Emerging Trends in Digital Banking for 2025

Economic unpredictability and shifting consumer behavior signify that 2025 will be a year of both significant challenges and exciting opportunities for banking and financial services. Not that the previous couple of years weren’t. The past decade in banking can be summed up in one word: unpredictable. Rapid, unprecedented changes have forced banks to create playbooks on the fly.

Technology forces the financial sector to evolve. The good news is that it also assists in the process. Traditional institutions are feeling the heat from emerging challenger banks and fintech disruptors. All the while, they face mounting urgency to adopt AI. But priorities remain the same for all players—ensuring exceptional customer experiences and seamless service delivery.

Let’s unfold the top 2025 digital banking trends, omnichannel banking trends and mobile banking trends that are to make the most impact on the industry.

The Engine of Digital Banking Development

Technology is not the only force pushing the limits of the finance ecosystem. Other critical drivers exist, and they play equally important roles in its transformation. We mean an intricate blend of demographic, socioeconomic, regulatory, and environmental factors. Combined with technological advancements, they redefine lifestyles and economic participation.

Categorical shifts in banking operations are imposed by the collective and environmental consciousness. Customers bravely demand better access to supportive services. Gen Z and Millennials are driven by climate-conscious financial decisions, promoting green finance. Prolonged life spans, frequent career changes, and a shared economy emphasize the need for enhanced financial well-being. Banks have no choice but to support customers in meeting financial responsibilities.

Data

Data augmentation makes it challenging for individuals to manage and control the countless data points collected about them. Consumer awareness of the value of personal information has made them selective about what data they share. Consequently, trust is a critical factor for service providers.

