Everything You Need to Know about Stripe: a Brief Guide

The right payment solution is crucial for the success of your online business. The huge variety of merchant service providers burdens most startup founders. They need to pick the best fit for their needs. In this article, we’ll go through one of the most recognizable payment gateways, Stripe.

Stripe is starting to dominate the market, surpassing its rivals in quality and service metrics. Below, you will find a description of its core features and comparisons with other popular payment systems.

What is Stripe?

Stripe is an international payment service provider used to make and receive payments online. This system ensures successful financial operations for internet businesses of all sizes. Stripe helps buyers and sellers move money globally at speed. Its standard payout timing varies from one country to another, but it typically takes 2–7 business days.

Stripe has two main types of processing fees:

- Standard model with no monthly fees, setup costs, or hidden charges: 2.9% + $0.30 per online transaction (with volume discounts available) with a 1% fee for international payments.

- Custom package designed for your business. This method requires some setup time, but it provides you with substantial discounts.

How Does Stripe Work?

In Stripe, each online transaction requires a payment gateway and a processor. The first one securely captures and transmits the buyer’s credit card information to the processor. In turn, the payment processor transfers money to a third-party account, deducting card-related fees. After that, the payment is routed to the merchant’s bank account.

To integrate Stripe into your business, choose the method that perfectly suits your needs. Luckily, the platform provides a few flexible options. The easiest of them is Stripe Checkout, which adapts to your customer’s device and location. Clear and well-structured documentation makes Stripe integration easy and stress-free for your software development team.

