Logistics Industry Challenges and Potential Solutions

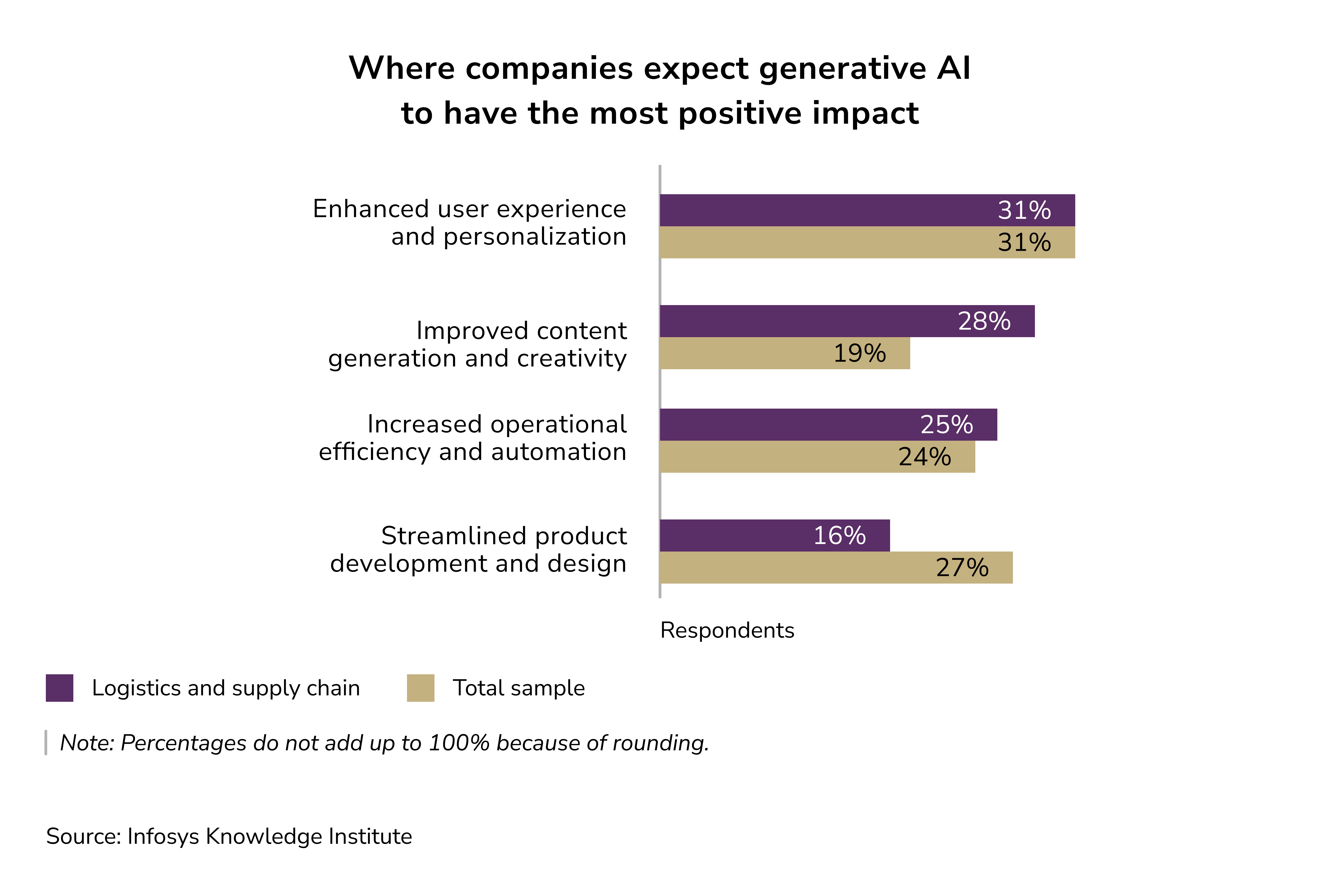

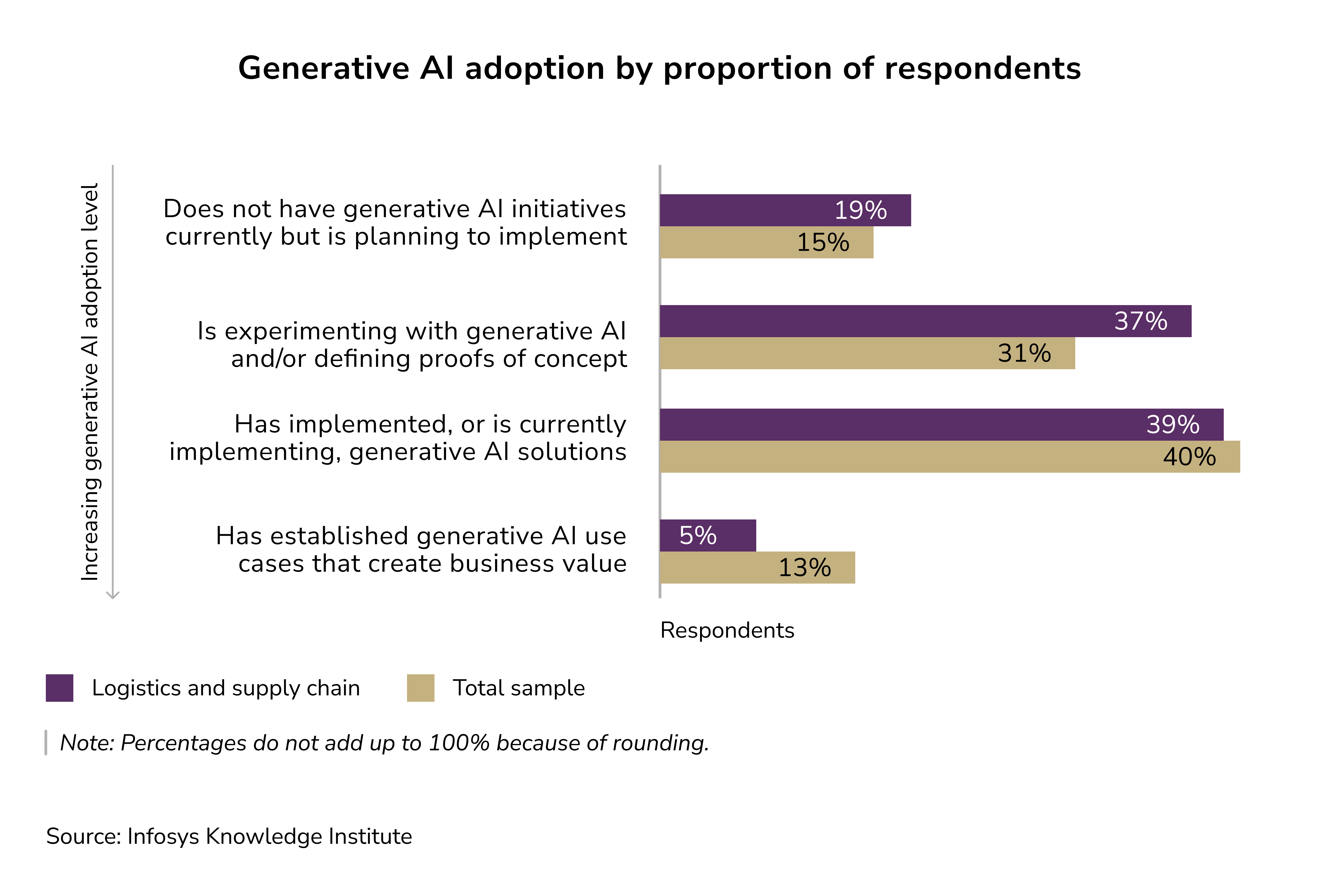

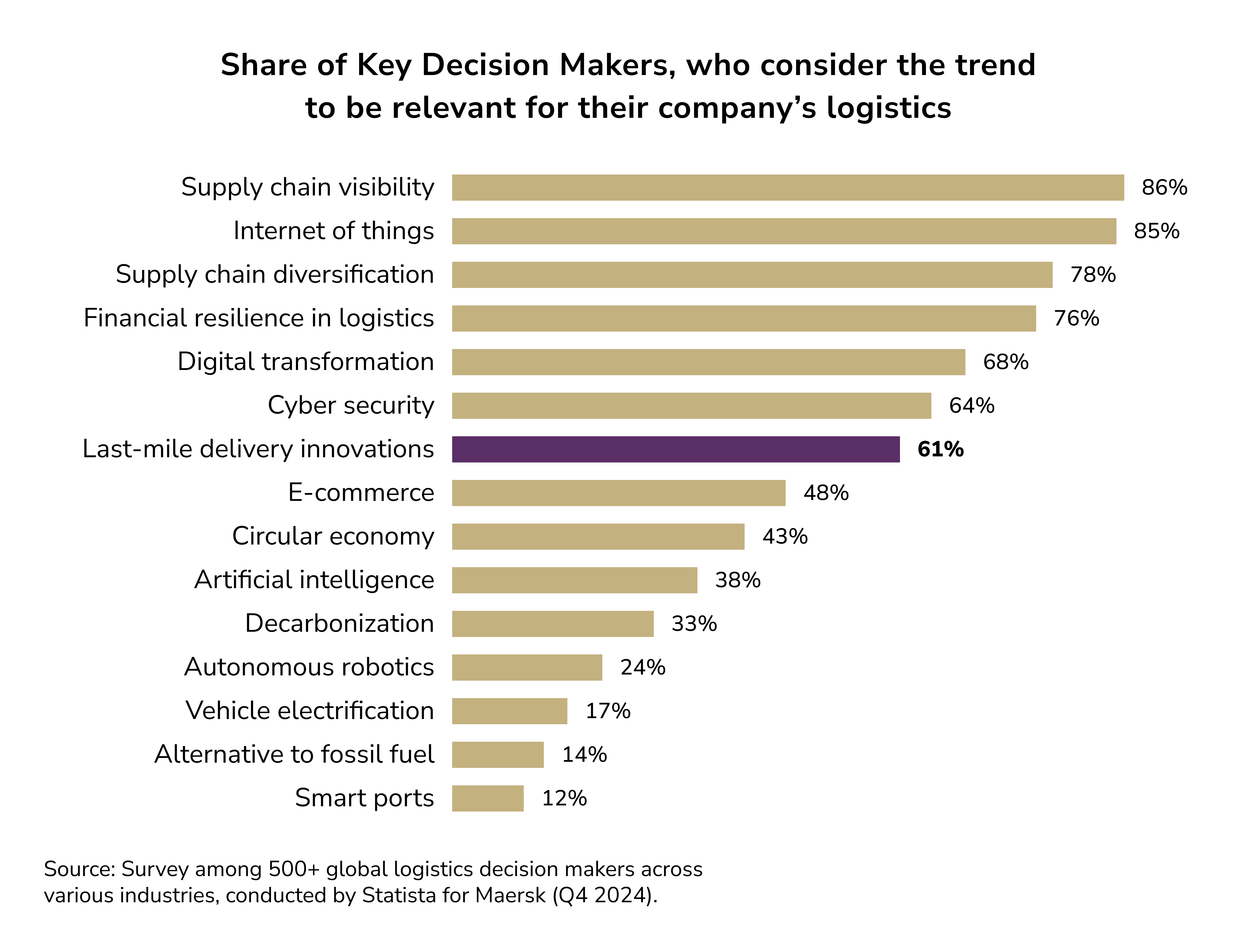

The logistics sector has a contradictory relationship with advanced technologies. The industry shows increased interest in new technologies but remains focused on only a few or is hesitant to implement them to the same extent as other industries.

Plus, in 2025, logistics is still mired in the challenges of the freight recession. The market remains particularly volatile and highly unpredictable, compounded by volatile forecasts for container volume growth.

In light of the challenging conditions, supply chain leaders embrace their entrepreneurial spirit and seek new ways to mitigate the disruption. We have researched the major industry challenges and potential ways to address them. But examining the effective and ineffective methods for achieving balance and delivering customer satisfaction is the burden of industry leaders.

Logistics Industry Dynamics

Logistics is affected by a myriad of global political, technological, and consumer changes. Geopolitical uncertainties, like changes in border trade policies and tariffs, have caused the industry to rethink its supply chain strategies due to a decline in global freight volumes. For instance, uncertainty around tariffs on China and the U.S. led to a decline in trade container volumes.

It also pushed companies to look for sources of nearshoring and other sourcing options. As a result, organizations now have a thriving culture of nearshoring, as suppliers support relocating manufacturing facilities to mitigate risk. At the same time, the global logistics networks have become even more complex. This is because the industry is complex and now relies on the coordination of multiple, often disparate systems.

