The Secret to Successful Mobile Banking App Development

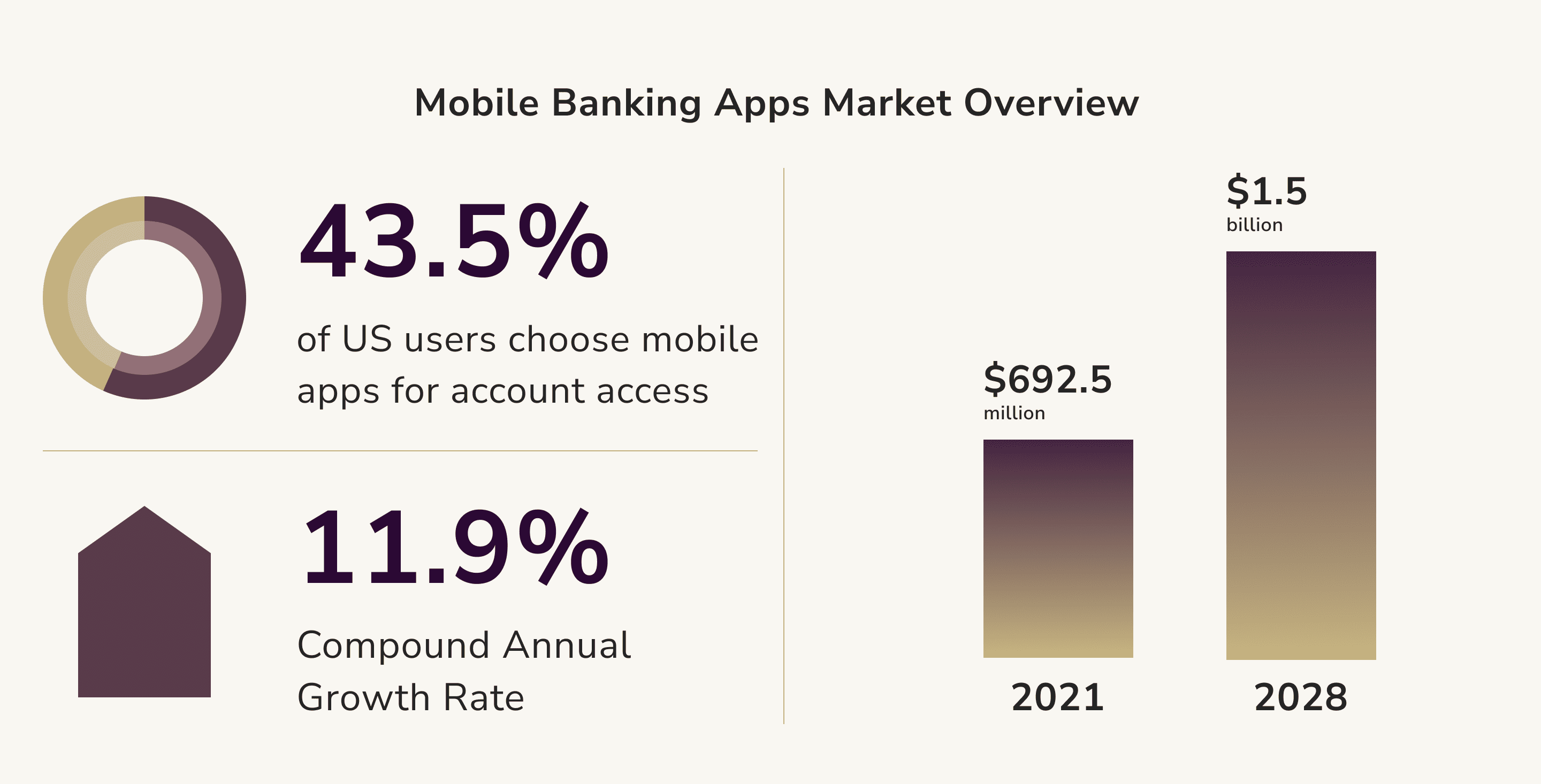

In the digital age, the way we bank is changing rapidly. Traditional brick-and-mortar banking gives way to on-the-go mobile banking, a trend that will only grow in the coming years. According to a report, the Global Mobile Banking Market is projected to grow from $692.5 million in 2021 to $1,35 billion by 2028, exhibiting a CAGR of 11.9%. This significant growth underscores the importance of understanding mobile banking app development.