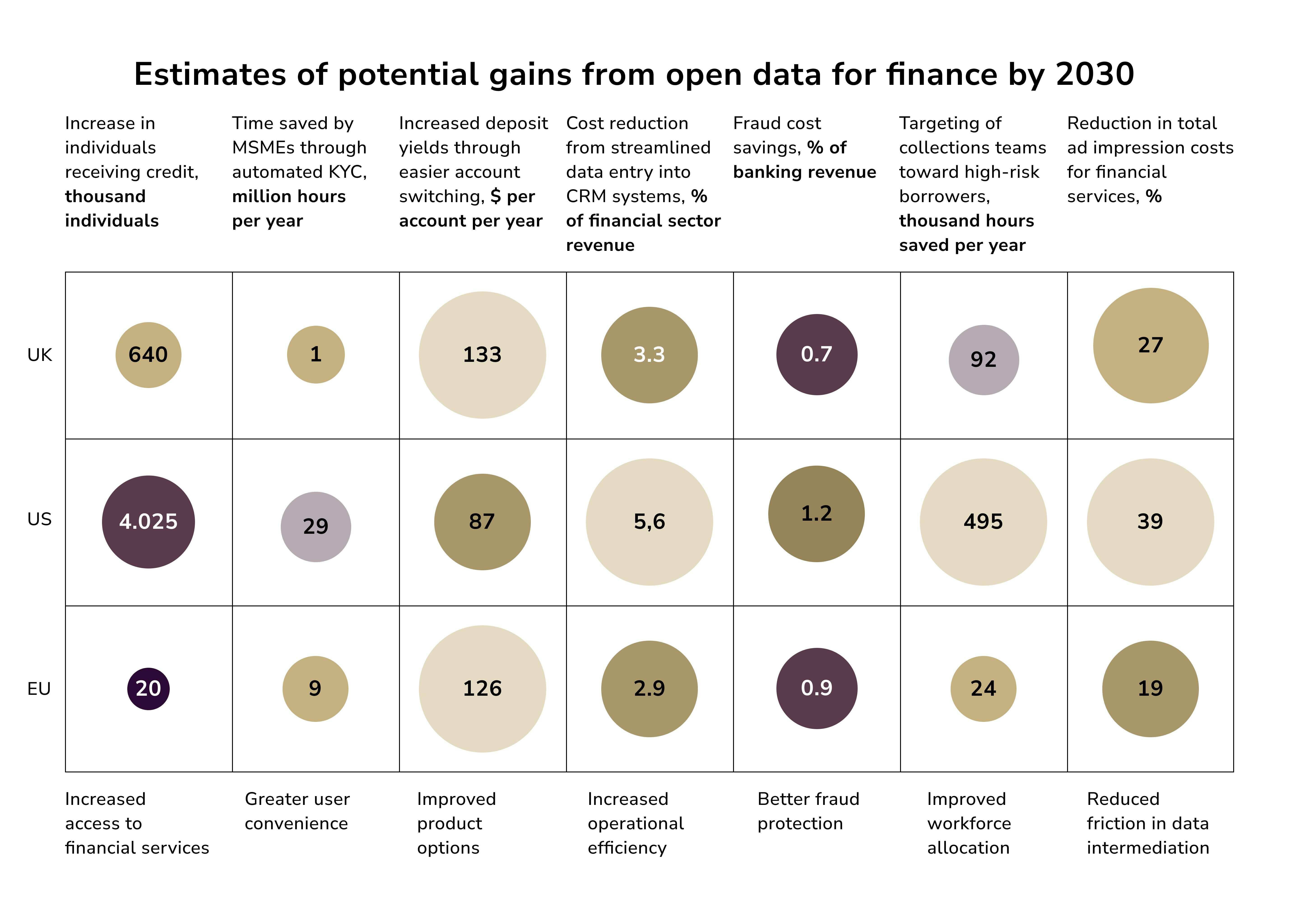

How can orgs offer tangible benefits in exchange for data permissions to earn consumer trust? Leveraging data to help households manage their budgets, enhance financial well-being, or enable banks to compare costs and value across various products and services, like utilities, promotes transparency and value.

Note: Banks are set to harvest significant benefits using customer data platforms (CDPs). These platforms can unify data from various channels. They enable more precise product recommendations and proactive customer service. By leveraging transaction data enrichment (via API, e.g., Tapix), banks can gain a deeper understanding of customer spending habits, anticipate future needs, and build stronger engagement. Avenues for enhanced customer experience and increased revenue across multiple channels become obvious.

Business Models

The financial services landscape is expected to undergo a modification driven by platformication. This shift will empower banks to act as orchestrators. They can offer hyper-personalized services through a network of providers—some owned by the banks and others through strategic third-party partnerships.

Consumers can finally be free from multiple standalone apps. Instead, they can enjoy unified solutions that cater to their diverse needs. This trend is already visible across domains. In telecommunication, companies have broadened their horizons from utility services to media and entertainment. Leveraging data from their networks, they unlock new revenue streams. In this evolving platform economy, banks need to learn to cater to both individual and small business customers. Leveraging trusted brands to create lifestyle layers that integrate ecosystems of fintechs and other service providers may be a good step forward. Failing to accomplish this risks opening the door for other brands to take their place in delivering these integrated customer experiences.

Regulation

The financially savvy consumers of tomorrow will evaluate financial service providers not just based on personal benefits but also on their broader societal impact. Not all applications of AI are ethical. So, it is vital for industry stakeholders to collaborate with regulators to establish resilient, trustworthy systems that protect consumers.

Innovative regtech solutions powered by AI are paving the way for more efficient and precise supervision. Data will play a central role in this transformation. Blockchain technology, by securely recording transaction histories, will enhance risk assessment models through a reliable source of trust. Additionally, regulations akin to the EU’s GDPR are likely to become widespread, with the potential for a globally unified data protection standard.

Technology

Technology makes services (not only in the financial sector) more personalized and accessible across devices and apps. It will redefine banking as we know it—altering channels, services, and the very role of banks in our daily lives.

The following digital banking trends have the potential to reshape the bank-customer relationship.

- Al and ML will automate tasks currently requiring error-prone human intelligence.

- DLT will decentralize the management of customer transaction data, providing more transparency across all businesses.

- Biometrics like facial and voice recognition will enable constant, real-time user identity validation and advanced behavioral profiling.

- 5G will vastly improve the UX and delivery of services in real-time when reaching over 1 gigabyte per second of downloads.

- Cloud computing will remove the hardware burden on data storage and processing.

- IoT-connected objects will gain the ability to produce data far beyond the smart speakers and wearables we know of today.

- AR/VR will allow banks to become more accessible to those who may not be able to visit a branch.

- Quantum Computing will be the enabler of processing vast volumes of data made available through loT.

Customer Experience (CX) at the Center of Changes

We’re not getting tired of saying everything revolves around improving CX. Customers and their demands remain at the core of every transformation. Banks that want to maintain their relevance should work on beating those expectations.

We decided to match needs with the required actions.

- Customers expect their banks to understand them deeply.

- Financial institutions should align with individual preferences and circumstances to ensure personalization in banking.

- Customers expect to manage accounts with minimal effort.

- Banks need to deliver intuitive services across platforms.

- Consumers value understanding and empathetic services.

- Financial institutions should thoughtfully tailor their services to align with each customer’s life stages, unique needs, and personal contexts.

- Customers are drawn to businesses that exemplify integrity.

- To stay ahead, banks should data protection, enhancing not only cybersecurity but also customer trust.

- Customers assess businesses by how effectively they address challenges.

- Banks should have a strategy in place, ready to resolve potential issues before they have a chance to disrupt CX.

Key Trends Impacting Customer Experience in Banking

CX in digital banking revolves mainly around personalization and mobile-first strategies. The tendency to ensure seamless digital payments will likely strengthen in 2025 and beyond, at least until banks get rid of legacy systems. Let’s focus on these and other crucial trends and why they matter.

AI-Powered Customized Banking

AI continues to dominate mobile app development, driving personalization and operational efficiency. The mobile AI market, valued at $19.5 billion in 2024, is projected to grow at a 25% CAGR through 2034. ML automates routine tasks, adapts to user preferences, and reduces costs. NLP powers intelligent chatbots and virtual assistants like Siri, providing seamless, human-like interactions. By 2033, the intelligent virtual assistant market could surpass $309.9 billion. In general, the financial sector is still exploring the potential of AI in fintech and the merits it can bring.

