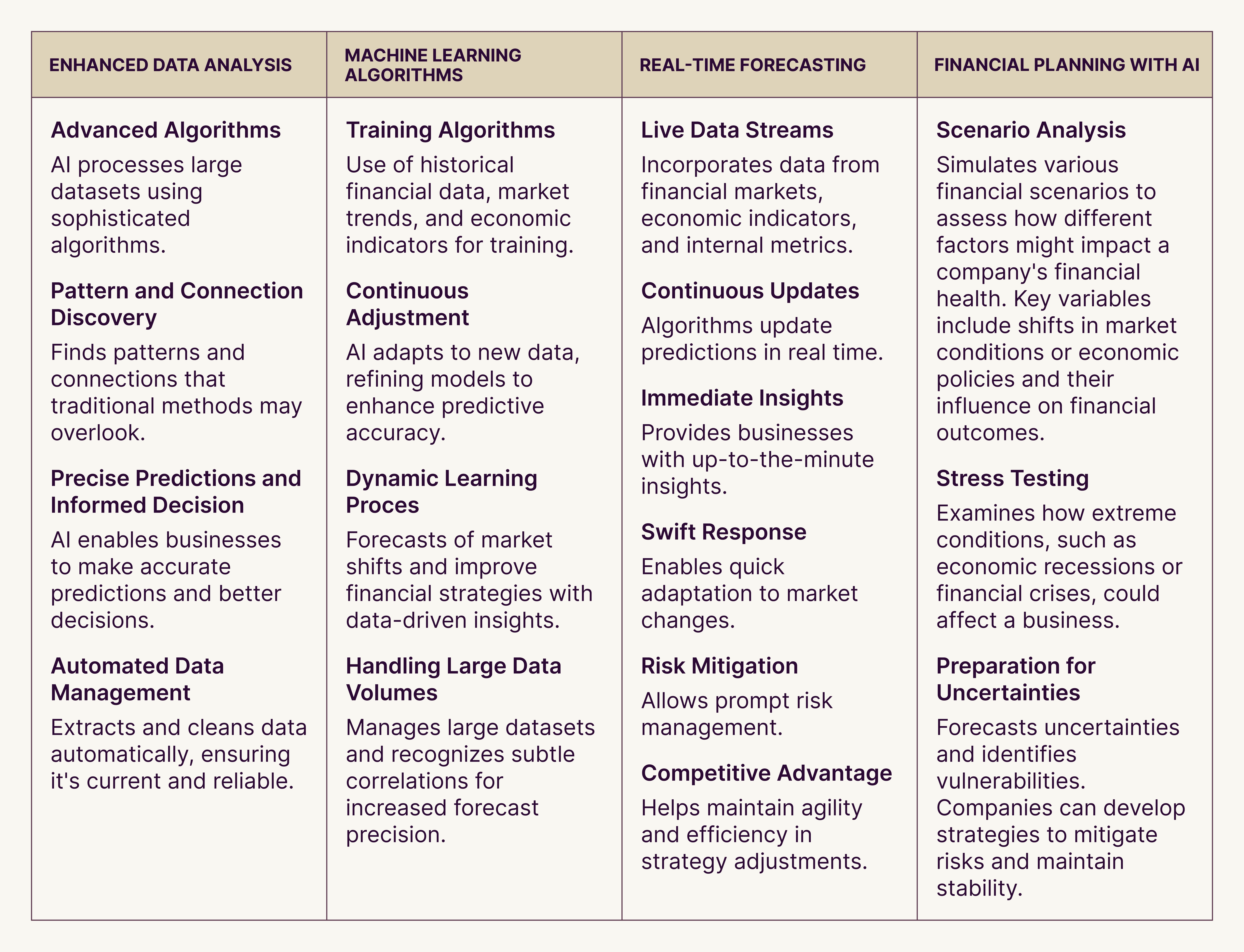

AI may be the golden mine for financial forecasting. It brings in improved data analysis, real-time predictions, scenario analysis, and stress testing.

Key AI technologies used in financial forecasting encompass:

- Machine Learning (ML) models examine historical data to forecast trends.

- Neural Networks mimic the human brain's processes to find patterns in data.

- Predictive Analytics uses statistics and ML to predict future events. It finds patterns in historical data.

Why Use AI in Financial Modeling and Forecasting?