When it comes to technology, organizations are mostly funding automation and AI solutions to improve supply chain resiliency. Logistics firms in North America apply AI for intelligent routing and the optimization of warehousing. The use of IoT-enabled, real-time tracking, and data analytics helps improve supply chain visibility and responsiveness. Innovations of this kind are necessary as organizations attempt to become more agile and resilient to changes, as the business climate becomes more and more trying.

Environmental, Social, and Governance Objectives

Another essential consideration is the heightened focus on sustainability and ESG (environmental, social, governance) objectives. Regulators and customers alike expect logistics operators to minimize carbon footprints, adopt greener modes of transportation, and enhance compliance with environmental regulations. Consequently, businesses are implementing sustainability measures at the strategic level (for instance, through the use of electric vehicles and route optimization to reduce fuel consumption).

Mergers and Acquisitions

Mergers and acquisitions have become a vital aspect of competing within the logistics industry. With the growing need for scale and varied capabilities, logistics industry M&A activities have increased considerably. For instance, the European logistics industry witnessed a significant recovery from pandemic lows, resulting in 364 M&A deals in 2024, which marked a 15 percent increase from the previous year. While many of these deals were small and mid-size acquisitions for market entries and specialized service additions, the market also hosted a number of notable large value transactions. One such transaction is Danish DSV's proposed acquisition of DB Schenker (Germany's rail logistics arm) for USD 12 billion, which will position DSV as the world's largest 3PL provider. Other notable transactions in 2024 were EP Group's £3.6B acquisition of the UK IDS (Royal Mail) and Apollo's $2.7B purchase of the parcel carrier Evri.

The need to establish scale, international presence, and comprehensive service offerings continues to drive consolidation. Logistics firms acquiring rivals and niche market players allows companies to grow their geographical presence and fill gaps in specific capabilities. For instance, a port operator acquiring a last-mile delivery company would enable the port operator to provide integrated services. Industry analysis indicates that even after the highly volatile pandemic phases, the industry continues to engage in M&A to de-risk exposures and enhance operational resilience. In effect, acquiring businesses that provide a "strength" layer to withstand potential shocks has become a fashionable strategy.

The ease with which firms make cross-border acquisitions may fuel speculation, as evidenced by the fact that in 2024, 44% of acquisitions in the European logistics market were international in scope. The acquisitions were to gain entry into new markets and high-growth trade lanes. The strategic buyers and private equity players have confidence that consolidation will provide the operational efficiencies, service diversification, and scale needed to improve the resilience of their businesses to deal with the challenges discussed below.