But why is this topic important? Mobile banking apps offer convenience, accessibility, and a range of features that traditional banking cannot match. They allow users to manage their finances at their fingertips, anytime, anywhere. As such, they are becoming an essential part of our digital lives.

This article will particularly interest startup owners, CEOs, and Development Team Leaders looking to tap into this booming market. Whether you're planning to develop a mobile banking app or looking to improve an existing one, this article will provide valuable insights into the development process, must-have features, and upcoming trends.

Mobile Banking App Market Overview

The mobile banking app market is a dynamic and rapidly evolving space. As of 2021, mobile banking was the primary choice of account access for 43.5 percent of U.S. consumers, making it the most prevalent banking method. Furthermore, Statista's mobile banking trends in 2023 show that around 48 percent of banking app users are 18-24 years old, indicating a strong preference for mobile banking among younger demographics.

According to this study, there is an estimated global mobile banking industry at $704.1 million in 2021, expected to rise to $1,352.96 million. This significant growth underscores the vast opportunities in the mobile banking app market.

The revenue generated by mobile banking apps is also noteworthy. Neobanks' global revenue was estimated at $6.8 billion in 2021, an increase of 88% from the previous year. An increase in the adoption of mobile banking apps largely drove this growth.

These statistics highlight the growing importance of mobile banking apps and the vast opportunities they present for businesses and developers. In the following sections, we will delve deeper into the intricacies of mobile banking app development, its benefits, and the trends shaping its future.