By transforming raw transaction data into meaningful insights (by means of AI), banks can tailor financial experiences to each individual. In the process, customers also get more context into their financial activity. Spending categories and behavioral patterns offer tailored analytics, helping clients manage their financial health more effectively. Personalization taps into the endowment effect, making customers feel understood and valued. This emotional connection can enhance customer loyalty.

Note: banks that equip their customer-facing teams with emotional intelligence (EI) training improve the quality of interactions, ensuring customers feel heard and valued. This is especially important during emotionally sensitive transactions. Training capitalizes on the empathy gap by equipping employees to connect with customers on an emotional level, fostering better outcomes and stronger relationships. For instance, Citibank focuses on EI training, resulting in better conflict resolution and improved customer experience scores.

Feature-Rich Mobile Banking

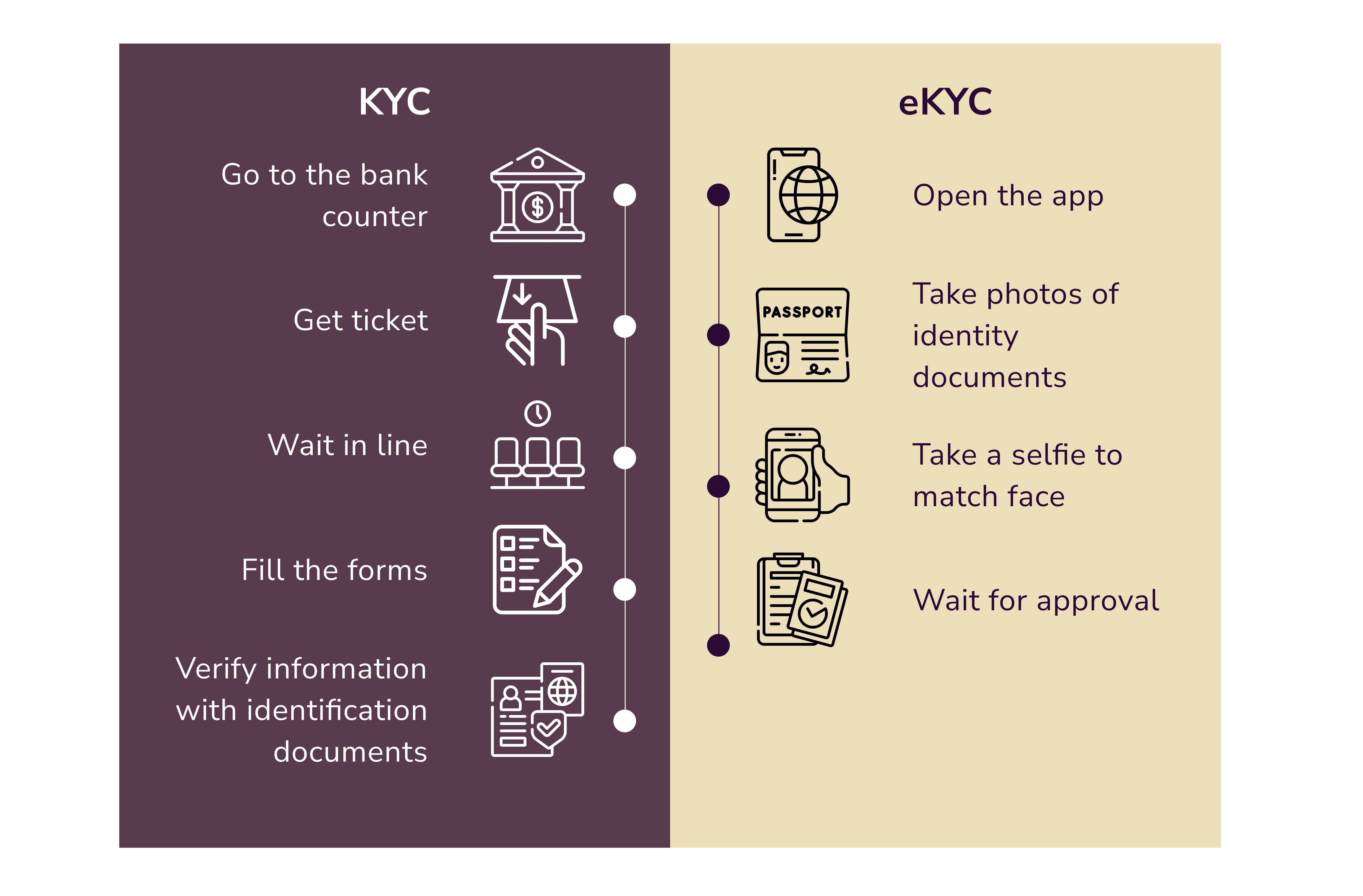

With access to advanced analytics and customer data, banks are optimizing mobile banking apps to provide more robust features. These include eKYC, personalized dashboards, loan management tools, and even financial education modules.