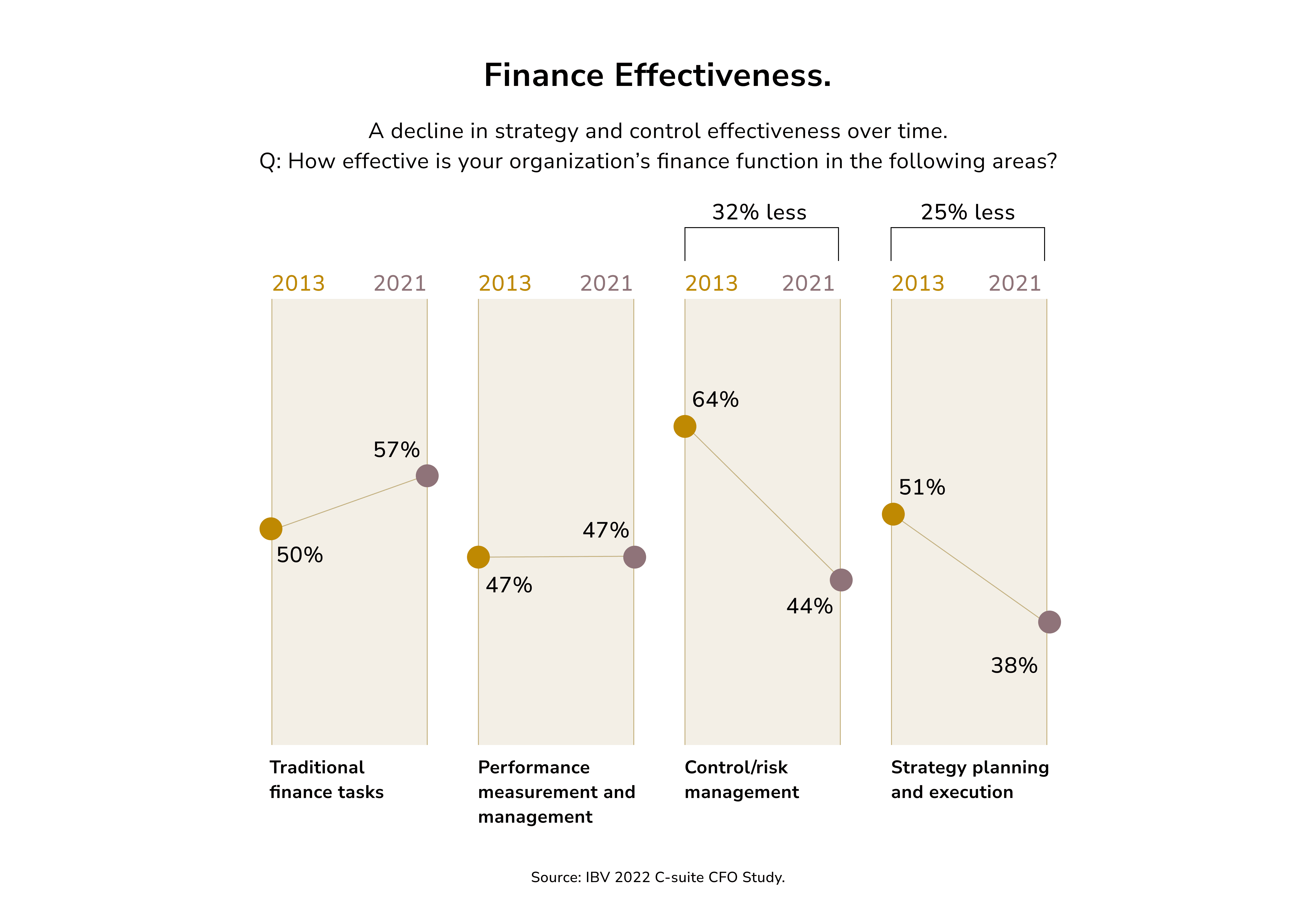

For CFOs and finance teams, their dual roles raised both the stakes and potential benefits. The thing is, they serve as protectors of stability and catalysts for change. To manage these contrasting duties and enhance organizational value, finance should

- upgrade strategies

- implement new tools

- change perspectives

- remodel organizational structures

- augment data-related skills.

Yet, CFOs remain uncertain about their finance teams’ performance. According to the IBV 2022 C-suite CFO Study, two out of five executives adept at traditional finance roles still struggle. Only 47% believe they are good at performance measurement and management. That figure is unchanged since 2013. Only 38% of respondents feel competent in strategic planning and execution. This shows a 25% decline in the same timeframe. Meanwhile, control and risk management have become 31% less effective since 2013.