Logistics Industry Challenges

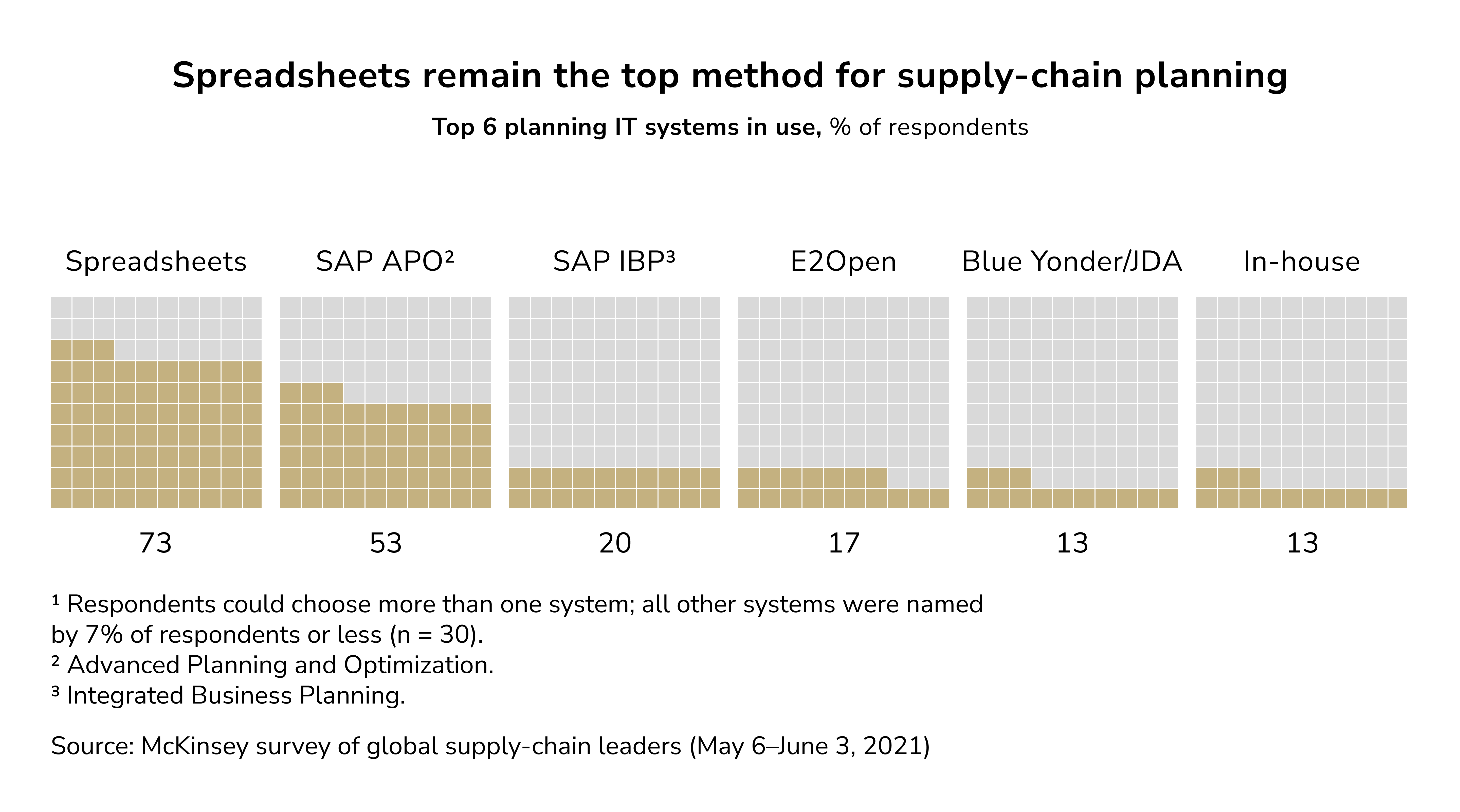

Many challenges in the sector stem from two interdependent factors: 1) the supply chain is inherently complex and dynamic; 2) the industry continues to cling to old tools. The effectiveness of a supply chain depends on a plethora of operations, including procurement, warehousing, transportation, inventory management, distribution, and last-mile logistics. Unfortunately, most industry leaders continue to hold on to legacy systems in their business processes. McKinsey states that “supply-chain leaders haven't done themselves any favors by clinging to manual systems and antiquated software, including one widely used application that’s so old the provider will soon stop supporting it.”

The reason why so many companies in the sector hang on to their old systems is that upgrading or moving to new ones takes a lot of time and money. The more complicated the chain is, the more resources the upgrade necessitates. For instance, a complex supply chain like the pharmaceuticals industry might take 4 to 6 years and cost between $60 and $120 to move to a new supply-chain-planning system. In addition, the upgrade doesn't necessarily yield the expected business outcomes.

Let's talk about these and other problems in more detail.

Challenge 1: Siloed Operations

Logistics and supply chain processes encompass various functions, including warehousing, transportation, inventory management, and customer service. If these functions operate on different systems, or data is not exchanged freely, information silos are created. This, in turn, leads to poor communication, delays, and inefficiencies. When different teams in different locations all use different systems, information becomes dispersed and hard to locate. This makes rapid and efficient operations in a fast-moving global marketplace almost impossible. Siloed operations result in a lack of visibility across the chain, delayed decision-making, and increased expenditure owing to redundant or erroneous processes.

Overcoming this challenge requires aligning information, goals, and technology across the organization. Many logistics providers are investing in integrated platforms (like Transportation Management Systems and Warehouse Management Systems) to connect siloed functions formerly. Integration allows a unified, real-time view of all moving parts in the order management, warehouse stock, and transport. With customers expecting services within mere seconds, operational isolation can be detrimental to business. Meanwhile, providing every team with operational data to improve collaboration creates a strategic operational advantage. In this case, integration is the answer to the challenge of addressing visibility issues and creating seamless customer service.