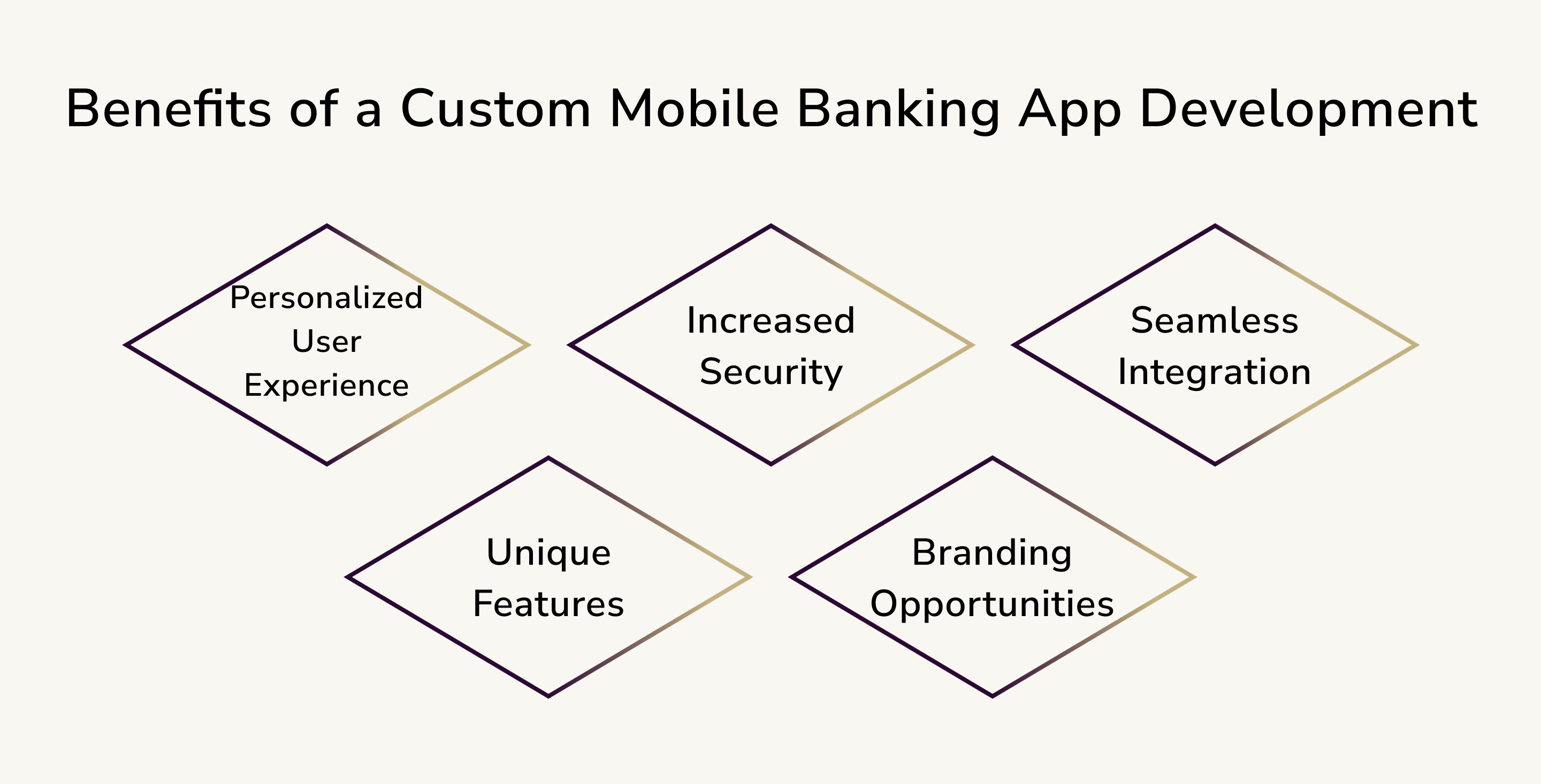

Benefits of a Custom Mobile Banking App Development

Developing a custom mobile banking app can provide a multitude of uses, not only for the financial institution but also for the end-users. Here are some key benefits:

Personalized User Experience

A custom mobile banking app allows for a personalized user experience. Data analytics enables the app to understand user behavior and preferences and provide customized recommendations and services. For example, the app could suggest a savings plan based on the user's spending habits.

Increased Security

Custom mobile banking apps can incorporate advanced security features to protect user data and prevent fraud. This could include biometric authentication, encryption, and secure APIs. For instance, many banking apps now use fingerprint or facial recognition for secure access.

Unique Features

With a custom app, you can integrate unique features that set your app apart. This could include financial planning tools, virtual assistants, or innovative payment solutions. For example, some apps offer a virtual card management system, allowing users to lock their cards if they are lost or stolen instantly.

Seamless Integration

A custom app can seamlessly integrate with existing banking systems, ensuring a smooth and efficient operation. This can lead to improved productivity and reduced operational costs. For instance, the app can be integrated with the bank's CRM system for better customer service.

Branding Opportunities

A custom mobile banking app provides an excellent platform for branding. The app's design and user interface can be tailored to reflect the bank's brand identity, helping to build brand recognition and loyalty. For example, the app can incorporate the bank's logo, color scheme, and other brand elements.

