AI in Wealth Management: Altering Investment Strategies

Wealth management is a component of financial services, incorporating expert advice across various domains for finance management. It’s an all-encompassing approach guiding financial planning, taxation, estate, and legal matters. Wealth managers act as a key connector between stakeholders in the process. They collaborate with accountants, tax professionals, and estate managers to align financial goals and needs wrapping them into a cohesive strategy. A holistic and client-focused approach ensures optimal financial health. It enables individuals to make investment decisions that will safeguard their future.

Where does AI stand in this and why do financial advisors need it?

How Does AI for Wealth Management Work?

Today's multitude of AI software development services for finance alter how wealth managers work. The conventional process of drafting a multifaceted investment strategy requires significant effort. Collecting data, performing manual analyses, and the heightened risk of overlooking critical information are just some of the challenges advisors face daily. Ensuring regulatory compliance presents even more complexities. Advisors need to compile and evaluate client portfolio data from various sources. This is both time-consuming and labor-intensive (often requiring up to 14 days to complete).

As in many other domains, AI is ready to take the burden of manual labor related to data analysis off humans’ shoulders. With the help of NLP and ML, advisors can (with much less effort) offer their clients:

- data-driven investment decisions

- tailored portfolio rebalancings

- risk management strategies

- instant, more precise recommendations.

“Artificial Intelligence refers to the ability of machines to carry out cognitive tasks similar to humans, such as reasoning, problem-solving, learning, and adapting to new information,” explains Nigel Gregory, managing partner and global head of wealth at GSB Group in a WealthBriefing interview. “In the context of wealth management, AI has the potential to provide valuable insights into clients’ spending and saving patterns, as well as their financial goals. This can help advisors and customer-oriented professionals to offer highly personalized content and advice.”

Indeed, integrating AI into wealth management redefines traditional practices. Large Language Models (LLMs) combined with extensive data assets can work miracles, yielding profits for both investors and wealth managers.

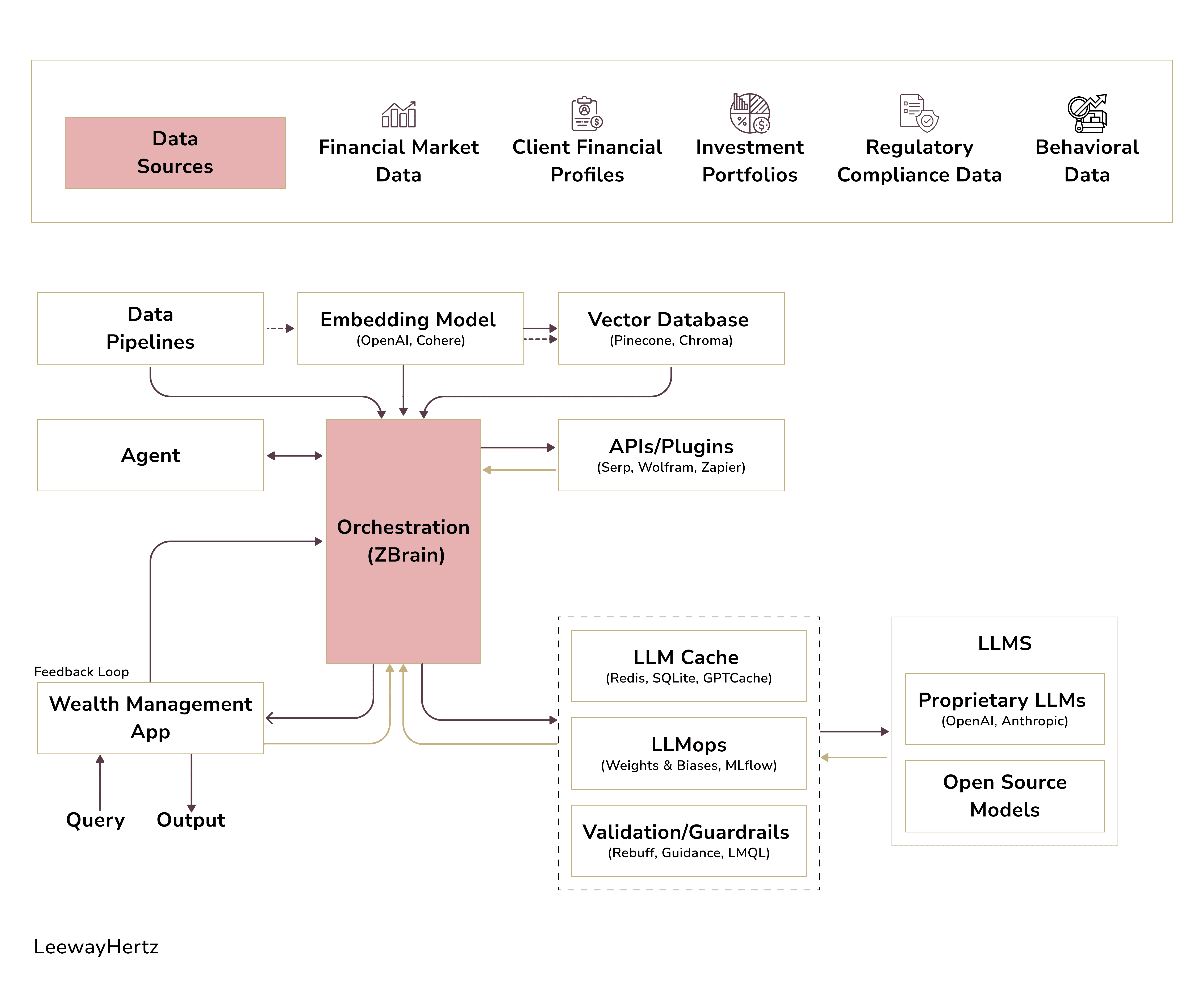

This framework portrays how a range of components work together to optimize AI-driven wealth management processes.