Challenge 2: Data Management and Security

Modern logistics collects, stores, and processes large volumes of shipment, inventory, route, and customs data. Because of global trade, the logistics sector harbours unprecedented volumes of data that are increasing by the minute. This can be sensor data from IoT cargo trackers, customer orders, or delivery status updates. More often than not, information is incomplete or disparate. This eventually results in shipment tracking data not syncing with retailer order data. Needless to say, data management becomes even more difficult in this case. Furthermore, manual data handling often introduces more errors, resulting in inefficiencies in customer service, as well as mistakes in shipments and billing.

Investing in modern data management systems (e.g., cloud databases and unified data platforms) can help handle the growing volume of data. Modern tools can consolidate the data, making data processing much easier and precise. Keep in mind, though, that with digitalization comes increased risk of cyberattacks. So, in addition to managing the flow of information, appropriate safeguards must be deployed to ensure data security and privacy.

Logistics firms, therefore, face dual challenges. They must find and implement modern data management solutions like cloud databases and unified data platforms. Meanwhile, they should also enhance privacy and security through cyber controls, such as encryption and access controls. Meeting this challenge will allow firms to leverage and manage their information as a tactical liability in risk management and derive real-time analytics and insights.

Challenge 3: Lack of Process Automation

For a long time, the logistics industry has had to deal with unautomated processes that are time-consuming and labor-intensive. Consider the paperwork and packages that need to be completed and sorted. In the fast supply chain of the modern world, unautomated processes can slow operations down and increase the chances of error. Human-centric, paper-based workflows are time-consuming but also carry a high risk of error. In the supply chain, this error will manifest in delays and unexpected costs.

An example of the problem is document processing. Logistics is one of the most paper-intensive industries, handling numerous time-sensitive documents. If those are processed manually, the chances of shipment delays increase due to data entry errors and missing documents, as well as time lost to employee paperwork.

As customers place next-day delivery requests and demand precise delivery tracking, logistics companies understand the need for advanced business process automation. Automation in this context can mean many things, such as robotic process automation in the back office, and physical automation in the warehouse (automated sorting conveyors, robotic picking systems, etc.).

All of these innovations seek to boost speed and precision. The integration of robotics and AI-controlled systems can lead to remarkable increases in productivity. McKinsey predicts that applying AI and automation in logistics could generate $1.3–$2 trillion per year in economic value over the next 20 years. This number is a vivid demonstration of the cost of continuing manual processes.

Note: the complexity of older systems and processes within an environment makes the first steps of automation implementation the major hurdle. Organizations must first go through the AI opportunity discovery stage to identify which processes require automation (such as order data entry and invoice processing) and then invest in the appropriate systems. Many companies use AI-enabled systems to automate document handling, reducing processing time and error rates.

Challenge 4: Dependency on Legacy Systems

As we've already stated, many logistics companies are still reliant on legacy IT systems, e.g., aging software, outdated platforms, and even paper-based recordkeeping. This problem arises in many ways: old systems have slow processing speeds, lack the functionality needed for modern business, and generally reduce productivity. Maintaining old software or hardware is expensive and prone to breaking down or requiring specialized expertise to fix.

Even more so, legacy logistics systems for warehouse management, transport management, and the like will almost always poorly integrate with newer tech. Innovations such as real-time tracking, advanced analytics, and mobile solutions are basically useless if they can't interface with the core system. For example, interfacing a 20-year-old freight management system with modern IoT platforms or cloud-based analytics tools will pose a huge challenge due to siloed data.

In order to achieve scalability and resiliency, the logistics and supply chain sector should leave behind outdated technology. Adopting new systems is critical for handling peak demand, adjusting to new modes of transport, such as drones and autonomous cars, and incorporating new data streams quickly. Unlike modern systems, legacy systems lack the necessary functionality and adaptability. Many logistics and supply chain companies have recognized that modernizing these core systems is important for operational continuity. Migrating to a cloud-based architecture, next-gen ERP or logistics software, using AI for refactoring legacy systems, and using middleware/APIs to integrate legacy and modern systems are all parts of the solution.

Note: Reducing reliance on legacy systems is, without question, becoming a crucial objective for logistics and supply chain companies to maintain efficiency and flexibility. The primary challenge, however, has to do with justifying the upfront capital expenses and managing the transition without disruption to current systems and processes.

Challenge 5: Skilled Labor Shortages

Besides being a process-driven business, logistics is also a people business. For the last several years, the industry has been dealing with a shortage of skilled workers, which has been a significant challenge for maintaining operations and achieving growth. Most segments are grappling with gaps in the workforce, be it truck drivers, warehouse workers, supply chain planners, or freight handlers.

In a 2024 survey, 76% of respondents from logistics and supply chain organizations reported significant workforce shortages, and more than 33% described it as a significant growth barrier. The impact is particularly pronounced in specific roles: trucking, transportation, and warehousing functions report the highest shortfalls, with 61% of transportation and 56% of warehouse operations reporting understaffing. This labor shortage compels logistics firms to operate with fewer staff, leading to burnout, overwork, and the inability to fully meet operational demands.

In response to this challenge, firms are adopting workforce-focused strategies and automation. Empowering employees to self-schedule and switch shifts through workforce management software may reduce burnout and improve retention. Reducing workforce strain through AI- and machine-learning-based automation also eases employee workload. For example, autonomous mobile robots relieve the routine picking workload of multiple employees, reducing dependency on human pickers. Employee satisfaction may also improve when provided with easy-to-use modern job technology.