Mobile apps today go beyond simple transactions. Sophisticated features such as financial planning tools, advanced security through biometrics, and AI-powered chatbots for real-time support are redefining mobile banking experiences. Enhancing user engagement, these features encourage users toward better financial habits by offering actionable insights. Bank of America’s Erica virtual assistant helps users manage bills, track spending, and discover personalized financial insights—all within the app.

Voice Banking with Conversational AI

Voice banking continues to mature, with conversational AI transforming customer service interactions. AI-powered assistants like Google’s Dialogflow can initiate fund transfers with simple voice commands. In trend now, is banks integrating voice assistants into wearables like smartwatches. It seems like the future has arrived: customers can bank on the go without even lifting a finger.

The adoption of voice-enabled technologies shaped conversational banking as we know it. Customers can manage accounts, pay bills, or transfer funds hands-free. Needless to say, it improves accessibility and convenience. DBS Bank in Singapore allows users to perform transactions through voice commands, catering especially to tech-savvy customers.

Personalized Financial Wellness Programs

A major focus of banks now is helping customers make well-informed financial decisions. These initiatives build trust and strengthen customer-bank relationships. But, hyper-personalized financial wellness programs will become a thing only when banks will learn to leverage data to its fullest. These programs are generally built on tailored advice regarding

- savings

- debt management

- retirement planning

- long-term financial stability

Wealthfront’s digital financial planner, for instance, uses AI to assess users’ financial portfolios and suggest growth actions. Wells Fargo’s “Your Financial Health" program supplies customers with personalized tools, advice, and progress-tracking scorecards to manage debt, save, and invest better.

Sustainability and Responsible Banking

Climate-conscious values are being loudly conveyed from every corner. And, finally, it seems to be working. But being sustainable isn't just about promoting green products. It's about aligning with customers’ values. Responsible banking efforts, like transparent reporting on ESG initiatives or offering eco-friendly credit cards, may not be enough to cement trust in clients' minds. Ten years ago, though, it would be more than enough. Today, however, customers value not just actions but their continuity. Over 60% of Millennials prefer businesses that take a public stand on sustainability. And that stand better be lasting.

One of the amazing examples of eco-friendly financial services is the Triodos Bank's philosophy. This bank exclusively funds projects that positively impact society and the environment, appealing to socially responsible customers.

The Real-Time Payments Surge

Real-time payments are rapidly expanding across the globe, with over 266 billion transactions processed in 2023 (a 42% year-over-year surge). This growth is empowering consumers with more choices. The push to interlink domestic payment systems is making cross-border transactions faster and smoother. Meanwhile, interoperability with central bank digital currencies (CBDCs) and digital assets is expected to simplify transactions.

Note: we won't surprise you with the fact that the need for immediacy on both sides has been a major driver of the expansion of RTP. In other words, the world is fast-paced, and so are our needs. And fintech giants dealt with it by employing RTP. With its help, banks can achieve higher operational efficiency and boost customer satisfaction levels. RTP also reduces manual processes, helping mitigate fraud risks and making it a valuable tool for modern businesses. Advanced real-time fraud detection systems equip banks to combat cyber threats while fulfilling customer expectations for speed. Yet, cybersecurity is still a field that requires significant investments and study.