Where does it all take beginning? In data, of course.

At its heart, AI-based investment advisory relies on diverse and richly interconnected data sources. These include:

- Financial market data with historical and real-time trends, stock prices, etc.

- Client financial profiles, financial goals, risk tolerance, and past investments.

- Historical performance data that highlight patterns, helping refine strategies.

- Regulatory compliance data for adherence to financial regulations.

- Behavioral insights into clients’ preferences for hyper-personalized financial advice.

These datasets drive everything from market analysis to client-specific recommendations.

AI for Investing: Use Cases

What can better visualize AI at work than seeing market giants apply it? Let us highlight some of the most prominent instances.

AI for Personalized Investment Recommendations

Personalized financial planning and robo-advisors are among the top AI tech trends in the domain. AI considers risk tolerance, financial goals, and investment preferences. Then, AI-powered systems effectively craft unique investment strategies. ML analyzes vast datasets in this scenario, including historical investment performance, economic indicators, and market trends.

A great example is Betterment, a prominent advisory platform that leverages AI to build personalized portfolios aligned with clients’ financial goals. The platform continuously adapts to client behaviors and market conditions, ensuring recommendations remain customized and relevant.

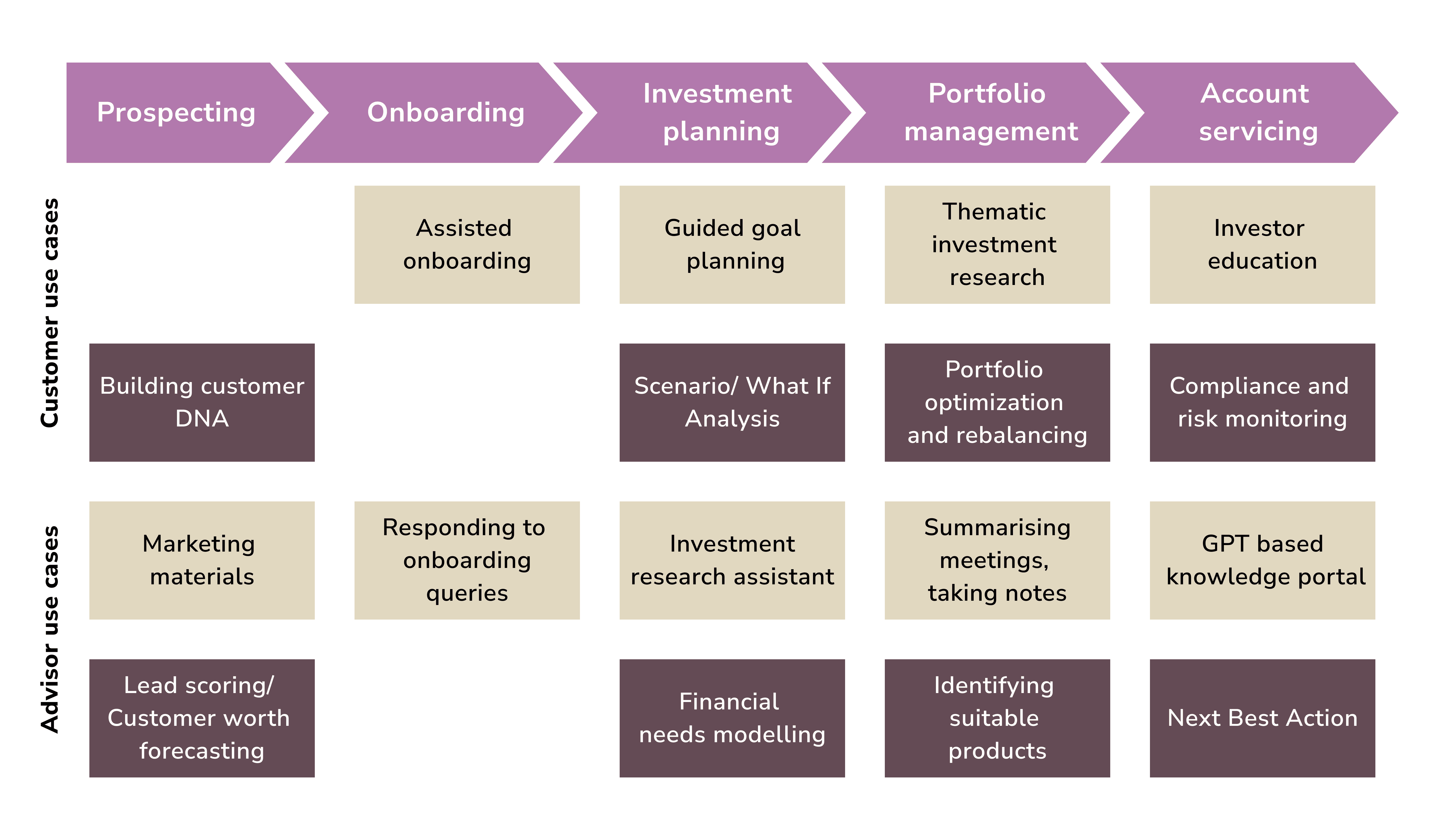

Also, Morgan Stanley’s Wealth Management Unit introduced the “Next Best Action” system, which leverages advanced AI algorithms to match investment opportunities with client profiles. This tool streamlines the selection of investment solutions. It identifies client interests, making interactions more engaging and tailored to their priorities.

AI for Predicting Investment Opportunities

AI’s predictive analytics capabilities empower firms to make more accurate predictions. One of the major strengths of AI in forecasting is its speed in detecting potential investment opportunities. It examines historical data alongside current market conditions. Predictive analytics then evaluates market dynamics and derives ideal strategies.