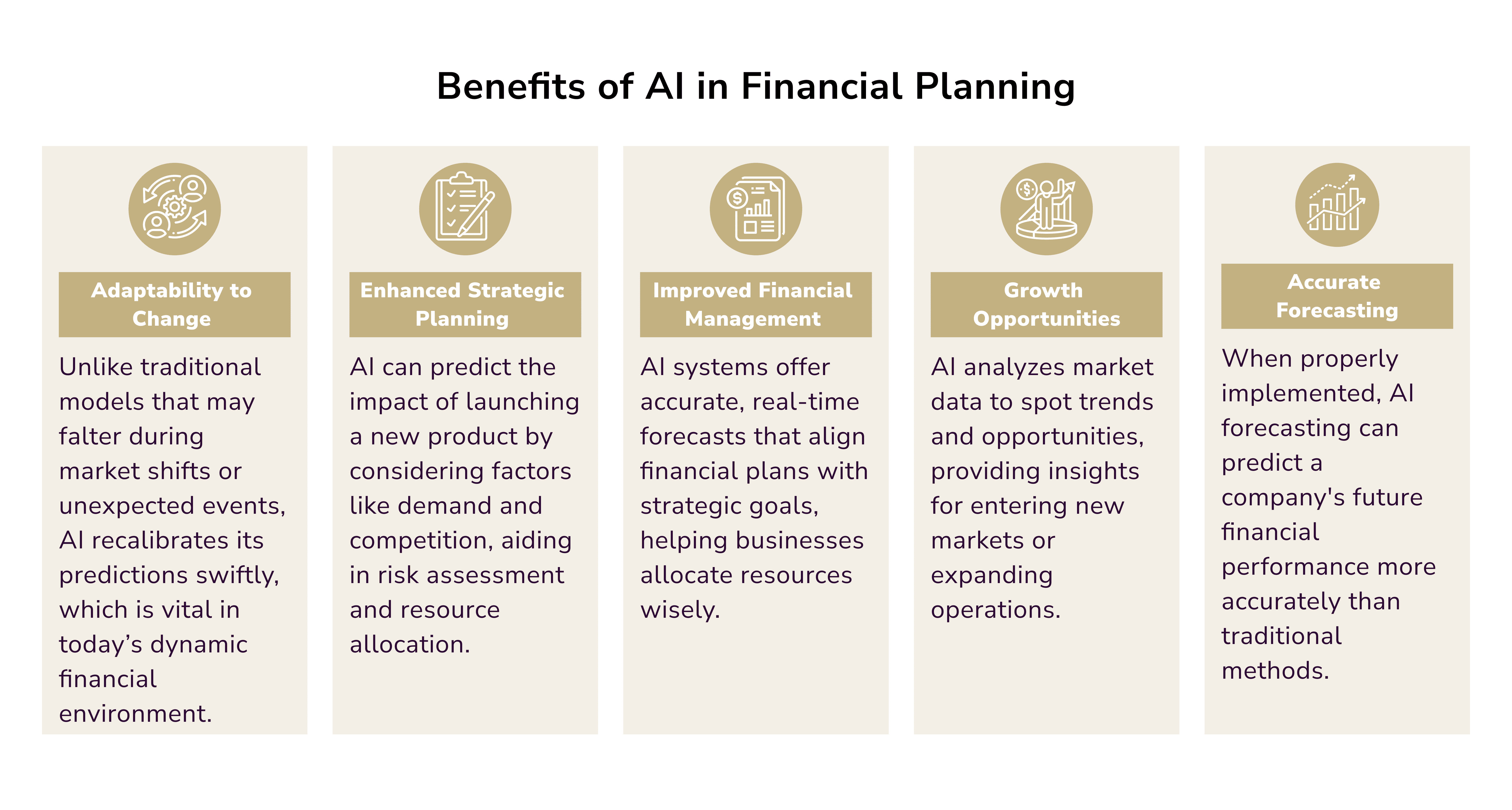

How can AI help address these issues? For starters, AI systems can quickly process huge data volumes. They can find patterns that human analysts might miss. This allows for nuanced forecasts that account for a broader range of variables.

Modern cloud platforms provide powerful tools to improve forecasting capabilities:

- Google Cloud AutoML Tables simplify the development and deployment of ML models. Google’s BigQuery ML allows users to create and run these models with SQL.

- Azure provides Azure Machine Learning. It’s a comprehensive suite for developing, training, and deploying predictive models. Additionally, Azure Cognitive Services delivers pre-configured AI functionalities.

- Amazon SageMaker simplifies building, training, and deploying ML models on a large scale. Its ready-to-use algorithms make it a great tool for financial planning.

Next, AI can improve financial modeling. It enables more efficient data analysis, insight extraction, and improved decision-making. Gartner predicts that by 2026, 80% of enterprises will utilize generative AI platforms. These include internally managed tools based on proprietary business data.

Third, AI can help financial firms boost revenue, refine processes, and cut costs. Its applications span the entire organization, from front-office operations to back-office tasks.

Note: finance leaders are shifting focus from revenue growth to cash management. This change is happening amidst increasing economic uncertainty and complex global business conditions. The turbulent economy has made capital acquisition more challenging, and deal-making has slowed. As a result, growth has slowed. So, finance teams must rethink cash flow strategies to ensure cash availability. Specifically designed AI tools help adjust to market shifts and management demands. This is key in unpredictable business environments.

How to Implement AI for Financial Modeling and Forecasting

A typical use of AI is automating time-consuming, routine tasks. This is particularly beneficial for data analysis and forecasting.

However, AI requires extensive external data to enhance planning accuracy. Misjudging demand can lead to adverse effects on revenue and profitability. AI amalgamates both internal and external data sources. This approach helps generate forecasts that align closely with reality. This ensures the execution is based on the most accurate projections possible.