Countering AI-enabled Fraud with AI

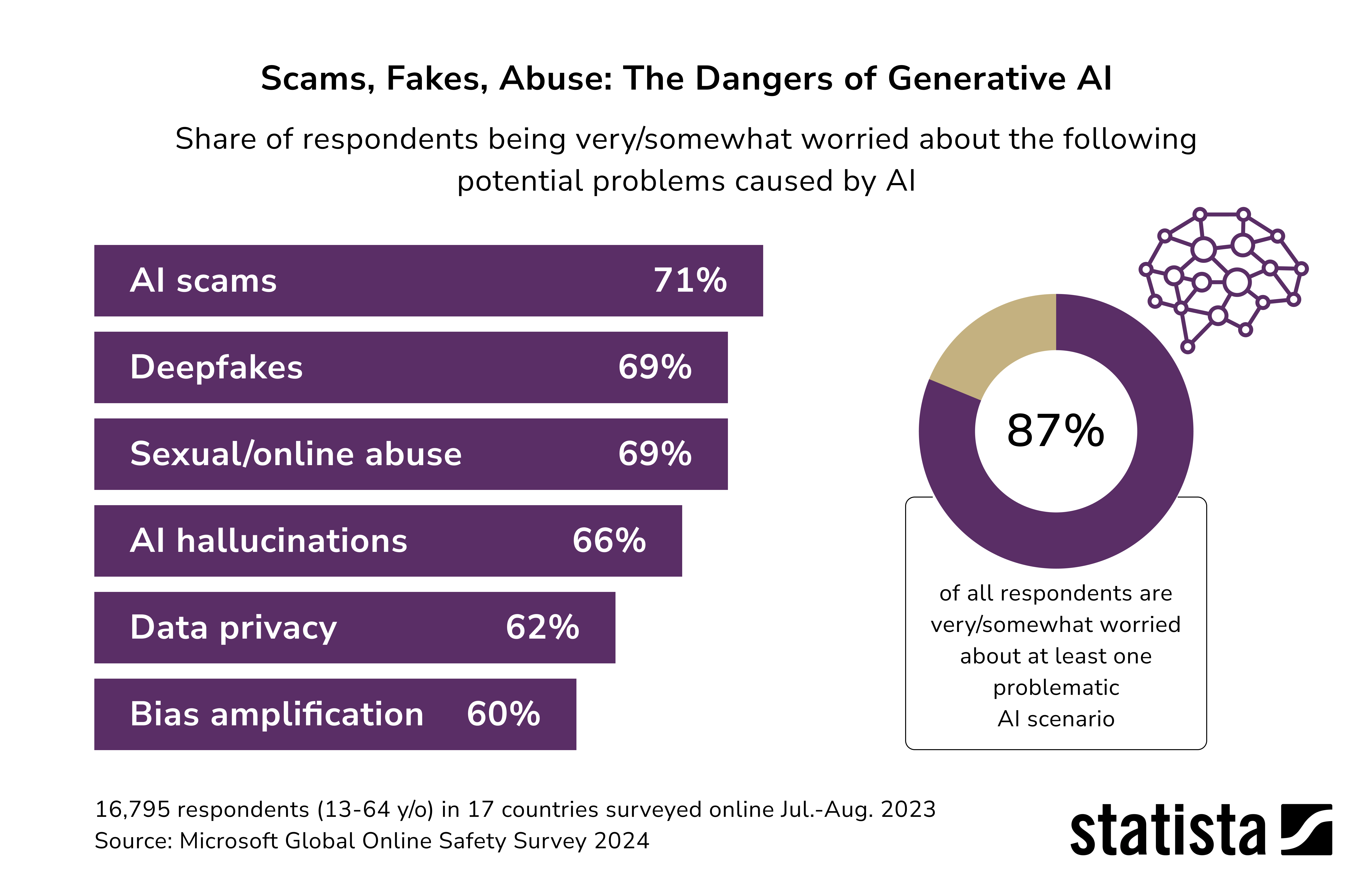

All new technologies pass the test of time, mainly on the scale of how much value they bring vs. how much damage they enable. GenAI is already being used by cybercriminals to create hyper-realistic phishing scams and deepfake videos. With cybercrime projected to hit $10 trillion annually by 2025, the stakes are high. Microsoft's online survey reflects user fears of potential GenAI-enabled scams.

However, AI helps detect and prevent fintech fraud. So, it also serves as a powerful defense mechanism. Let’s take Mastercard’s Decision Intelligence Pro, for instance. It uses generative AI to analyze over a trillion data points in milliseconds. This way the company can identify potentially fraudulent transactions much faster than via any other method available. This technology has boosted fraud prevention rates by an average of 20%, with some cases seeing upgrades of up to 300%. Another impressive case is Mastercard’s Consumer Fraud Risk. It can detect and halt unauthorized payment scams before funds even leave the victim’s account.

Omnichannel Banking Trends

Omnichannel banking trends are a critical focus for financial institutions. Today’s customers expect a seamless experience across all banking platforms, whether they’re using a mobile app, website, or visiting a branch in person. A well-executed omnichannel strategy ensures these experiences align to create a unified customer journey. By mitigating choice overload through integrated and consistent options across channels, banks make decision-making simpler and improve customer satisfaction.

Spain’s CaixaBank is a leading case of omnichannel innovation, blending online, mobile, and branch services to tailor the banking experience for different customer segments more effectively. The Connected Money app from HSBC integrates accounts from multiple banks, presenting customers with a consolidated view of their finances.

Here’s a look at the latest omnichannel banking trends:

1. AI and voice technology

Voice commands and AI-powered assistants are becoming essential as customers seek more convenient ways to interact with their banks. These technologies enable users to conduct transactions, ask questions, and receive custom assistance, creating a seamless and simplified banking process. With AI in wealth management, customers can easily alter and optimize their investment portfolios.

2. Optimized mobile experiences

With smartphones dominating daily life, banks are prioritizing user-friendly, mobile-first solutions. Enhanced mobile banking apps featuring intuitive functionality and design are now central to delivering an exceptional digital experience.

3. Seamless cross-channel transitions

Cross-channel connectivity is revolutionizing the user experience. Customers can now begin a transaction on one channel (e.g., a mobile app) and complete it on another (e.g., a physical branch or website) without interruption, ensuring fluidity in their banking interactions.

4. Social media as a banking channel

Banks are tapping into social media’s potential to interact with their customers. By integrating platforms such as Facebook, Twitter, and Instagram into their omnichannel strategies, banks offer updates, assistance, and engagement opportunities that prioritize convenience.