Challenge 6: Strengthening Cybersecurity in Logistics

Logistics firms store and manage sensitive information regarding customers and shipments, to which supply chain routes may be added. This makes them targets of cybercriminals' malicious activities. As the industry digitizes, the cyber-attack surface expands with each connected digital system. Freight management software, customer portals, and even IoT devices—all provide channels for system breaches. An operation halts, and data loss results in a loss of customer trust.

With the digitization and integration of logistics systems, industry threats are gaining greater attention. Traditional concerns like cargo theft are being augmented by sophisticated cybercrime schemes that specifically exploit logistics vulnerabilities. For instance, the FBI estimates that U.S. businesses lose $15–30 billion annually to cargo theft (usually cyber-synchronized). In 2024, several quarters recorded unprecedented levels of theft. Even more concerning is the complete digital takeover of logistics systems: "ghost trucks," ransomware attacks, and double-broke

It’s concerning that the transportation and logistics sector experiences roughly 11% of all cyberattacks (by volume). This means that sector-specific cybercriminals are running probes against shipping and logistics operators. For example, poorly protected APIs between shippers and carriers can be hacked to divert or ransom cargo shipments. Therefore, each new piece of digital technology developed for the sector (route-planning software, IoT sensor networks in the warehouse, customer-tracking portals) needs to be assessed and protected to ensure no additional cybercrime entry points are introduced.

Installing multiple layers of encryption, implementing strict data access controls, monitoring for network intrusions, and training employees in cyber risk awareness are among the steps necessary to improve cybersecurity.

Challenge 7: Adapting to Customer Expectations

Customer expectations in logistics today are higher than ever – and constantly evolving. Adapting to these expectations is an ongoing challenge for logistics providers. In the age of Amazon Prime and on-demand services, clients now expect "Amazon-level" speed and convenience as a bare minimum. This means fast (often same-day or next-day) delivery, highly flexible options, and low or no shipping costs. For B2B shippers as well, the bar has been raised by B2C experiences: it's no longer acceptable for a business delivery to take weeks if consumers can get packages in hours. Customers also demand real-time visibility – they want to track shipments live, receive instant updates, and get proactive notifications if there's a delay. In addition, there's growing concern about sustainability; many customers now expect logistics providers to minimize environmental impact (e.g., by using green delivery vehicles or carbon offsets) as part of the service promise.

These expectations present a tough balancing act. Meeting tighter delivery windows and providing more transparency typically adds cost and complexity for logistics companies. For instance, offering real-time tracking requires implementing IoT devices and data systems across the fleet. Speeding up delivery might mean using a denser distribution network or multiple fulfillment centers to get closer to end customers, which can be costly. Yet, failing to meet expectations can result in lost business, as customers now have more choices and less patience than before. Meeting delivery windows is no longer enough – shippers and end consumers want a superior, technology-enabled experience around the delivery itself.

To adapt, logistics providers are embracing innovations. AI and machine learning tools are being used for smarter route planning and demand forecasting, helping anticipate issues and optimize operations to maintain speed. Companies are also investing in last-mile solutions – from electric delivery vans and drones to micro-fulfillment centers in urban areas – to ensure both speed and sustainability in final-mile delivery. Additionally, enhancing customer communication via apps and platforms (for live tracking, re-routing deliveries, etc.) has become standard. The industry, by nature, thrives on solving complex puzzles, and each new expectation is driving creative solutions. In summary, the challenge of customer expectations requires logistics firms to be more customer-centric, tech-savvy, and agile than ever, turning logistics from a behind-the-scenes function into a visible part of the customer experience.

Challenge 8: Dealing With Market Volatility

While global logistics markets are cyclical, the last few years have added extreme volatility to the supply, demand, and pricing equations. Fluctuations in the volume and value of logistics and freight services are rapidly changing, and each company must manage these changes. A striking example of volatility of freight rates occurred at the end of the downturn due to the pandemic, when, in the last few weeks of Q2 2024, spot rates for dry van trucks increased 20% and for refrigerated ("reefer") trucks 15%. These large increases (and decreases) in rates are difficult to manage. Expected rates made in contracts at the start of the year can be dramatically different and far worse at the mid-point of the year.

Uneven economic recoveries, changes in demand, and unexpected events lead to volatility. For example, during 2023-2024, smaller trucking companies failed while bigger ones consolidated their holdings, sharply changing market capacity. There have been large, unpredictable changes in fuel prices, which have led to large, unpredictable transportation costs. Trade flows are directly affected by geopolitical events and changes in trade policy. For instance, new tariffs and conflicts can dramatically change trade volumes. And, as mentioned earlier, ongoing driver shortages can lead to sudden capacity tightening.

All things considered, supply chain managers need to make adjustments on the fly. Logistics firms are increasingly relying on data analytics and market intelligence tools to sense changes early (for example, monitoring port throughput or tender rejections as leading indicators). Indeed, some bright spots in late 2024, like a 7.4% rise in container port volumes in H1 2024 and tender rejection rates climbing above 6%, signaled demand picking back up, which helped companies prepare for a firmer market in 2025.