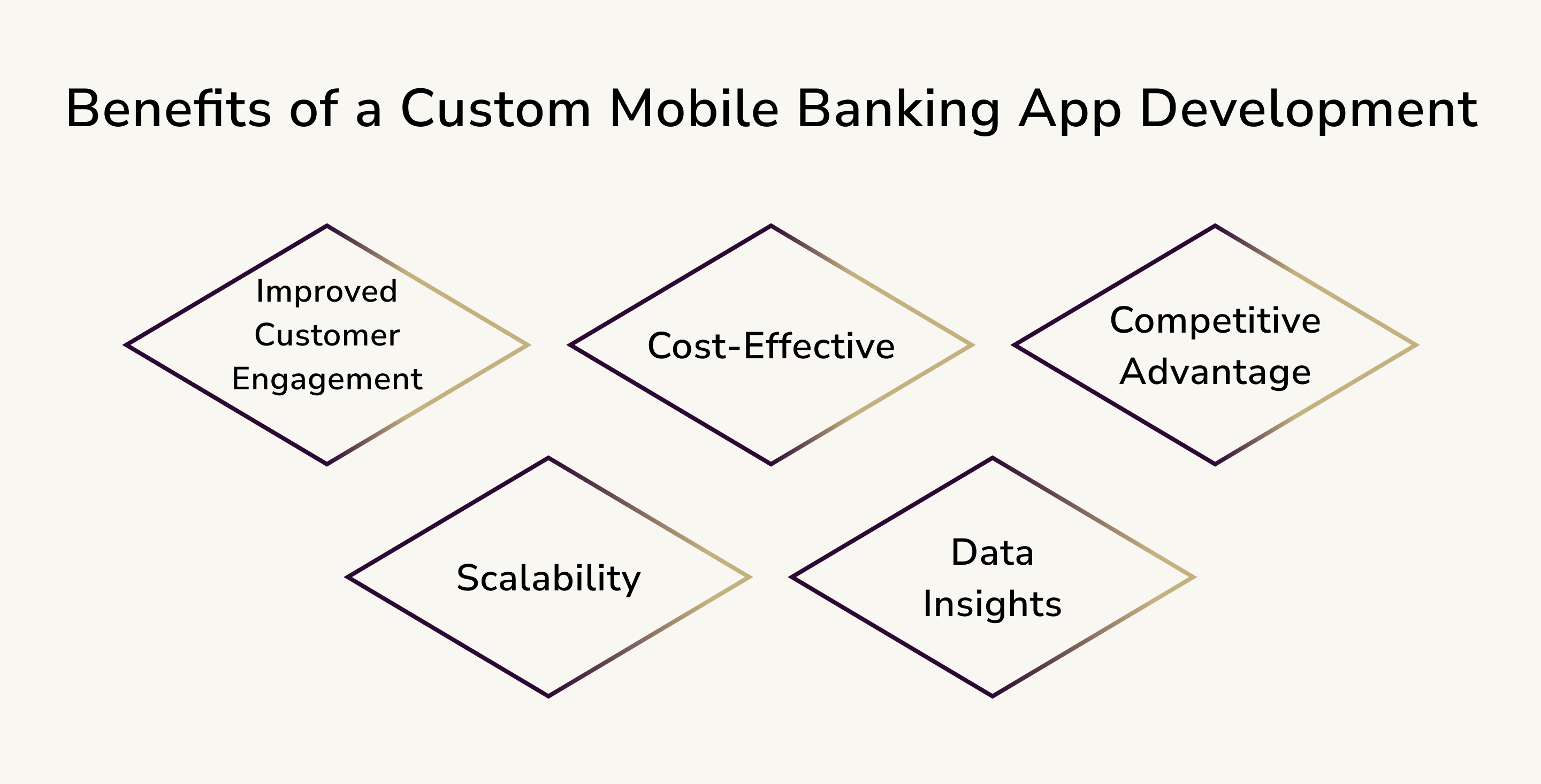

Improved Customer Engagement

A custom app can significantly improve customer engagement with features like push notifications and personalized messages. Banks can send timely notifications about new offers, updates, or alerts, keeping customers engaged and informed. For example, users can receive instant notifications about suspicious account activity.

Cost-Effective

While the initial development cost may be high, a custom mobile banking app can be cost-effective in the long run. It can reduce the need for physical branches and personnel, leading to significant cost savings. Additionally, the app can drive customer acquisition and retention, providing a high return on investment.

Competitive Advantage

A custom mobile banking app can provide a significant advantage in the competitive banking industry. It can help attract tech-savvy customers, provide superior customer service, and differentiate the bank from its competitors. For instance, a bank that offers innovative features like AI-based financial advice or blockchain-based transactions can stand out in the market.

Scalability

Custom mobile banking apps are highly scalable. As the bank grows and evolves, the app can be easily updated or expanded to accommodate new features or changes. This ensures that the app remains relevant and valuable to users over time.

Data Insights

Finally, a custom mobile banking app can provide valuable data insights. By analyzing user behavior and interactions, banks can better understand their customers and make data-driven decisions. For example, data insights can help banks identify popular features, detect trends, and improve their services.

These benefits contribute to a more effective and user-friendly mobile banking experience, ultimately leading to increased customer satisfaction and loyalty.

Mobile Banking App Must-have Features

A successful mobile banking app should include a variety of features that not only ensure easy account access and robust security measures and enhance the overall user experience. Here are some of the must-have features:

- Multi-factor Authentication. The importance of security in mobile banking apps cannot be overstated. Multi-factor authentication greatly enhances the safety of bank accounts. However, its application should not interfere with user experience. For example, streamlining the process for minor or low-risk transactions can improve user experience.

- Instant Payments. Banking app users anticipate the ability to execute payments instantly with a few clicks. Immediate transactions enable users to avoid carrying physical cash and provide significant convenience.