AI also excels at processing large datasets from multiple sources. It identifies patterns, trends, and anomalies within financial data. These insights can then highlight deviations, seasonal variations, or even fraudulent activity.

Follow the instructions below to develop an AI solution for finance forecasting and integrate it into your workflow.

Step 1. Evaluate Your Requirements

Begin by pinpointing challenges and inefficiencies in your current FP&A. Determine which tasks you'd like to automate with AI. These may include minimizing forecast inaccuracies, improving data consolidation, or enhancing real-time decision-making. Engage with your finance team to identify areas causing the most frustration.

Step 2. Select Appropriate AI Tools and Platforms

Select an AI development company or AI-driven tools that match your needs. Many solutions on the market allow you to

- create and train AI models tailored to your specific business needs

- ensure seamless integration with existing systems like ERP, CRM, and HRIS

- have a familiar Excel interface to view AI-generated results

- provide real-time data integration for up-to-date information

- have pre-trained capabilities for everyday FP&A tasks.

Step 3. Test Your AI Tool Thoroughly

Initially, scrutinize the AI tool's output as it may require time to adapt to your org. Regularly assess its performance to ensure alignment with your business objectives. Provide feedback and make adjustments to help it evolve.

Step 4. Pilot and Expand Gradually

Launch a pilot project to test your AI tools and tweak your strategy. Begin with a particular aspect of your financial modeling or forecasting. Consider starting with revenue prediction or expense management. Assess team efficiency and collect feedback on improvement opportunities. If successful, gradually expand AI implementation to other areas.

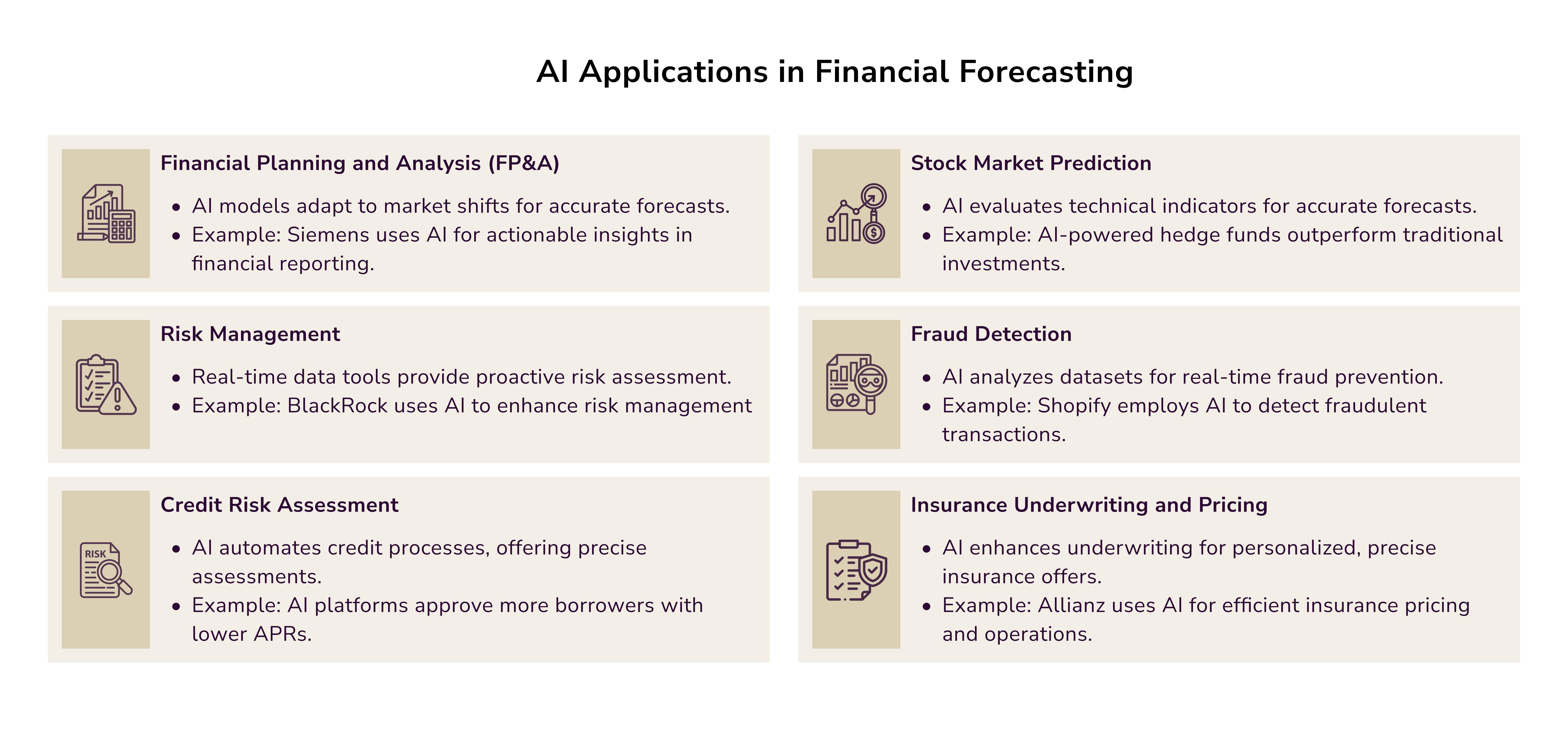

Applying AI in Financial Forecasting

Explore various applications of AI for enhancing financial modeling and forecasting.