Challenge 9: The Cost Pressure of Last Mile Delivery

The last leg of the delivery process is getting a product from a distribution hub to the final customer's doorstep. The "last mile" is notoriously the most expensive and inefficient. With the expansion of e-commerce, managing the cost pressure of last-mile delivery becomes increasingly more difficult. Last-mile costs are high due to fragmented, individualized delivery stops, the manual, intensive labor required, and traffic and other time-absorbing inefficiencies. It is estimated that last-mile delivery can account for more than 50% of total costs.

There are a number of reasons for this. Customers expect rapid delivery, often same day, for little or no extra charge, so companies quickly learn that this immediacy comes with a price. Driving in town for delivery is time-consuming, requires more fuel, and is more costly in terms of work hours, especially for smaller packages. These costs increase with failed delivery attempts when a recipient isn't home. Each missed delivery attempt costs, on average, $14, which impacts a carrier's profitability. Free shipping and returns have created a situation in which last-mile delivery is negatively affecting already low profitability.

There are numerous tactics attempted to deal with the costs associated with the last mile. Route optimization software and real-time tracking can reduce travel distances and idle time, improving drop densities (deliveries per trip). Some companies consolidate deliveries using parcel lockers and pickup point networks. By the way, Impressit has been lucky to work on a smart locker project with GoLocker.

There are also attempts to use crowdsourced delivery systems or autonomous vehicles, like drones and delivery robots, to reduce the potential cost of labor. Plus, delivery failures can be predicted and prevented with IoT and enhanced data, enabling customers to reschedule or redirect packages in real time.

Challenge 10: Narrowing Profit Margins in E-Commerce Fulfillment

The explosive growth of e-commerce has been a boon for logistics volume, but it comes with a profitability challenge: narrowing profit margins in e-commerce fulfillment. Fulfilling online orders is often more labor- and cost-intensive than traditional wholesale distribution, and many providers are seeing margins squeezed even as they handle more parcels. Globally, e-commerce now accounts for about 11.9% of total retail sales and is expected to reach 17.5% by 2025, representing a massive volume of shipments that need to be picked, packed, and delivered.

- Consumer expectations: Buyers in today's market often expect same-day delivery, hassle-free returns, and rapid service for no fee. But the service costs need to be absorbed by retailers and 3PLs.

- Increased costs: Order fulfillment costs are affected by higher warehousing, transportation, and labor costs. The increased demand for services means the need for fulfillment center space and labor, but warehouse labor shortages mean higher wages and recruitment costs

- Intense competition: The e-commerce logistics market sees a jump-and-skip competition for contracts, led by integrators, postal services, and new startups. This drives down the prices logistics providers can charge, making prices stickier even as their costs increase.

The net effect is that many businesses see their e-commerce operations' margins shrink. Deliveries that involve multiple touches (fulfillment center pick, line-haul, local delivery) without perfect optimization could easily erode any profit.

To combat narrowing margins, companies are focusing on efficiency and optimization in fulfillment. This includes the adoption of lean supply chain practices, such as advanced slotting and warehouse automation, to lower the cost per order. Technologies such as automated retrieval systems, AI demand forecasting (to prevent overstock and urgent shipment), and intelligent inventory distribution can all eliminate inefficiencies. Some inexpensive retailers and 3PLs are adjusting value-capturing strategies by incentivizing order consolidation and slightly charging for fast delivery to optimize the cost-form utility imbalance.

Challenge 11: Low Visibility Across the Supply Chain

Supply chain visibility (the ability to track shipments, inventory, and events in real time across the end-to-end supply chain) remains frustratingly low for many logistics operations. This turns into a major challenge because companies cannot manage (or fix) what they cannot see. Surprisingly, nearly 45% of companies have little to no visibility into their supply chain beyond their immediate ("Tier 1") suppliers. This means a shipment or delay occurring upstream or downstream can blindside a company, since it lacks timely information.

Poor visibility leads to all kinds of problems:

- delays, as issues aren't detected and communicated in time;

- miscommunication, since each player might have only partial data;

- and even lost or misrouted shipments that fall through the cracks.

In sensitive sectors like pharmaceuticals or food, a lack of visibility can be downright dangerous if products are lost or delayed without knowledge.

Implementing visibility tools and improving data sharing throughout the supply chain are necessary steps to solve this problem. Many logistics companies are focusing their efforts on IoT sensors, GPS trackers, and cloud systems, which consolidate data from various dashboards, carriers, warehouses, and suppliers. Indeed, two-thirds of global business leaders have stated they want better supply chain visibility and consider it key to resilience. The industry response has been a surge in real-time visibility software, which enables shipment visibility, monitors supply handling conditions, and sends alerts for potential issues.