IBM’s Watson is a multipurpose platform and a leader in AI use for finance. Wealth managers now widely use the company’s tools to anticipate changes in the market. It allows them to adapt strategies in real time avoiding risking investments.

AI Customer Service and Chatbots

Chatbots bring much input in wealth management, particularly, when it comes to customer service. Some firms also use it to automate recommendations based on a client’s financial objectives. However, it does lack the human touch so necessary in today’s environment.

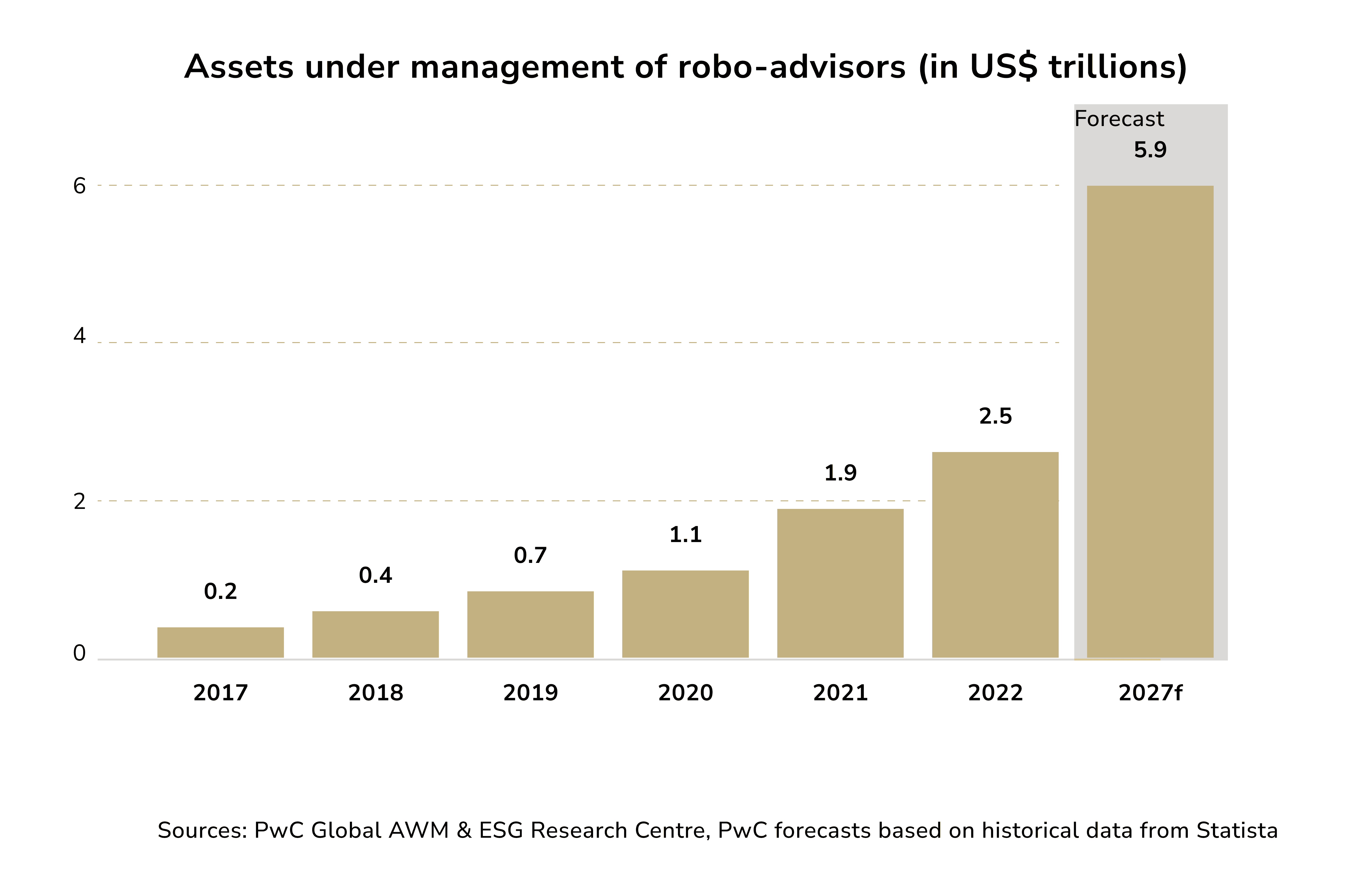

Still, market projections indicate the robo-advisory sector will reach $5.9 trillion by 2027. That’s up from $2.5 trillion in 2022, as per PwC. We consider its cost-effectiveness as a major drive for growth. Reducing manual intervention (or, in some cases, eliminating it) allows for lower advisory costs.

Wealthfront exemplifies this model. It implements AI to streamline financial planning and investment strategies for a broad audience. The company’s chatbot elevates customer service by handling routine inquiries and providing real-time support.

Bank of America’s Erica chatbot assists users with banking tasks, financial advice, and account management.

AI in Compliance and Regulation

One particular case where automation is especially valuable is monitoring and reporting compliance processes. Failure to meet regulatory demands can result in financial penalties and reputational damage. On the other hand, manual compliance processes are time-consuming and costly. AI technologies like NLP and data analytics bring balance to this process.

For example, ComplyAdvantage employs AI to ensure firms’ adherence to anti-money laundering (AML) regulations. The system detects suspicious activities indicative of financial crimes.

Ernst and Young’s cloud-based AI solution, SARGE, helps wealth management firms extract critical info from legal contracts and identify liabilities. While not entirely automated, SARGE has proven to save compliance teams up to 75% of their time. This is one of the tools that delivers on its promise to reduce costs while improving accuracy.