- AI-Driven Chatbots and Conversational Interactions. AI-driven chatbots can increase the accessibility of a banking app. Users can interact with a chatbot as if they were conversing with a bank teller from the comfort of their homes. Natural language processing capabilities can also lighten the load on the bank's customer service team.

- Seamless Omnichannel Experience. Customers interact with their banks through various channels. An omnichannel experience merges these channels, allowing customers to continue their interaction through any of them.

- Financial Management Tools. Banking apps collect a wealth of data on customers' financial behaviors. Banks can leverage this data to provide customers with advice on managing their finances.

- In-App Notifications. Transparent in-app notifications are crucial for an app's user experience. Every notification or message should be user-tested before being released to the entire user base.

- NFC and Touchless Payments. Most contemporary smartphones are equipped with NFC or Near Field Communication technology. By incorporating this technology into their apps, banks can make their services more fluid.

- Digital Wallets Integration. Almost half of consumers appreciate the ease of integrating their mobile app with digital wallets like Apple Pay or PayPal.

- Account Aggregation. Most Americans engage with multiple digital financial providers. Customers are eager for services that enable them to view, monitor, and manage their financial accounts across various providers.

- Automated Savings. One in four Americans with bank accounts want their bank to assist them in saving. Some U.S. banks have incorporated "roundup" features into their apps to encourage savings.

- Data Management Tools. Privacy-aware customers desire more control over which apps can access their data. The Forrester report highlights the JPMorgan Chase mobile banking app for its approach.

- Instant Virtual Card Issuance. Many customers would appreciate the temporary support of a virtual replacement offered through their mobile banking app — an option that few institutions currently provide.

- Budget Management. People have been utilizing digital devices for budgeting for 25 years, according to Wannemacher, but new features will make this beneficial to a wider audience.

- Shared Finances. The demand for managing joint financial matters, from roommates to married couples to elderly relatives, is increasing and ripe for innovation.

The cost of developing these features can vary greatly depending on the part's complexity, the development team's experience level, and the region where the development is taking place. For instance, developers in North America typically charge higher rates than those in Eastern Europe or Asia.

The cost can also depend on your chosen engagement model — project-based, dedicated team, or time and material model. Each has its pricing structure and implications for project cost. Longer projects will generally cost more, but the per-hour or per-day rate may decrease for longer engagements due to economies of scale.

Additional costs can include any project management fees, software or hardware costs not included in the developer's rate, and any costs related to compliance with regulations or certifications.

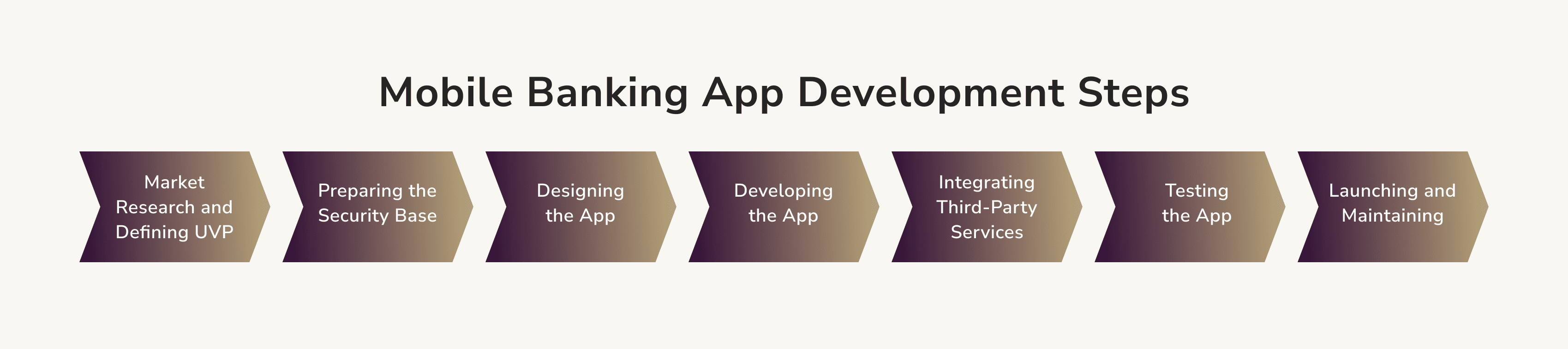

Mobile Banking App Development Steps

Mobile banking apps have become a necessity rather than a luxury in the digital age. They offer convenience, security, and many features that make financial management a breeze. This section will delve into the step-by-step process of developing a mobile banking app, providing technical details and examples for each stage.