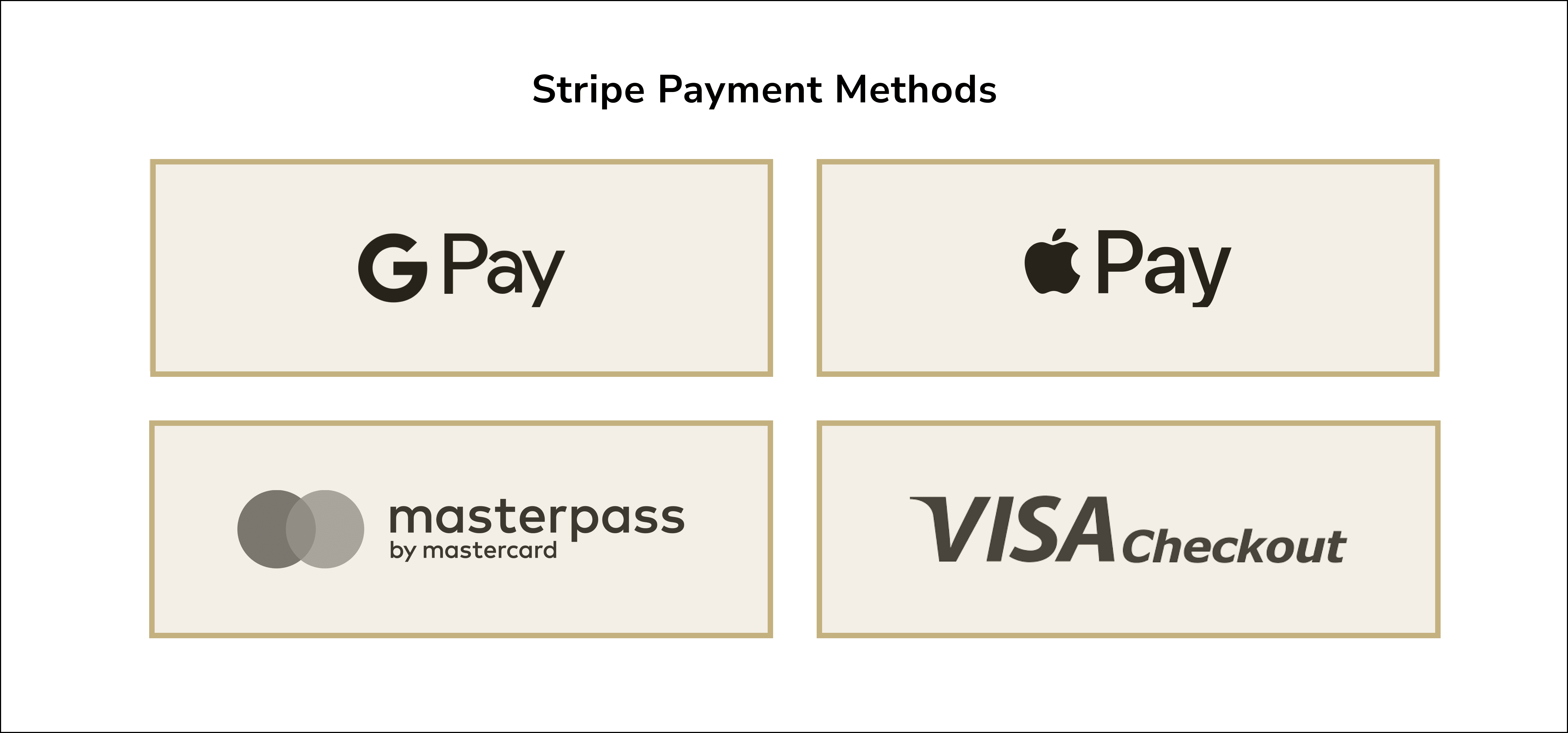

Stripe Payment Methods

Since Stripe payment fees are relatively low, it is considered to be one of the cheapest ways to handle eCommerce. Doing business in foreign markets becomes much easier with Stripe because it’s compatible with lots of payment methods.

Stripe’s API supports the following universal payment types: Alipay, Apple Pay, Google Pay, Microsoft Pay, Amex Express Checkout, Masterpass, Visa Checkout, and WeChat Pay. Stripe supports local payment types too. These include ACH, Bancontact, EPS, Giropay, iDEAL, Klarna, Multibanco, P24, SEPA Direct Debit, and SOFORT.

Keep in mind that this list may change depending on changes in local financial regulations.

Why Choose Stripe?

Business owners from all over the world prefer Stripe secure payment mostly because it removes the “pain” from payment processing. However, there are a few more key reasons for choosing this solution.

- Stability. The platform functions perfectly, thanks to frequent updates and continuous testing. It processes payments without delays or errors.

- Transparency of Payments. Stripe pricing is transparent since the company focuses on the best ethical practices. The system doesn’t charge any hidden fees from businesses or customers.

- Reliable Reputation. Is Stripe secure? For sure, yes! It has proven its trustworthiness over years of successful performance on the market.

- Usability of the Interface. The Stripe interface is intuitive and extremely easy to use, which saves much time when navigating and entering data.

- Universality. Stripe is a universal solution because it processes all currencies and credit cards. It also works with numerous payment methods.