AI for Client Onboarding and KYC (Know Your Customer)

Client onboarding and KYC procedures take up a lot of time in the finance domain. Investment firms have to conduct document verification, anti-money laundering (AML) checks, and risk profiling with severe scrutiny. AI fraud detection tools can automate these processes granting quicker access to critical client information.

Onfido, for instance, uses AI to validate client profiles and safeguard against fraud during the onboarding process. Deutsche Bank Wealth Management has implemented an advanced AI system featuring multi-language support and NLP capabilities. It verifies user identities and compiles clients’ background data. As a result, the bank creates comprehensive profiles categorized based on risk levels.

AI for Market Surveillance and Sentiment Analysis

How else can businesses gain a competitive edge if not via thorough market analysis? AI-powered sentiment analysis tools evaluate data sources like social media and news to gauge market sentiment and investor behavior. Now, imagine AI is integrated across these critical areas. It would allow for a significant upgrade in

- streamlining marketing research processes

- improving client satisfaction

- minimizing investment risks

- staying ahead in a competitive landscape.

Platforms like Accern deliver insights into public sentiment advisors can use to make data-backed decisions. Nasdaq has fused AI algorithms with its market surveillance systems. Now the trading platform helps spot anomalies to ensure fair trading practices. Often overlooked, such functions are invaluable for maintaining market integrity and reducing the risk of fraudulent activities.

AI in Asset Management

The number one way AI can help improve asset management is by collecting data in the field. It uses OCC (Optical Character Recognition), so users can simply take a picture of their asset tag or label. From there on, ML and pattern recognition search for info from the plates and deliver it to your device. This is how wealth managers are capable of processing huge amounts of data in real-time.

BlackRock (which we will discuss in more detail below) has been known to leverage AI tools to parse unstructured data. It delivers insights that traditional analysis might overlook. This capability boosts the trend detection process enabling a proactive investment approach.

AI Portfolio Management and Rebalancing

With portfolio management, many firms take things a step further - they automate and optimize the entire portfolio management process. This is possible due to ML algorithms that continuously learn from new data, thereby refining investment strategies over time. For instance, reasoning in AI supports portfolio optimization, risk assessment, and personalized investment advice by reasoning through market data and client preferences.

Numerai hedge fund utilizes its own unique approach. Data scientists from around the world create ML models to predict stock market movements. Numerai’s platform allows participants to submit their models, which the fund then aggregates to form a meta-model for trading. This collaborative effort aims to enhance predictive accuracy.

Another great example of AI in portfolio management is Qraft Technologies. This is a South Korean fintech company that employs AI to construct and manage equity portfolios. Their AI platform automatically rebalances portfolios based on market conditions. The end goal is to outperform traditional benchmarks.

AI for Lead Generation

Traditionally, identifying potential clients relied heavily on manual approaches and conventional metrics like demographics and net worth. Now, AI enables wealth managers to micro-segment prospects. This is possible via advanced sentiment analysis. Leveraging insights from social media, niche news outlets, and public information, managers uncover new leads and craft highly personalized pitches to resonate with prospects.

Finantix is a financial technology provider based in California. The company has developed an AI-based platform that analyzes LinkedIn data to assess whether relationship managers are connected to a prospective client. It then generates pitch messages in an appropriate tone, simplifying the lead-generation process.

AI for Advisory Automation

The adoption of robo-advisory platforms has grown substantially, driven by advancements in ML and changing client expectations. These platforms bring value in many aspects of investing, like

- automating financial planning and investment management

- delivering data-driven recommendations to clients

- reducing the need for in-person interactions.

During the pandemic, Wealthfront experienced a significant 68% surge in account sign-ups. Its AI-based robo-advisory service helped customers analyze their saving and spending patterns to predict optimal steps toward meeting financial goals. Realizing the need for transparency, Wealthfront later updated its platform to give users more control ensuring long-term client relationships.

AI Investing Tools

With AI platforms popping up faster than ever, it can be difficult to select the one that actually fits your needs. Meanwhile, you also have to keep watching other critical technological upgrades. Ideally, AI and ML applications should align with wealth management goals, rather than compete with them.