Step 1. Market Research and Defining Unique Value Proposition

The first step in mobile banking app development is conducting thorough market research. This involves studying competitors, understanding the target audience, and identifying gaps in the market that your app can fill. For instance, you might find a demand for a banking app that offers personalized financial advice or supports multiple currencies for international transactions. It's also important to consider cultural aspects and user habits in the market you're entering.

After conducting market research, you can define your app's unique value proposition (UVP). This is a clear statement that describes the benefit of your app, how it solves your customer's needs, and what distinguishes it from the competition.

Step 2. Preparing the Security Base

Security is paramount in mobile banking app development. You need to ensure that all passwords are hashed before being stored in a database, implement auto logout features, limit access to sensitive user data, and use secure platforms for data storage. Additionally, you should secure authentication with features like fingerprint security for Android devices and Apple KeyChain for iOS and use security certificates like SSL Certificates or SSL Pinning to keep data private and secure.

Step 3. Designing the App

The design phase involves creating a user-friendly UI/UX. This includes developing wireframes and simple sketches of your app's layout and then developing these into detailed mockups. The design should be intuitive and friendly, making the app visually appealing and easy to navigate.

Step 4. Developing the App

Once the design is finalized, you can start developing the app. This involves coding the app's functionality, integrating it with your bank's systems, and implementing security measures. You must choose a development platform (like Android, iOS, or cross-platform) and a programming language (like Swift for iOS or Kotlin for Android).

Step 5. Integrating Third-Party Services

Integrating third-party services can make your app more user-friendly and retain customer attention. Common third-party providers in mobile banking development include customer data analytic tools like Segment, in-app notifications setup tools like Iterable, user verification tools like Onfido, financial account connection tools like Plaid, and in-app messaging tools like Sendbird.

Step 6. Testing the App

After the app has been developed, it needs to be thoroughly tested. This involves checking the app's functionality, performance, security, and usability. Use manual testing, automated testing tools, or a combination of both.

Step 7. Launching and Maintaining the App

You can launch the app once testing is complete and any issues have been addressed. This involves submitting the app to the App Store and Google Play Store and promoting the app to your target audience. After launching the app, it's essential to regularly update and improve it based on user feedback and evolving market trends.

Developing a mobile banking app is a complex but rewarding process. It requires a clear understanding of your target audience, a focus on security, and a commitment to continuous improvement. With the right approach, you can create a mobile banking app that not only meets your customers' needs but also gives you a competitive edge in the market.

Perfect Tech Stack for Mobile Banking App Development

The technology stack, or tech stack, forms the backbone of any mobile banking application. It's a combination of software tools and programming languages that work together to create a well-functioning app.

- Frontend Development. The app's front end is what users interact with, so it needs to be intuitive and responsive. For Android app development, Kotlin or Java can be used, while for iOS app development, Swift or Objective-C is preferred. For cross-platform development, frameworks like React Native or Flutter can be used.

- Backend Development. The app handles business logic and database operations. Languages like Python, Java, or Node.js can be used for server-side development. Frameworks like Django (Python), Spring Boot (Java), or Express.js (Node.js) can be used to speed up the development process.

- Database. The database stores all the user data and transaction details. Relational databases like PostgreSQL, MySQL, or Oracle can be used. For NoSQL databases, MongoDB or Cassandra can be used.

- Cloud Services. Cloud services like AWS, Google Cloud, or Azure can be used for hosting the app and database. They provide scalable and reliable infrastructure.

- Payment Gateway. Integrating a secure payment gateway is crucial for a banking app. Payment gateways like Stripe, PayPal, or Braintree can be used.

- Security: Implementing high-level security is crucial for a banking app. SSL/TLS can be used for secure data transmission, encryption algorithms for data at rest, and OAuth 2.0 for secure authentication.

- AI and Machine Learning. AI and ML can be used for features like chatbots, fraud detection, and personalized recommendations. Libraries like TensorFlow, PyTorch, or Scikit-learn can be used.