5. Banking through IoT devices

The Internet of Things (IoT) is redefining omnichannel banking. By leveraging smart devices and wearables, banks empower customers to perform transactions, make payments, and access accounts directly from interconnected gadgets, adding unparalleled ease to financial management.

Mobile Banking Trends

Mobile banking continues to shape the future of customer-centric banking. In that future, it’s not all merely about convenience but about delivering smarter, faster, and safer financial services. The mobile banking trends we’ve listed below are vital for digital banking development.

1. Real-time features for an on-the-go audience

With mobile banking’s inherently fast-paced nature, real-time services have become a necessity. Customers now expect instant access to financial transactions, payments, and notifications on their smartphones. Banks are leveraging advanced analytics and decision-making engines to meet this need, ensuring swift and seamless processing.

2. Hyper-personalized experiences

Mobile banking has unlocked unparalleled opportunities for personalization. By analyzing app usage, location data, and customer behaviors, banks deliver contextually relevant and tailored experiences directly to users. This not only enhances engagement but fosters long-term loyalty.

3. AI & ML for smarter banking

AI and ML are revolutionizing mobile banking by introducing features such as:

- predictive analytics that empower financial forecasting with AI

- AI-driven chatbots that provide instant, 24/7 customer support

- enhanced security protocols powered by intelligent detection systems

These technologies elevate the efficiency, security, and convenience of mobile banking.

4. Mobile-first strategies and digital-only banking

The rise of neobanks has pushed traditional financial institutions to adopt mobile-first strategies. Banks are now focusing on making everything—from account setup to loan applications—accessible and user-friendly within mobile apps, matching the convenience and innovation of digital-only competitors.

5. Seamless payment integrations

Mobile banking apps increasingly support integrations with mobile wallets and contactless payment systems. From NFC-driven tap-and-pay to third-party payment services, these seamless payment ecosystems simplify day-to-day transactions for users.

6. Voice and AR innovations

- Voice-activated banking is gaining popularity, allowing users to complete transactions or access account information through voice commands.

- Augmented Reality (AR) is reimagining customer interactions, offering tools to locate nearby ATMs, simulate financial scenarios, or visualize savings growth—all directly through mobile apps.

7. Open APIs and Banking as a Service (BaaS)

Open banking APIs are enabling banks to integrate external services, offering customers an all-in-one platform for diverse financial needs directly on mobile. This trend drives greater convenience and flexibility.

8. Stronger cybersecurity measures

With the growing reliance on mobile banking, robust security is critical. Multi-factor authentication, encrypted communications, and secure app architectures are fundamental to protecting sensitive data and transactions in today’s digital landscape.

Digital Banking Trends: Future Outlook

Several overarching trends are set to define the digital banking development landscape in the next few years. Here’s where banks should direct their focus:

Everything-as-a-Service (XaaS) and Cloud Adoption

The reason behind the massive growth of Everything-as-a-Service (XaaS) and cloud technologies is the agility they offer. Among the many merits cloud platforms bring is scalability, which is undoubtedly important. But what makes them even more valuable is the integration of advanced APIs, such as transaction data enrichment.

XaaS model also facilitates collaboration between banks and fintechs. Integration of third-party services like AI advisors, payment gateways, and micro-lending platforms has become effortless. This synergy is critical for developing next-gen financial solutions.

GenAI

To fully capitalize on AI, banks must strike a balance between leveraging traditional AI—systems designed to perform specific tasks with predefined algorithms—and exploring generative AI, which creates entirely new content. While large language models (LLMs) and other generative AI innovations have captured global attention, many banks still have untapped opportunities to optimize business outcomes through the predictive capabilities of traditional AI.