Challenge 12: Sustainability and Compliance Pressures

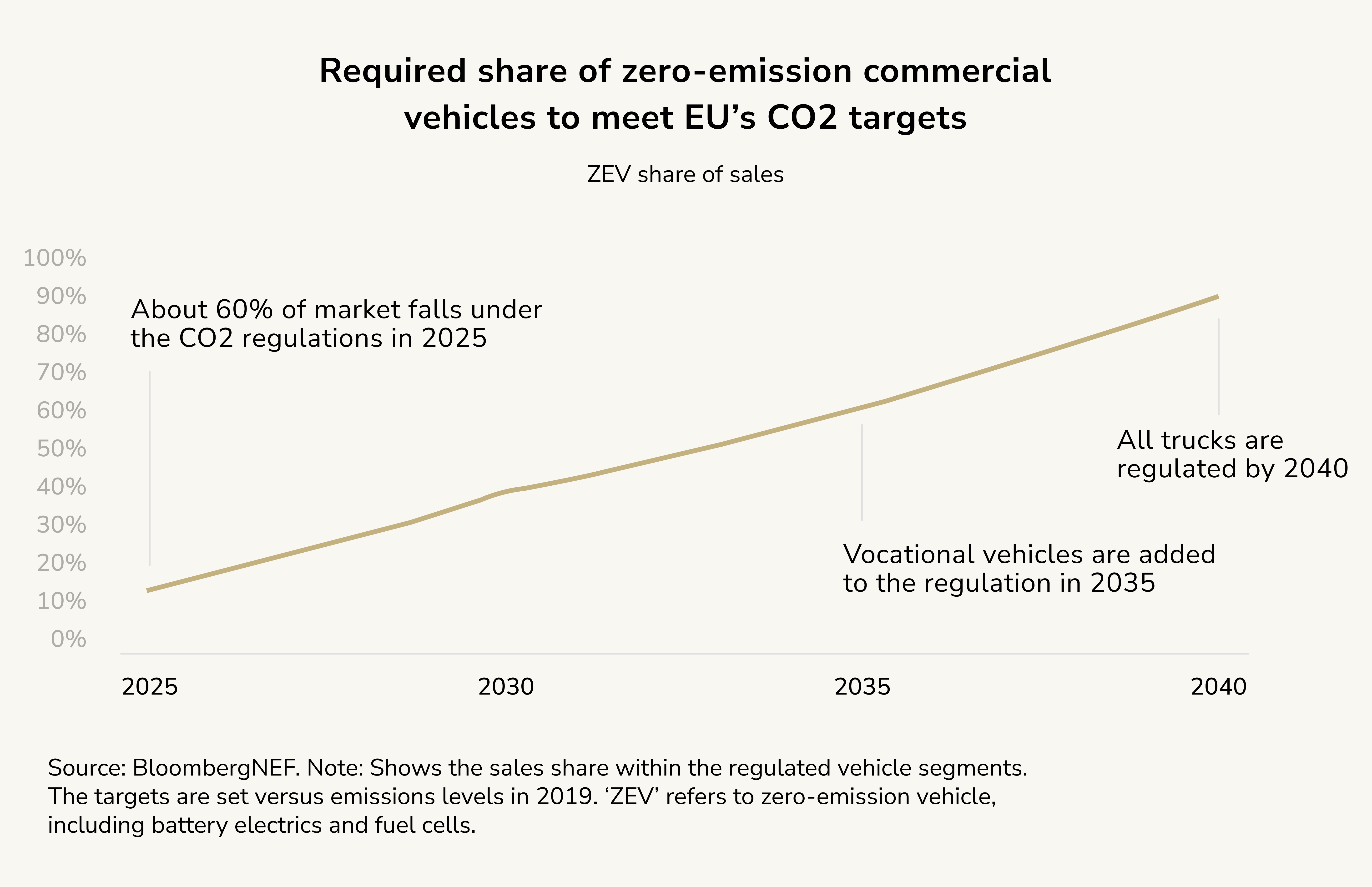

Sustainability has become a core issue in logistics due to regulatory requirements and public demand for environmentally friendly practices. The transport and logistics sector is a significant contributor to carbon emissions, and if no effective action is taken, it could be responsible for as much as 40% of worldwide carbon emissions by 2050 – an alarming projection that underscores the urgency for change. Governments and international bodies are enacting stricter regulations to mitigate this. For example, under the Paris Agreement targets (which many jurisdictions have adopted), companies in. This has a direct impact on logistics and sustainability, where emissions reporting is mandatory, and fleet composition is overhauled to avoid non-compliance. Non-compliance comes with extreme penalties in the form of reputational damage and hefty fees.

Sustainability is becoming a priority for consumers and corporate clients alike, who demand reducing CO₂ emissions, using renewable energy sources, and maintaining ethical, transparent supply chains. This creates competition within the logistics sector to show leadership in sustainability. The challenge is that while customers expect deliveries to be more sustainable, they are not willing to pay more for the cost of "greening" the delivery. This forces logistics firms to adopt cleaner technologies and practices while absorbing costs. This puts financial pressure on them to find operational efficiencies that justify the cost of the technologies and practices.

Responding to sustainability and compliance pressures requires various approaches. Businesses are adopting alternative fuel vehicles, such as electric trucks and LNG-fueled ships; improving and optimizing routes to reduce emissions; sustainable packaging and reverse logistics to minimize waste; and enhancing energy efficiency in warehouses. Another aspect involves improving traceability and compliance management through the use of digital tools to track carbon footprints per shipment, ensure suppliers meet environmental standards, and address visibility and data management challenges.

To sum up, today the logistics industry is at an inflection point with challenges arising from geopolitics, sustainability, and disruptive innovations creating new rules of the game." In closing, the logistics industry today must contend with rapidly shifting customer expectations, technological change, and the need to build and operate resilient, sustainable systems in the context of global uncertainty. Providers must remain flexible to contend with these environmental and operational challenges and retain their competitive edge.

Roman Zomko

Other articles