AI and Black Swan Events

The financial sector tends to suffer more from Black Swan events and their aftermath than any other industry. This concept, introduced by Nassim Nicholas Taleb, is characterized by

- unexpected occurrences

- significant consequences

- and the tendency to be explained only after they happen.

The economic and financial sectors have encountered several such instances. These include the dot-com bubble, the 2008 financial crisis, and the COVID-19 pandemic.

AI is great at predicting market trends. But, it struggles with Black Swan events. Its ability to foresee or handle them is uncertain. The challenge with Black Swan events lies in their unpredictability. AI relies on historical data and patterns. So, it struggles to foresee events that are outside normal expectations. Black Swan events defy past trends. So, AI systems trained on old data can't predict them.

However, AI can help manage and reduce the effects of these unpredictable events. Here's how:

- Real-time Data Processing: AI can quickly process vast amounts of data. Potentially it can detect the onset of a Black Swan event, allowing for faster responses.

- Risk Management: ML can pinpoint portfolio vulnerabilities that may worsen an event's impact. Susceptibilities detected early allow firms to enforce risk mitigation strategies.

- Crisis Management: AI can automate mundane tasks. It thus frees human resources to concentrate on strategic planning.

- Post-event Analysis: AI can analyze its impacts and dynamics after a Black Swan event. The data can then be used to prepare for future incidents.

AI for Financial Planning and Analysis

Before the rise of large language models (LLMs) in 2023, analysts predominantly relied on custom modeling. Basically, they employed traditional analytical tools like Excel to develop various financial models.

Although these tools are flexible, they require considerable time and manual input. Building Excel financial models to answer one query often requires multiple team members. They manually collect, input, and check data from diverse systems. This is to fix errors and standardize formats. Without real-time data access, firms generally update financial models monthly or quarterly. This results in decision-making based on outdated information.

Today, finance teams can harness AI-powered FP&A tools to:

- automatically extract data from ERP systems and other sources into a central database

- analyze data using natural language prompts.

- deliver real-time dashboards that update financial metrics automatically

- detect trends and forecast sales with better accuracy

- develop dynamic financial models that refresh in real-time

- continuously monitor and evaluate risk factors.

FP&A teams can incorporate additional variables and both internal and external factors. This approach helps with many tasks, most importantly

- crafting industry scenarios

- analyzing peer activities

- and formulating ROI projections.

Also, AI analytics can weigh win chances against prices. This can boost revenue, profits, and win rates. It uses past successes and transaction details to improve pricing. These details include the product, configuration, deal size, and customer data. Deals at or above optimal price guidance can be auto-approved or fast-tracked.

Note: In FP&A, digital twins are a powerful tool. They model different financial scenarios. This technology enables businesses to strategize within a controlled environment. It gives a significant edge in risk management. Digital twins visualize the outcomes of different financial strategies.

Financial Planning Software Market

In 2023, the financial planning software market was worth $1,882.5 million. It is expected to grow to $4,991.49 million by 2031. The CAGR from 2024 to 2031 is projected at 14.30% (Verified Market Research, June 2024).

Several factors contribute to this growth:

- Technological Advancements: AI and ML enhance personalized financial advice. This boosts user engagement.

- Cloud Technology: SMEs and large corporations increasingly adopt cloud-based financial planning tools. This is due to the latter's scalability, cost-effectiveness, and ease of access.

- Mobile Solutions: Smartphones and apps are everywhere. This has increased the demand for financial planning tools that work on the go and banking app development in general.

- Regulatory Changes: Stricter rules in finance require better financial tools. This drives the demand for AI-based software.

- Data Protection Regulations: Stringent laws, like GDPR, require better protection of sensitive data.

- Complex Financial Products: The many complex financial products require advanced software. They help handle investments, retirement planning, tax strategies, and estate management.