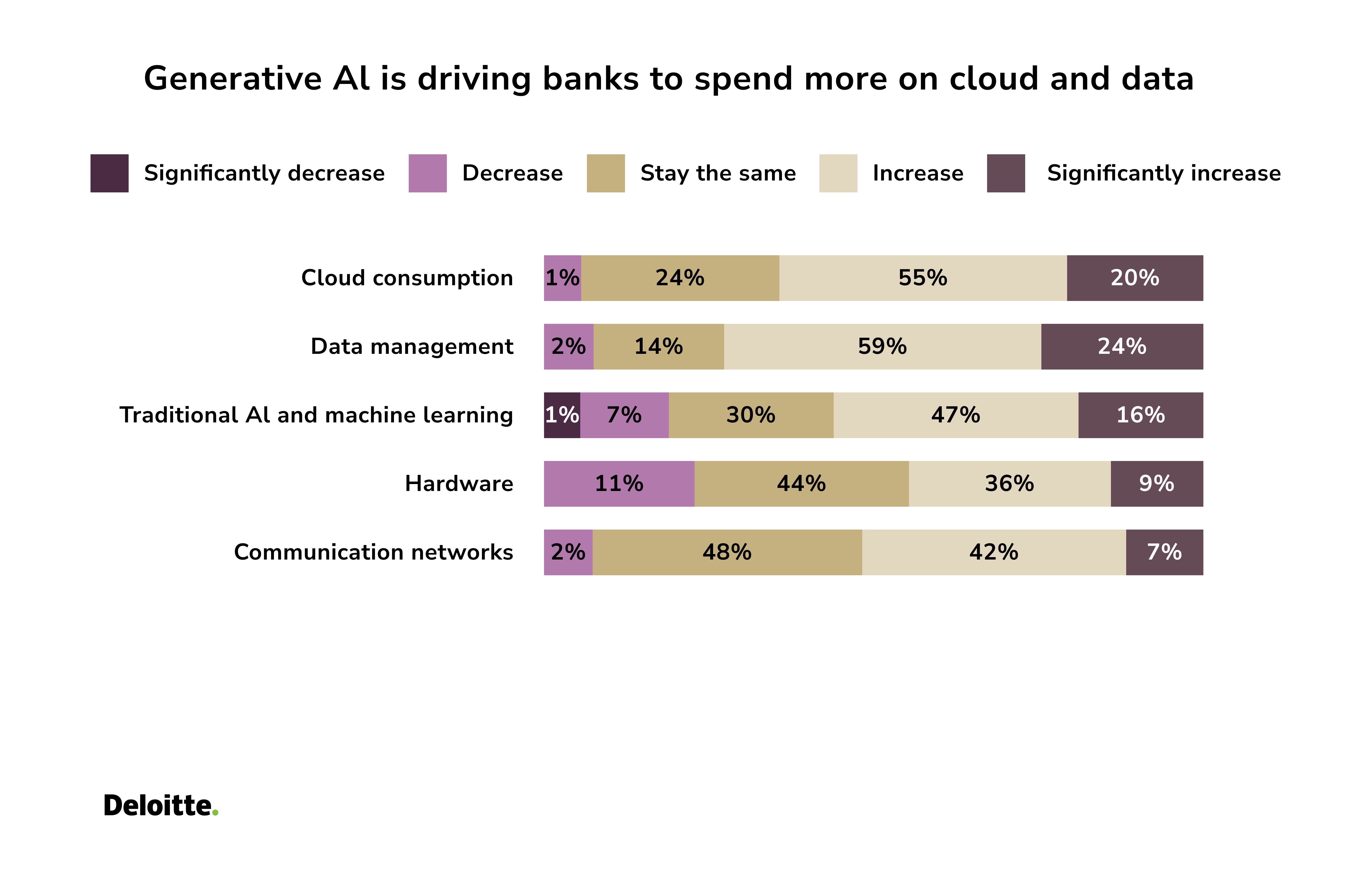

Another problem that banks will have to solve in the coming years is rising infrastructure expenses. The thing is, GenAI is driving banks to spend more on cloud and data.

Demand for Sustainable Financial Products

Consumer demand for ethical and environmentally sustainable financial solutions will continue to grow in 2025. Investment opportunities within renewable energy projects and ESG-focused funds will dominate this space. This means financial institutions will need to enhance transparency starting from the initial phases of banking app development. Disclosing metrics regarding transaction-related energy consumption and carbon emissions may be an obligation rather than an option.

We can also expect banks to launch more

- green loans

- carbon offset accounts

- renewable energy investment products

Quantum Finance

Although widespread commercial adoption of quantum computing might still be several years away, breakthroughs are anticipated in the near future, with specific applications addressing targeted business challenges emerging within three to five years.

The practical applications of quantum computing within financial services can be broadly grouped into three categories:

- targeting and prediction

- trading optimization

- risk profiling

Next-Gen Banking Services with Super-Apps

A financial super app is essentially a multi-functional platform that consolidates several financial services—such as banking, insurance, investments, and payments—into one easily accessible application. Designed with user convenience as a priority, these apps simplify financial management by offering features like account tracking, mobile payments, expense management, online shopping, and investment monitoring. The key lies in delivering these wide-ranging services within a seamless, user-friendly environment that enhances the overall experience.

By creating a centralized hub for users to manage their daily tasks and activities, super apps eliminate the need for installing multiple standalone applications. Valued at $75.5 billion in 2023, the global super-app market is expected to grow at a 28.2% CAGR.