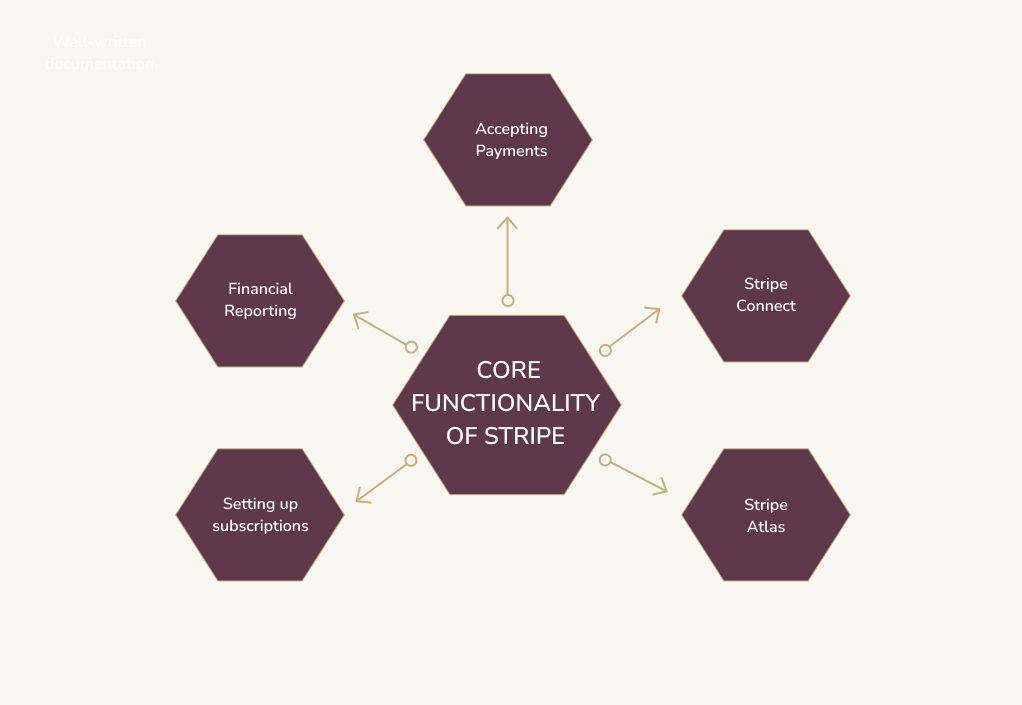

The Core Functionality of Stripe

Let’s dig deeper into the core functionality of Stripe.

- Accepting Payments

Your customers can pick their preferred payment option, which allows you to reach a broader audience. Stripe accepts international payments from all major debit and credit cards and also provides for digital wallet payments. Additionally, buyers can use bank redirects and direct debits for subscriptions or recurring charges. Those who prefer the ‘buy now, pay later’ option can use Stripe too. Moreover, its mobile SDKs make it possible to accept payments from your app or mobile website.

- Financial Reporting

Stripe provides real-time information about transfers, refunds, and fees, so you can quickly gain insight into what’s going on with your accounting. Stripe Sigma analyses your data and allows you to create financial reports using built-in features or customized API instantly.

- Setting up subscriptions

The Stripe payment gateway allows you to set up subscriptions. This way, you are able to charge your customers daily for the services you provide. You can set the price for a subscription in just a few steps using your Stripe dashboard. Let us guide you through them:

- Open Stripe Dashboard and go to the subscriptions page.

- Tap on +Create subscription.

- Find/add a customer.

- Enter the price and product info.

- Set the subscription start/end date.

- Set the billing start date.

- Stripe Atlas

This tool helps entrepreneurs launch a US-based startup from anywhere on Earth. Using Stripe Atlas, you can register a C Corporation in Delaware and open a U.S. business bank account fast and safely. Stripe makes it easier for founders to obtain a U.S. Employer Identification Number and complete all the necessary legal documentation. And what’s more, you can join a global community of entrepreneurs and experts who share their invaluable experiences.

- Stripe Connect

Stripe Connect makes the payment process easier for any marketplace or platform. Payment compliance is Stripe’s responsibility, and users can control funds flow, facilitate payments, and easily manage platforms. Moreover, Connect offers various tools for any business model.

Stripe Connect is Stripe’s solution for marketplaces that has three models to choose from:

- Standard — everything is covered by Stripe. The user has to create the accounts both on the marketplace app and on Stripe to manage payments.

- Express — a mix between Standard and Custom models. Stripe handles some parts, and others can be tailored.

- Custom — the name speaks for itself. With sufficient resources and a development team, you can fully customize everything from the registration form to the dashboard. This is the most complicated model.