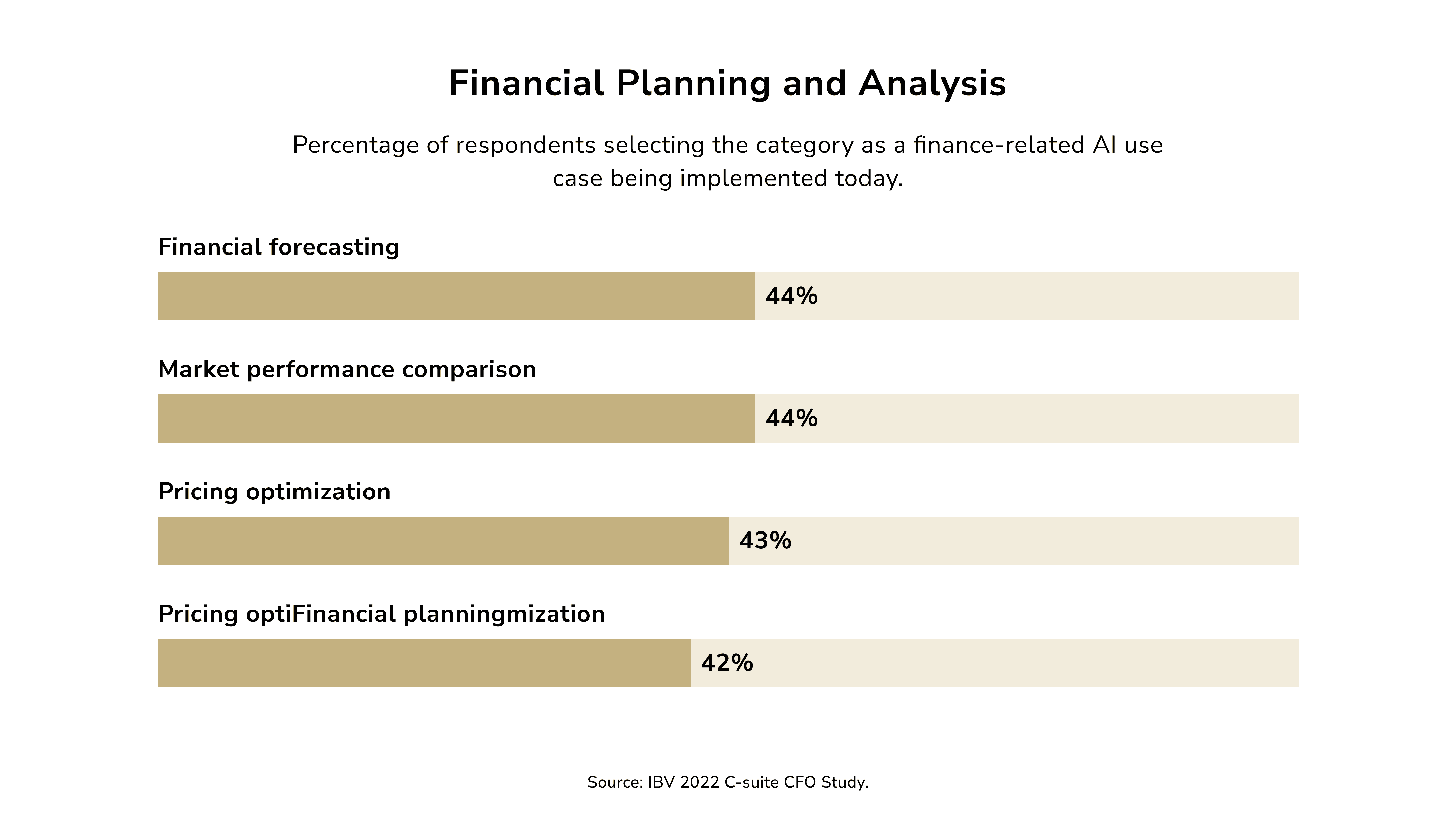

FP&A teams must gather a lot of data. It should relate to market dynamics, company performance, competitors, pricing, and operations. Integrating AI can streamline this laborious process by

- sifting through the data to detect irregularities

- improve predictive accuracy

- refine pricing strategies

- offer strategic recommendations.

According to Gartner, more than 40% of respondents report adopting AI in this area.

AI uses correlation analysis and neural networks for financial predictions. It finds patterns and anomalies. Neural networks, in particular, analyze data relationships to make forecasts accurate.

Real-Life Case Studies

These are the most impressive implementations of AI for financial planning so far:

- Egencia uses AI and ML to simplify travel booking and expense management. This tech-driven approach helps find the best flights, hotels, and car rentals. Meanwhile, it also streamlines expenses, saving over a million work hours annually.

- Coca-Cola combats customer churn with AI forecasts on when customers might stop buying. They have reduced churn by 5% by analyzing purchase history and behaviors.

- Bank of America prevents fraud by analyzing payment data and IPs for suspicious activity. Their approach has safeguarded over a billion dollars in potential fraud losses.

- Siemens uses AI to improve financial reporting. It created dashboards to spot trends and aid decision-making. Their AI efforts have increased forecast accuracy by 10%.

- Hilton Hotels uses AI to improve guest experiences. It personalizes room and activity recommendations based on past bookings. This has increased guest satisfaction by 5%.