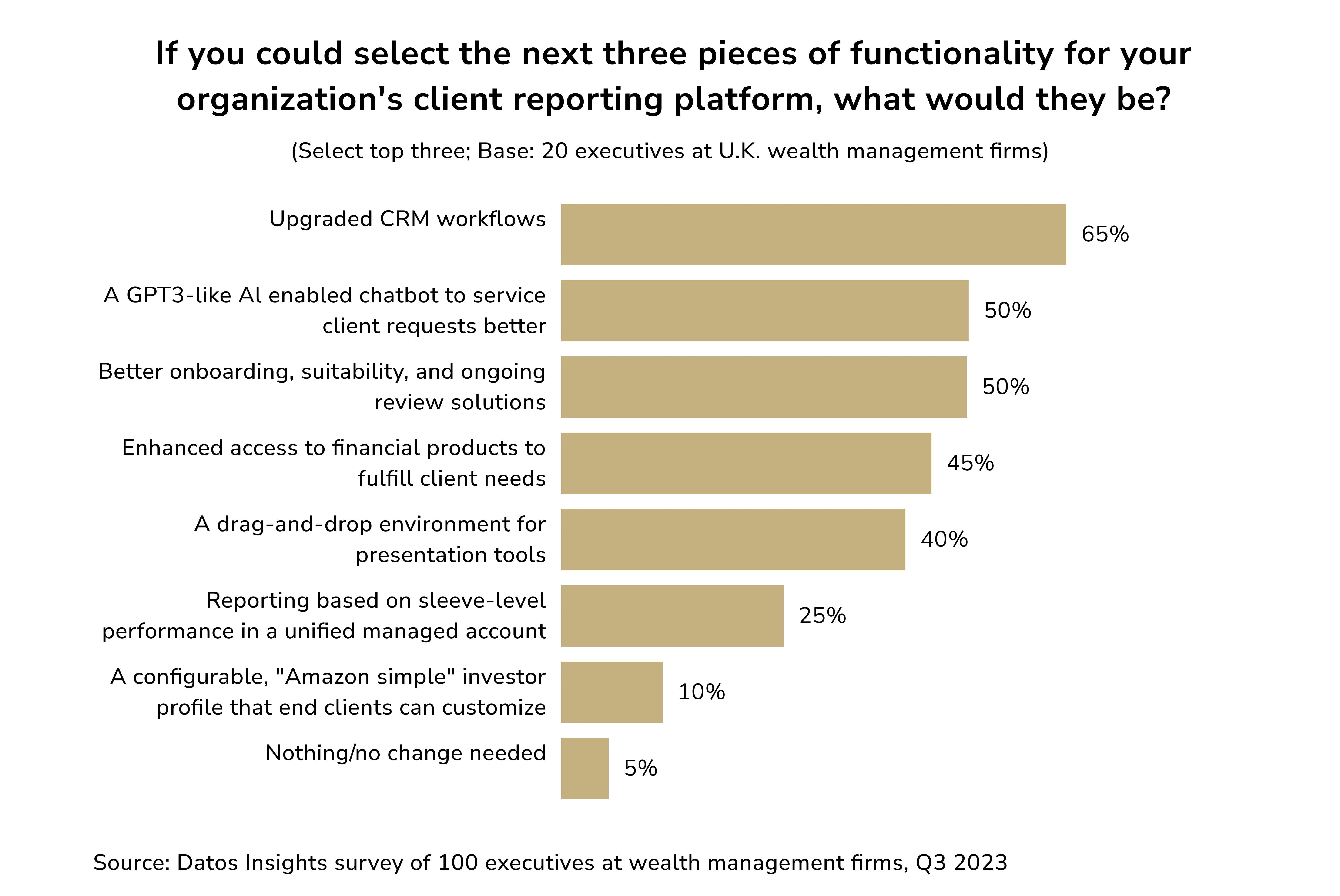

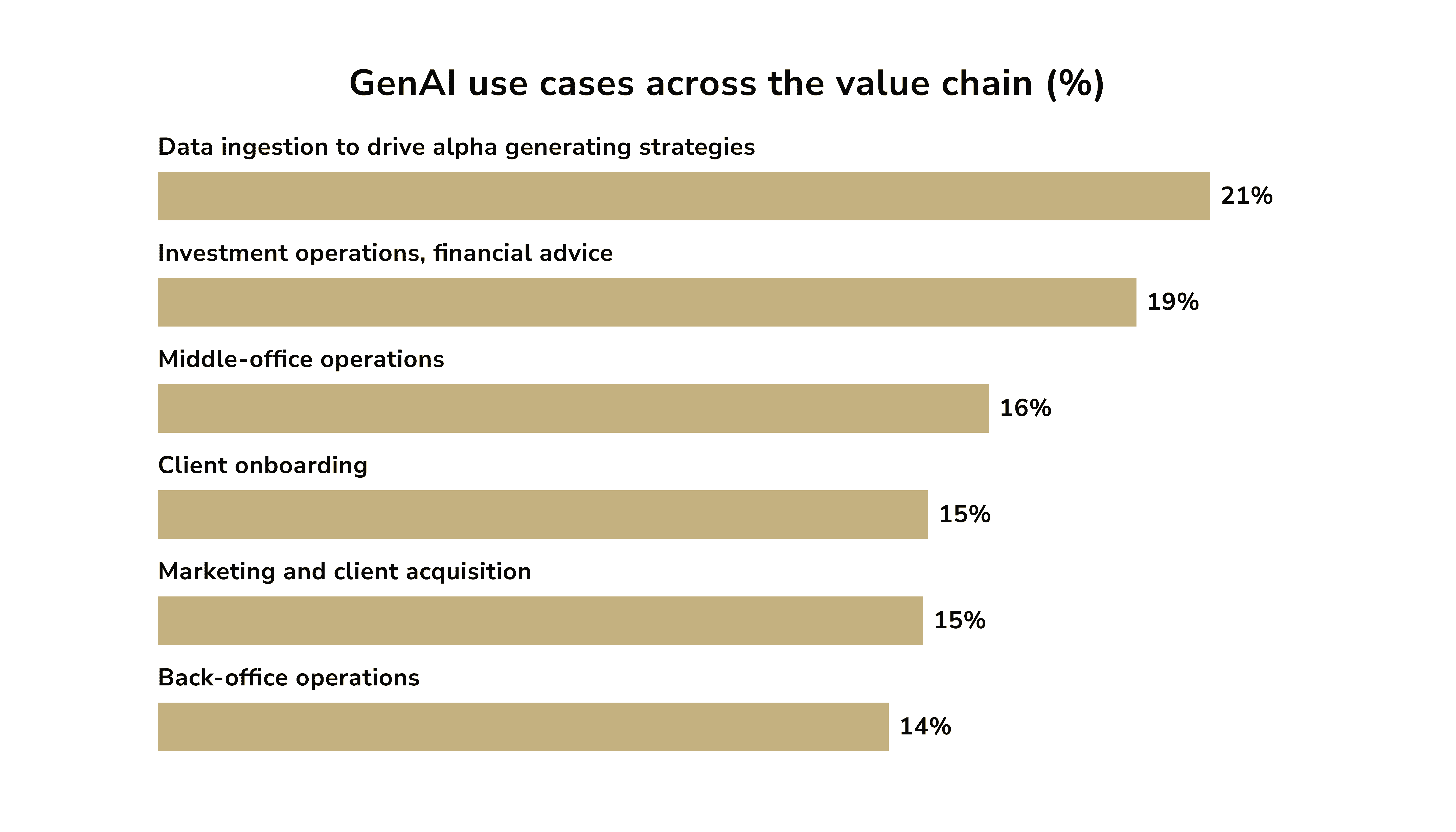

The report below explores the features wealth managers identify as essential for their client reporting platforms. It also examines how U.K. firms are approaching AI and ML across the value chain. The findings are based on quantitative survey responses from 20 U.K. wealth management pros during Q3 2023.