- Blockchain. Blockchain technology can be used for features like secure transactions or smart contracts. Ethereum for smart contracts or Hyperledger Fabric for private blockchain can be used.

- DevOps Tools: Tools like Docker for containerization, Jenkins for continuous integration and deployment, and Kubernetes for container orchestration can be used to streamline the development process.

Choosing the right tech stack is a critical decision that can significantly impact your mobile banking app's performance, security, and overall success. Therefore, it's crucial to consider your app's specific requirements and consult with technical experts to make an informed decision.

Cost of Mobile Banking App Development

The cost of developing a mobile banking app can vary depending on several factors. These factors include the complexity of the app, the number of features, the development team's location, and the developers' expertise.

The development cost for a mobile banking app typically ranges from $50,000 to $100,000 for a single platform (iOS or Android). This cost includes developing essential features like user registration, account management, transaction history, fund transfers, push notifications, and customer support. However, adding advanced features such as biometric authentication, AI-based customer support, and advanced security measures can increase the overall cost.

The total mobile banking app development cost may vary based on different estimates. It can range from $60,000 to $120,000, considering factors like UI/UX design, backend, and frontend development, project management, and quality assurance.

Another estimate suggests that the cost of developing a mobile banking app can range from $100,000 to $500,000. This estimate includes the cost of developing a minimum viable product (MVP) with basic features.

It's important to remember that these approximate cost ranges can vary depending on various factors and specific project requirements. To get an accurate cost estimate for your mobile banking app development, it is recommended to consult with professional app development agencies or teams.

Ultimately, the cost of mobile banking app development is an investment that can provide significant returns in terms of improved customer experience, increased convenience, and enhanced user security.

Challenges in Mobile Banking App Development

In mobile banking app development, several challenges often arise, making the process complex and demanding. These hurdles range from ensuring top-notch security to providing a seamless user experience, complying with banking regulations, and more. Let's delve into these challenges and explore potential solutions.

Ensuring Top-Notch Security

Challenge. Mobile banking apps handle sensitive user data, including personal information and financial transactions. Therefore, ensuring top-notch security is an important challenge. Any breach can lead to significant financial losses and damage the bank's reputation.

Solution. Implement robust security measures such as multifactor authentication, encryption, secure APIs, and biometric authentication. Use secure password hashing and storage, auto logout features, and secure certificates like SSL for web apps or SSL Pinning for mobile apps. Limit the access of people who create the app to sensitive user data. Complying with Banking Regulations.

Ensuring Data Privacy and Compliance Challenge

Challenge. Data privacy is a critical concern in mobile banking app development. Mobile banking apps handle sensitive user information, including personal and financial data. Ensuring data privacy and compliance with data protection regulations, such as GDPR or CCPA, poses a significant challenge.

Solution. Implement robust data encryption and secure data storage practices to protect user information. Adhere to data privacy regulations and obtain necessary user consent for data collection and processing. Conduct regular security audits and vulnerability assessments to identify and address potential data privacy risks.

Managing Compatibility and OS Fragmentation Challenge

Challenge. Mobile banking apps need to be compatible with a wide range of devices and operating systems, including different versions of Android and iOS. OS fragmentation, with various device sizes, screen resolutions, and hardware capabilities, presents a challenge for app developers.

Solution. Conduct thorough testing on different devices and operating systems to ensure app compatibility and performance. Use responsive design principles and adaptive layouts to optimize the app's user interface across various screen sizes and resolutions. Regularly update and optimize the app to support new OS versions and address compatibility issues.

Providing a Seamless User Experience

Challenge. Users expect a seamless and intuitive experience when using mobile banking apps. This includes easy navigation, fast loading times, and a clean, attractive design. Achieving this level of user experience can be challenging, especially when dealing with complex banking features.

Solution. Invest in UX/UI design and create a prototype before developing. This allows you to test your ideas, gather user feedback, and make necessary adjustments. Also, use user-friendly design principles and consider the cultural aspect of your target market.

Integrating with Existing Banking Systems

Challenge. Mobile banking apps need to integrate seamlessly with existing banking systems. This can be complex due to the various systems and technologies banks use.

Solution. Use APIs to integrate your app with existing banking systems. This can help ensure smooth and efficient operations, improving productivity and reducing operational costs.