Real-World Applications of AI in Financial Forecasting

Several industry leaders are using AI technology to improve their financial forecasting. We listed some noteworthy examples below.

Predictive Analytics in the Banking Sector

Mastercard’s Decision Intelligence, an AI-based system, evaluates transactions instantly. It improves fraud detection. It also gives accurate assessments of fraud and insights into transaction patterns. Incorporating AI into their forecasting models enables banks to anticipate market fluctuations better. They can also refine their investment tactics and provide customized customer service. This strategy keeps financial institutions competitive and adaptable to changing market environments.

AI in Corporate Financial Management

IBM leverages AI to assist clients in risk management and boosting operational efficiency. Their AI tools help orgs make timely, accurate decisions. They forecast and plan for scenarios. This is great for businesses. Especially for companies who want to improve their financial strategies and meet their goals. IBM shows how AI can transform corporate finance. It provides deep insights and accurate forecasts.

AI Tools for Small and Medium Enterprises (SMEs)

HighRadius provides AI cash forecasting solutions. They analyze company-specific factors to deliver precise forecasts. This aids SMEs in managing liquidity and making well-informed financial choices. Betterment, a robo-advisor, uses AI to manage investments. It optimizes portfolios based on user risk and market dynamics. Such tools equip SMEs with forecasting capabilities typically reserved for larger corporations.

Use Cases of AI-Powered Financial Forecasting

Industries harness AI’s analytical capabilities to stay ahead of market trends. The most popular use cases are listed below.

Demand Forecasting:

- E-commerce: AI systems analyze sales data, customer actions, and trends. They predict demand by using historical data and external factors. It helps optimize inventory, avoid stockouts, and cut excess costs.

- Healthcare: Hospitals use AI to predict patient admissions and allocate resources. AI models analyze historical patient data, seasonal trends, and disease outbreaks. They then adjust staff levels and manage bed availability.

- Content Strategy: Streaming services use AI to predict what viewers will like. It also predicts which new content will succeed. Companies analyze viewer behavior, such as watching habits, searches, and ratings. Then, they use the data to refine content creation and acquisition strategies.

Supply Chain Forecasting:

- Retail Inventory Management: Retailers utilize AI to manage inventory levels across stores. AI systems analyze sales data, foot traffic, and external factors like the weather. Retailers then use the results to minimize overstock and understock issues.

Operations:

- Energy Consumption Prediction: Utility companies use AI to forecast energy usage patterns. AI models can predict peak demand times. They can help users optimize their energy use. This prevents power shortages during high-demand times and improves grid stability.