Now, let’s review several prominent AI investing tools.

BlackRock Aladdin

BlackRock Aladdin is a comprehensive platform currently in use by institutions and investment managers worldwide. It incorporates sophisticated risk analytics, portfolio management, and operational tools under a single interface. With the help of ML algorithms, it provides insights into market trends, risk factors, and performance metrics.

One of Aladdin’s standout features is its ability to simulate various market scenarios. Scenario analysis assumes specific changes in the value of a client’s portfolio. Examining a theoretical worst-case scenario helps prepare the portfolio for a valid response. Following the principle of “what if” an adviser can offer the client the most comfortable strategy.

It is worth mentioning that Alladin focuses on ESG (Environmental, Social, and Governance) factors. The platform thus strengthens its commitment to transparency and accountability.

IBM Watson

IBM Watson represents a true paradigm shift in how AI can be applied across various domains, including finance. According to the AI Time Journal, “IBM Watson uses more than 100 different techniques to analyze natural language, identify sources, find, and generate hypotheses, find and score evidence, and merge and rank hypotheses.”

In the investment domain, Watson offers tools assisting in sentiment analysis. Investors can gauge the market via news articles, social media, and other relevant data sources. Synthesizing this information allows Watson to deliver actionable intelligence to portfolio managers. Strategic planning and risk management processes become simple. Moreover, IBM constantly improves its algorithms based on new inputs, making the company a dynamic ally in the world of finance.

Kensho

Kensho, a subsidiary of S&P Global, specializes in financial analytics. The firm has developed sophisticated tools to query complex datasets using natural language. This user-friendly approach democratizes access to advanced analytics. Investors are able to derive insights without requiring extensive technical expertise.

Kensho’s analytics engine identifies correlations between market events and financial metrics. It comes in handy for investors when historical and predictive trends play the most vital part in portfolio rebalancing. Kensho speeds up the decision-making process. Plus, being integrated into S&P Global’s data services further enhances its value in research and analysis.

Axyon AI

Another leading investment tool focused on predictive analytics tailored specifically for financial markets. Axyon AI’s algorithms consider variables like market conditions, historical performance, and macroeconomic indicators. These are valuable in identifying patterns and predicting future developments.

What makes Axyon shine is its emphasis on creating customized solutions for its clients. The company collaborates closely with financial institutions. This helps Axyon develop models that cater to specific investment strategies, thereby enhancing portfolio optimization. Since personalization is often cited as the number one investor demand, Axyon definitely gained ahead here.

DataRobot

DataRobot has over 12 years of experience in AI&ML. It is basically a pioneer in the field. It delivers value to the industry as a whole by democratizing access to ML for orgs across various sectors. The company’s suite of automated ML tools helps investors build, deploy, and manage predictive models without data science expertise.

In the context of investing, DataRobot is great in risk assessment, portfolio allocation, and trading strategies. Due to its self-service approach investment professionals can experiment with various algorithms and models. Then, they themselves can adapt to changing market conditions swiftly. What’s more, DataRobot is focused on operationalizing AI. Meaning firms can seamlessly integrate its capabilities into their existing workflows.

GenAI in Wealth and Asset Management

A survey by EY Financial Services in August 2023 sought input from executive and managing directors at wealth and asset management (AWM) firms generating over $2 billion in revenue. Participants ranked the areas they believe GenAI could impact across their organizations. Among the top applications in their opinion are

- alpha generation and financial advice

- client onboarding, marketing, and investment operations

- back-office operations transformation.

Roughly speaking, Gen AI in wealth management facilitates advisors’ daily work—making investment decisions for their clients. Financial data on a large scale includes market trends, historical performance, and economic indicators. AI-powered tools make analyzing and deriving hidden patterns easier and faster.

GenAI for Investing

Generative AI complements wealth management in several key ways:

- Boosts brand visibility and client acquisition through targeted strategies and campaigns (tailored outreach, automated lead generation, campaign performance tracking, sales forecasting, etc.).

- Provides strategies for clients to optimize tax liabilities (simulated tax strategies, investment tax optimization, custom tax solutions, etc.).

- Offers solutions for high-net-worth clients (customized portfolios, risk monitoring, real-time portfolio tracking, etc.).

- Helps clients plan financially stable and secure retirements (income forecasting, dynamic plan adjustments, scenario simulations, adaptive financial planning, etc.).

- Manages non-conventional assets, i.e., private equity, real estate, and hedge funds for portfolio diversification (asset valuation and forecasting, streamlined due diligence, etc.).

Developing AI Services for Investment

Predictions indicate asset management by robo-advisors will grow in the next several years.

This forecast makes sense once you remember that the idea of implementing AI is not new to the field. Many firms already use it to improve operations and the client experience. Even if you’re new to the concept, the shift doesn’t necessarily have to be an overwhelming experience. As an AI development company, Impressit can help you kick-start your project. We recommend approaching AI implementation strategically and sustainably. Here’s how you can start:

- Gain a Solid Understanding

Invest in understanding AI’s capabilities (keeping in mind their evolving nature), even if you are in no rush to use it. Familiarize leaders, advisors, and teams with the competitive landscape and relevant regulatory standards.