Offering a Wide Range of Features

Challenge. Users expect a wide range of features from mobile banking apps, from essential functions like checking account balances and transferring money to advanced features like financial planning tools and personalized recommendations.

Solution. Prioritize the most important features based on your market research and user feedback. Start with an MVP (Minimum Viable Product) that includes essential features, then gradually add more based on user needs and feedback.

Ensuring App Performance Across Different Devices and Operating Systems

Challenge. Mobile banking apps need to work flawlessly across a wide range of devices and operating systems. Ensuring consistent performance and user experience can be challenging due to the diversity of devices, screen sizes, and OS versions.

Solution. Use responsive design principles to ensure your app looks and works well on all devices. Also, test your app extensively on different devices and operating systems to identify and fix any issues.

Keeping Up with Technological Advancements

Challenge. The technology landscape constantly evolves, with new trends and technologies emerging regularly. Keeping up with these changes and incorporating them into your app can be challenging.

Solution. Stay updated with the latest technology trends and consider how they can be applied to your app. This could involve using AI for personalized recommendations, blockchain for secure transactions, or biometrics for enhanced security.

While developing a mobile banking app comes with challenges, these can be overcome with careful planning, a user-centric approach, and a focus on security and compliance. By addressing these challenges head-on, developers can create a mobile banking app that not only meets regulatory standards but also delivers a seamless.

Mobile Banking App 2023 Trends

The landscape of mobile banking is continuously evolving, with new trends and technologies shaping how we bank. As we look towards 2023, several key trends are set to redefine the mobile banking app landscape, offering enhanced security, personalized experiences, and innovative features.

- Artificial Intelligence (AI) and Machine Learning (ML). AI and ML are becoming increasingly prevalent in mobile banking apps. They are used to provide personalized banking experiences, fraud detection, and predictive analytics. For example, Bank of America's Erica is an AI-driven virtual assistant that helps customers with banking tasks.

- Biometric Authentication. Biometric authentication methods like fingerprint scanning, facial recognition, and voice recognition are being used to enhance security and user experience. Apps like HSBC's mobile banking app are already using biometric authentication.

- Blockchain Technology. Blockchain technology is integrated into mobile banking apps for enhanced security and transparency. It is also being used for cross-border payments and smart contracts.

- Open Banking. Open banking allows third-party developers to create apps and services around the financial institution. It provides a more holistic view of the customer's financial status and enables the creation of innovative services.

- Voice-First Banking. With the rise of voice assistants like Siri, Alexa, and Google Assistant, more and more banks are developing voice-first banking solutions. For example, Santander's SmartBank app allows customers to use voice commands to perform banking tasks.

- Chatbots. Chatbots are being used to provide 24/7 customer support and handle simple tasks like balance inquiries, fund transfers, and bill payments.

- Personal Finance Management. Mobile banking apps incorporate personal finance management tools that help customers track their spending, set budgets, and save money.

- Contactless Payments. With the rise of NFC technology and digital wallets, contactless payments are becoming more common. Mobile banking apps integrate with digital wallets like Apple Pay and Google Pay to facilitate contactless payments.

- Robo-Advisors. Robo-advisors are used in mobile banking apps to provide automated, algorithm-driven financial planning services with little human supervision.

- Cybersecurity. With the increasing number of cyber threats, mobile banking apps focus more on cybersecurity. This includes advanced encryption methods, secure coding practices, and regular security audits.

These trends are shaping the future of mobile banking, making it more secure, convenient, and personalized. As technology evolves, we expect to see even more innovative features in mobile banking apps.

Wrapping Up

The mobile banking app market is dynamic and rapidly evolving, offering vast opportunities for businesses and developers. As the trend toward digital banking continues to grow, so does the need for secure, user-friendly, and feature-rich mobile banking apps. By understanding the intricacies of mobile banking app development, including the benefits, must-have features, and cost considerations, businesses can better position themselves to tap into this booming market. Whether you're a startup owner, CEO, or Development Team Leader, this knowledge can provide you with valuable insights to guide your mobile banking app development journey.

As we move forward, the role of mobile banking apps in our digital lives is set to become even more significant, making this an exciting space to watch and participate in. If you want to share this path and get yourself a mobile banking app delivering value and profits, contact us, and our expert team will make this happen.

Andriy Lekh

Other articles