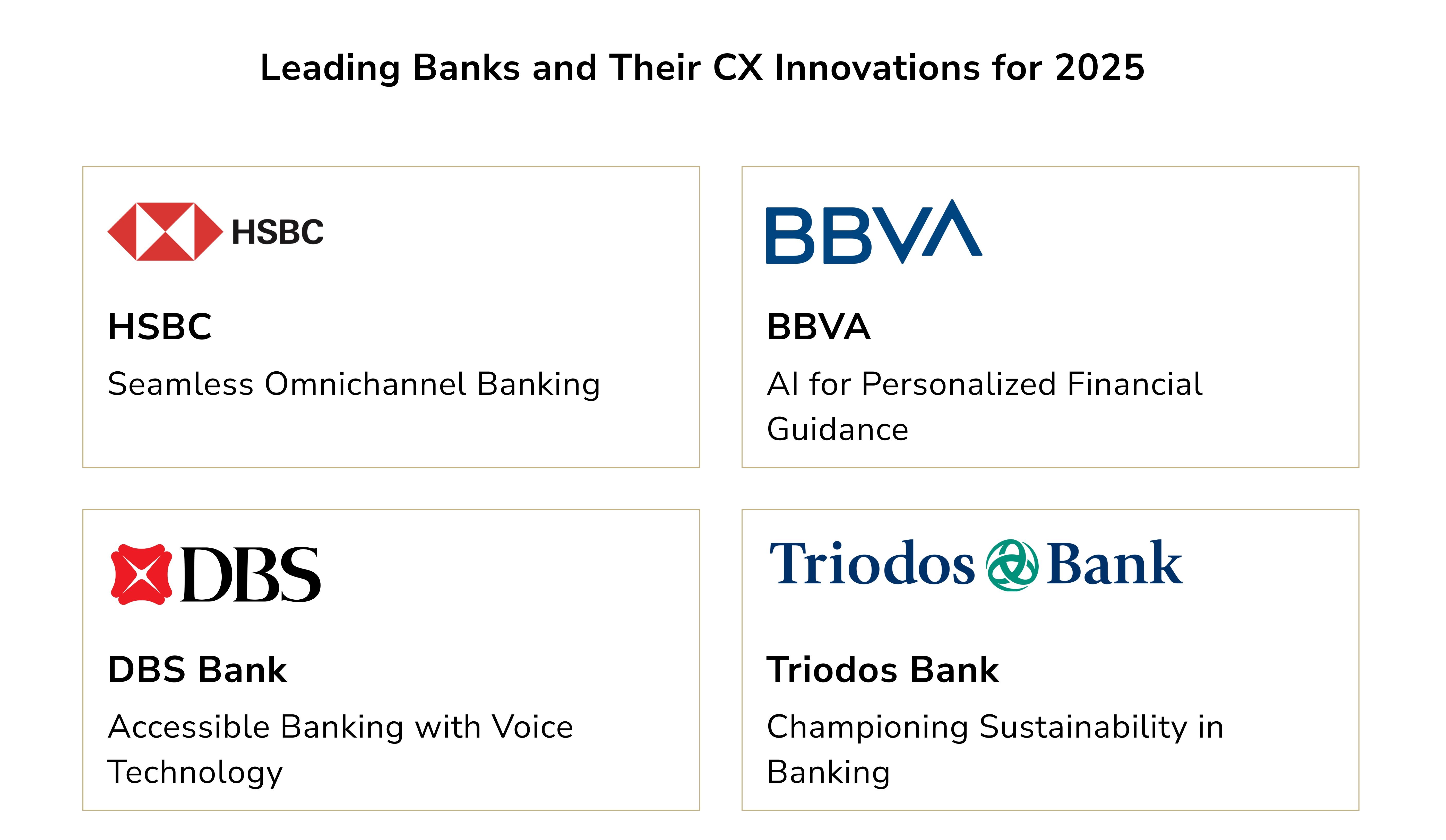

Leading Banks and Their CX Innovations for 2025

The best way not to lag behind is to learn from industry giants (perhaps your competitors). If you are one of the pioneers, keeping a close eye on the market should be within your routine.

We went over several trends being put to the test by successful financial orgs:

- HSBC has successfully merged its digital and in-branch services for the sake of a seamless customer experience. The org’s Connected Money app enables users to manage all their accounts (even from other banks) in one single platform. The result — a 15% increase in app engagement.

- BBVA employs AI to deliver personalized savings recommendations, investment opportunities, and real-time alerts about unusual account activity. The result — a 20% increase in customer engagement.

- DBS Bank has rolled out voice banking capabilities within its mobile app, making transactions and account inquiries as simple as speaking a command. This innovative solution enhances accessibility, particularly for visually impaired users or those who prefer a hands-free experience. The result — a 30% increase in DBS app usage.

- Sustainability lies at the heart of Triodos Bank’s philosophy, as it exclusively funds projects contributing to social and environmental well-being. This ethical focus resonates with customers who prioritize transparency and sustainability in their financial decisions. The result — a 25% surge in new accounts.

Final Word

So, how do you know when it’s time to invest in your org’s upgrade? Well, the time is right now. With digital banking trends shaping customer expectations faster than ever, the window for becoming an industry leader is narrowing. Progress loves motion. And because the world moves fast (almost too fast, it seems), you need to keep up. The amazing thing about technologies, particularly l AI, is that they actually make this task easier. You just need to use them accordingly. Start with two key steps:

- Audit your existing digital infrastructure to see where AI and other tech trends can bring value.

- Create a customer-first strategy aligned with sustainability and inclusivity—values that resonate strongly with modern audiences.

If you need help, we are at your service. We at Impressit help companies across niches leverage emerging technologies purposefully so you and your customers receive tangible value.

Roman Zomko

Other articles