- Explore and Experiment

Assess how AI can complement your specific business needs. To make an accurate analysis, it is best to resort to trusted vendors for a consultation. Experiment with generative AI tools first for personal use cases to understand their functionality.

- Establish Clear User Policies

Develop guidelines for your teams regarding AI-based procedures. Clearly assert when and how exactly your firm is allowing AI use. Emphasize human oversight and responsible use. Most importantly, ensure policies keep up with algorithm advancements.

Note: consider deploying fine-tuned models trained on your firm’s proprietary data. Bespoke AI instances (data observations) can personalize content delivery across channels. This will help your team fine-tune client communications and streamline complex tasks.

- Prioritize Data Strategy

AI’s effectiveness hinges on access to high-quality data. That being said, investing in data aggregation and integration helps maximize AI’s capabilities. Unbiased, organized data is key to unlocking AI’s potential to serve your firm effectively.

Concerns over AI Use in Finance

For the past several years, the biggest industry payers have driven the hype around AI (often focusing solely on GenAI). But the technology has only past the second of the five Gartner Hype Cycle stages — the Peak of Inflated Expectations. Hence, determining whether this particular innovation represents a genuine industry turning point or simply another fleeting trend is challenging. At least, for now.

This is especially true in Silicon Valley, known for big promises that often fail to be delivered. Securities and Exchange Commission Chairman Gary Gensler recently referred to AI as “the most transformative technology of our time”. But, he also added that risks exist linked to its misuse, noting that now “fraudsters have a new tool to exploit”.

JPMorgan Chase CEO Jamie Dimon has cautiously championed AI’s role in financial services. This is despite calls from some tech leaders to pause its development. Dimon argues that “bad actors” will leverage AI advancements in their malicious acts in any case. In his opinion, it seems prudent for legitimate entities to strategically adopt the technology right now.

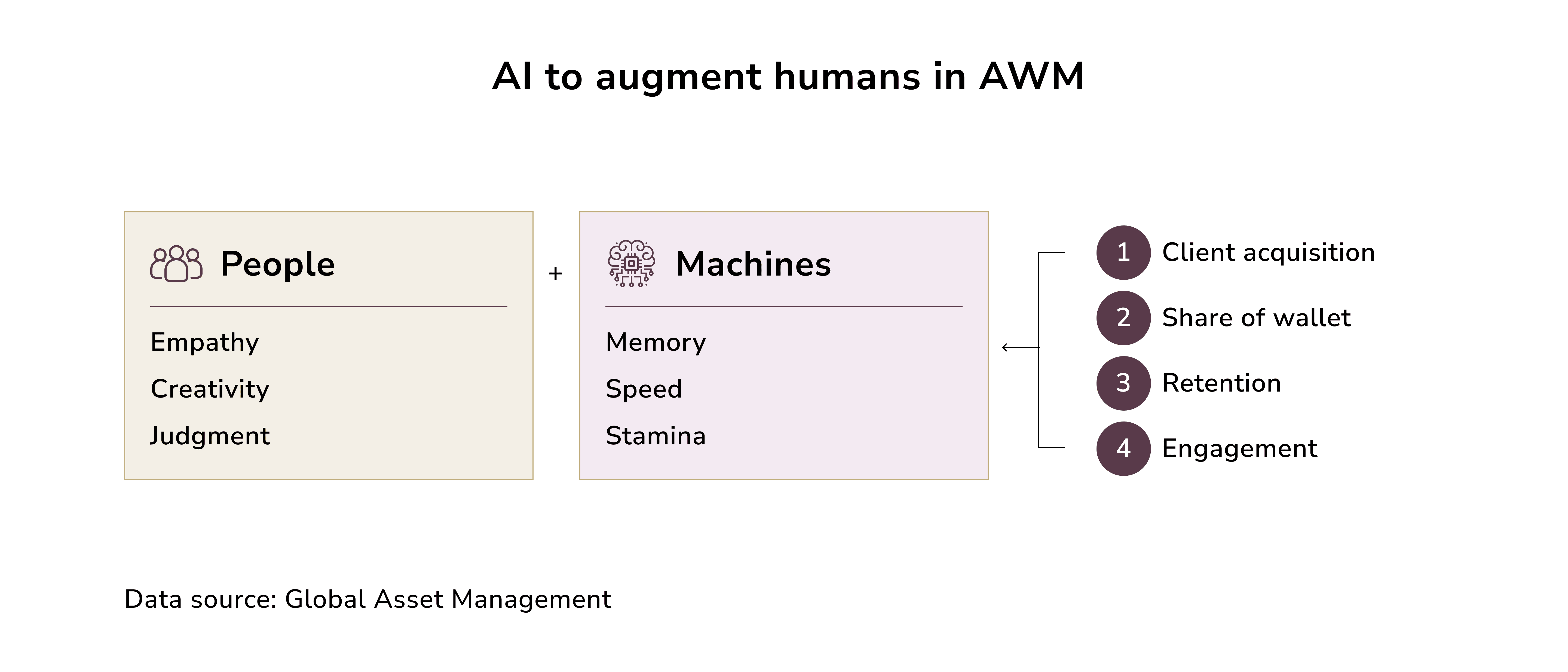

The domain seems in a hurry to explore AI’s potential, particularly in crafting investment strategies. But its integration requires making compliance-heavy decisions. It is essential to avoid over-reliance on AI. Algorithms should complement — not replace — human advisors. Complex financial planning often necessitates a deep understanding of personal circumstances, emotions, and long-term objectives. Perspectives that AI alone cannot replicate. Hence, firms should aim to adopt algorithms that will empower advisors to raise the standard of service they provide to clients. Only a balanced approach can ensure AI works ethically and effectively. Preserving the human touch remains irreplaceable.