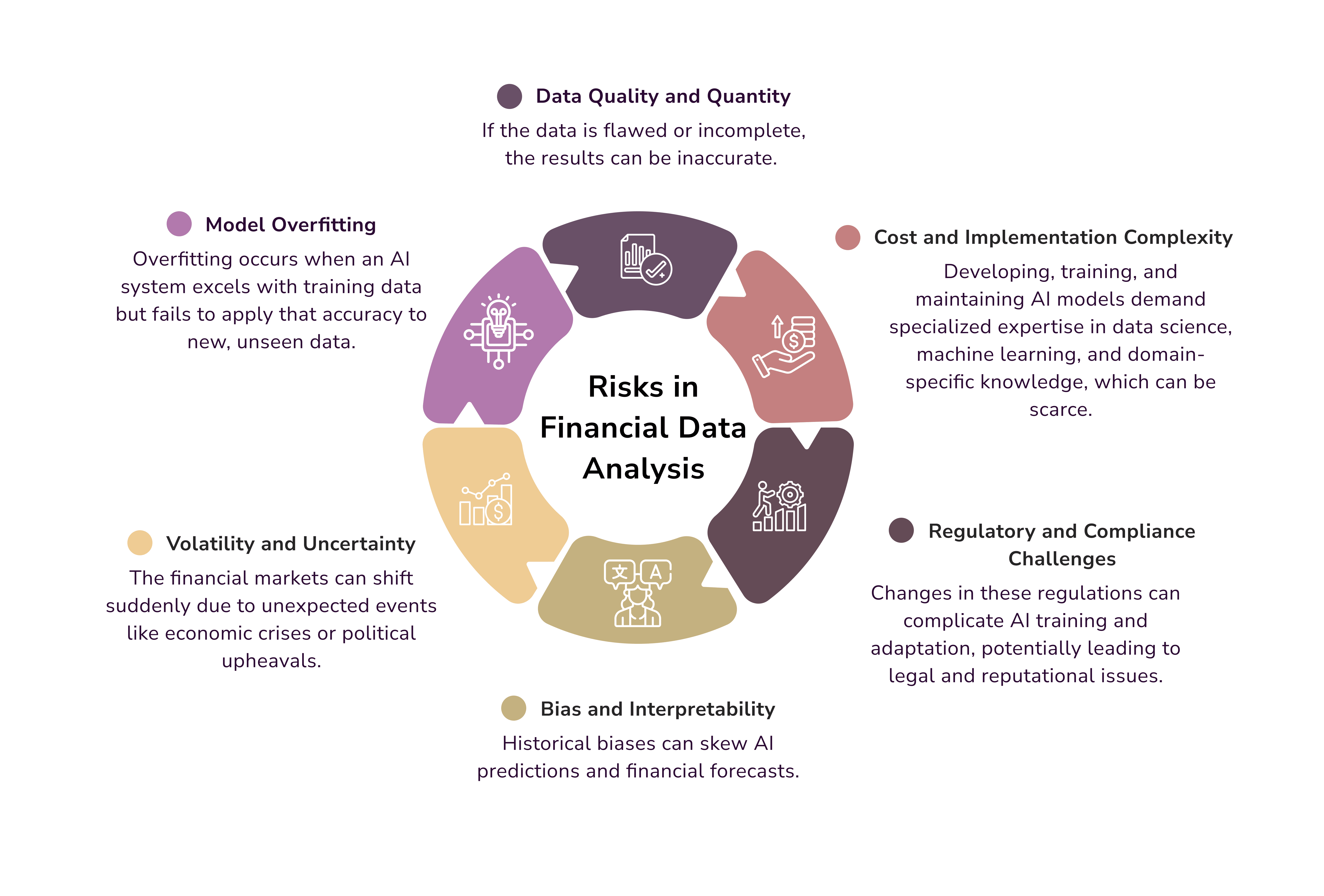

These practical examples reveal AI’s significant impact on financial operations. However, keep in mind that the success of AI forecasting applications depends on

- the quality of the data used

- effective model training

- continuous validation.

Best AI Financial Forecasting Tools

In financial forecasting, several industry giants use generative AI and ChatGPT. These are:

- IBM Watson Studio offers a comprehensive platform for building and deploying AI models. Watson Studio's strong ML can process massive financial data. It delivers actionable insights.

- Google AI Platform provides scalable ML tools. They enable businesses to create custom models tailored to their specific forecasting needs. Its powerful interface supports collaboration among teams, ensuring seamless integration into existing workflows.

- Amazon Forecast uses ML to deliver highly accurate forecasts. It can enhance prediction accuracy by incorporating external data.

- DataRobot simplifies the AI deployment process with its automated ML platform. DataRobot is easy to use. It lets businesses quickly build, deploy, and monitor AI models. It makes advanced forecasting accessible to non-experts.

- Alteryx's predictive tool empowers businesses to derive insights from data without technical expertise. It helps create sophisticated models that enhance forecasting processes.

- Oracle Cloud EPM Freeform runs complex what-if scenarios. It does this using large-scale, flexible modeling. This AI-driven tool verifies assumptions and minimizes decision-making risks.

Challenges and Constraints in AI-Based Financial Analysis

Like other software platforms, AI systems are vulnerable to cyber threats and other risks.

It's crucial to use a closed LLM to address security and privacy concerns. They offer several benefits for a company’s data safety strategy:

- Data remains protected from influencing public LLMs or their outputs.

- Sensitive information stays within the organization's secure environment, reducing exposure to external threats.

- Restricted access to the model minimizes unauthorized access risks.

- Data is processed safely within an org’s infrastructure, lessening breach risks during transfers.

- Closed LLMs can be tailored to comply with specific regulations (i.e., GDPR, CCPA, etc.).

- Organizations maintain control over model updates, allowing timely application of security patches.

The recent involvement of major, well-established corporations in the GenAI market has initiated fierce competition. Every enterprise aims to be the first to deliver groundbreaking value. Leadership teams are keen not to lag behind their competitors. However, CFOs are the primary guardians of an organization’s financial well-being. So, they must carefully weigh the advantages and potential risks of GenAI.

There are three crucial discussions that CFOs should engage in within leadership circles. These include:

- Dispelling the hype to prevent overblown expectations;

- Identifying GenAI use cases that are aligned, responsible, and practical;

- Establishing GenAI governance and guidelines for acceptable usage.

These inquiries should be addressed to set the goalposts. Also, it will help ensure AI is utilized to create value without introducing unacceptable risks.

Note: AI goalposts are benchmarks for measuring AI systems' progress and effectiveness. They include performance metrics, ethics, societal impacts, and technological progress. To understand AI goalposts, we must explore a few things. First, how they evolve over time. Second, the criteria that define them. Third, their implications for developing and deploying AI technologies.

A New Era of Financial Forecasting

Financial forecasting AI solutions bring merits for businesses of all sizes. For small businesses, AI reduces costs and optimizes resources. It allows a focus on growth and innovation. Medium-sized companies also benefit from AI. It can process complex data, increasing efficiency and reducing errors. AI gives large firms real-time financial reports and forecasts. It helps them make quick decisions and manage risks better.

Go to our blog to learn more about AI’s potential in fintech.

Andriy Lekh

Other articles