The Competitive Edge of AI

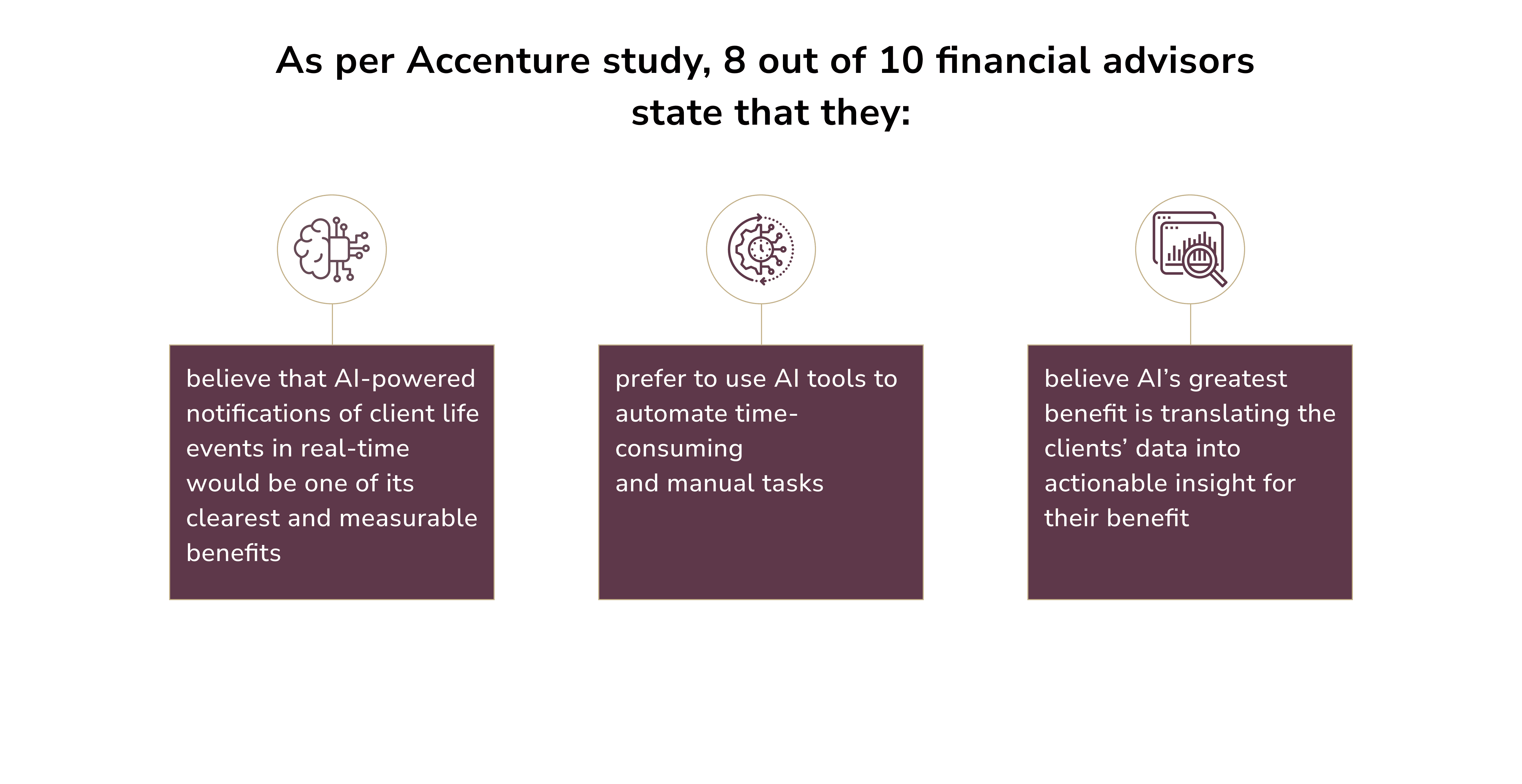

While AI adoption in wealth management requires robust governance, the technology does offer unparalleled merits. Its advantages, like optimizing client portfolio balancing operations, are appreciated by investment managers themselves. For businesses, implementing thoughtful strategies is a chance to confidently shift from managing risks to testing new opportunities.

Most forward-thinking advisors already observe the positive shifts in their workflows.

New-to-field orgs could benefit greatly from their independent expert consultancy. But, they have to act now to keep up with the pace. The demands of modern investors grow as tech capabilities evolve. This creates a highly competitive environment. Taking small, deliberate steps today can unlock long-term benefits and help stay afloat.

New-to-field orgs could benefit greatly from their independent expert consultancy. But, they have to act now to keep up with the pace. The demands of modern investors grow as tech capabilities evolve. This creates a highly competitive environment. Taking small, deliberate steps today can unlock long-term benefits and help stay afloat.

At this point, one question might have crossed your mind. How can your firm strategically adopt AI for your investing firm to create meaningful, scalable, and lasting impact?

AWM firms increasingly adopt generative AI for mid- and back-office functions, enhancing trading strategies and analyzing unstructured data. This is more of a necessity for those willing to keep up with the pace. To get ahead, you can start by:

- Outsourcing back-office functions to managed service providers. You can thus gain the capacity of cutting-edge technology platforms and the skills to operate them.

- Establishing innovation labs and conducting sandbox trials. This fosters the development and deployment of emerging technologies.

- Expanding services through AI-powered tools and robo-advice. Consider offering tailored solutions (once reserved only for high-net-worth clients) to a wider network. You can achieve this by adopting a hybrid delivery model combining human and digital interactions.

- Implementing strong governance, data protection measures, and processes. This is necessary to address possible concerns over data privacy, ethical usage, and potential unintended consequences.

Roman Zomko

Other articles