Stripe Pros and Cons

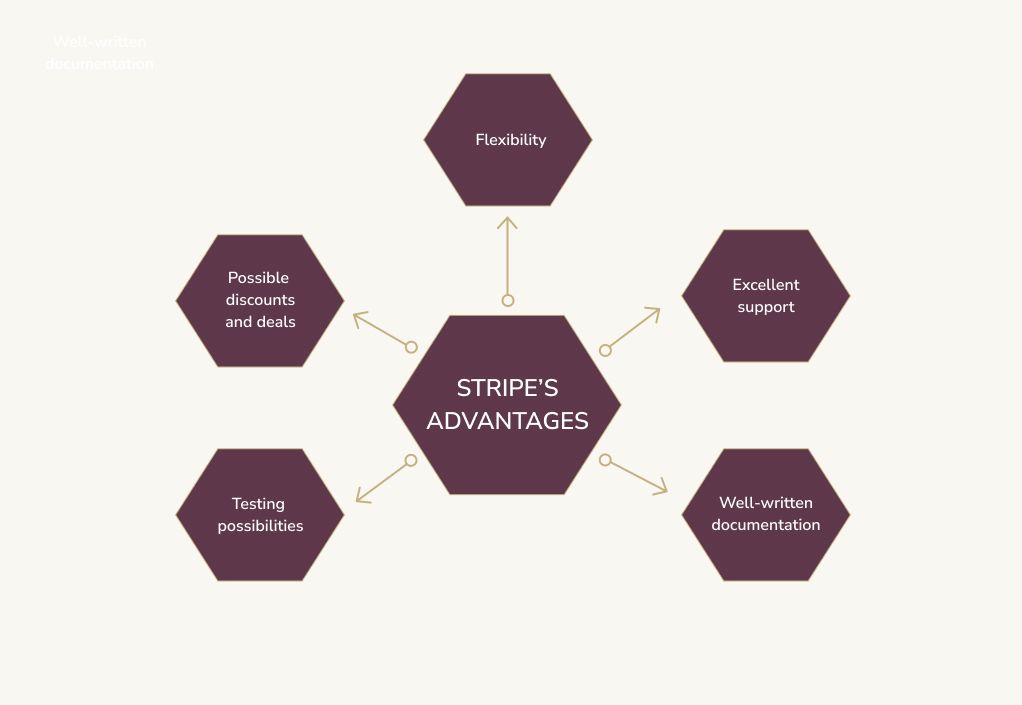

Pros of Stripe

- Ease of Use

Online businesses appreciate this credit card processor for being super easy to use. Its well-architectured API is not only free but also extremely simple. Entrepreneurs with minimum developer experience can customize it for their specific e-commerce activity almost effortlessly.

- A Large Number of Integrations

Stripe provides a wide variety of integration options so you can choose the most convenient one for your business. The system is compatible with various pre-built e-commerce plug-ins, including Drupal, Magento, PrestaShop, WooCommerce, WordPress, and Shopware.

- Detailed Documentation

Stripe was created by developers for developers. They have detailed, up-to-date documentation for various programming languages. You will find very detailed explanations for gateway customization and its testing possibilities. Stripe documentation is written in plain language, so anyone can understand how to use its features and work with API.

- Custom Libraries

Stripe custom libraries include a majority of programming languages. Developers can use Javascript, Ruby, PHP, Java, Python, and Node.js. You can focus on the product since there is no need to write additional subprograms to integrate Stripe.

- Payment Options

The system processes cards from major brands (e.g., American Express, Visa, Discover, Mastercard) and niche products (e.g., JCB, UnionPay, Diners Club). It accepts payments from Apple and Google Pay, Masterpass, Visa Checkout, Microsoft Pay, Amex Express Checkout, WeChat Pay, and other digital wallets. Stripe also allows for recurring regular payments, such as subscriptions.

- Testing Environment

Stripe can boast of its bug-free testing environment. The platform provides users dozens of sample credit card numbers, some of which contain invalid numbers. This way, you can see how the system generally works and the specific error codes. Stripe gives the option to switch between production mode and testing mode. Also, you can access the testing mode from countries where Stripe doesn't operate. This made the lives of our QA specialists much easier.

- Excellent Support

We communicated with Stripe’s support a lot, and this experience was great. Their team processed our questions and inquiries quickly and effectively. Stripe's company values definitely include the utmost attention to customers' needs. Also, the company is open to negotiating discounts and special deals for startups.

Cons of Stripe

- Geo Limitations

Stripe can process payments from anywhere in the world. But, it can only be used by businesses in 44 countries ( their team is working to add more). On top of that, some of its features may not be available in certain regions. However, you can use Stripe Atlas to incorporate a U.S. company, no matter where you are based.

- Requires a Developer

As mentioned above, Stripe customization involves some API key juggling. Therefore, to customize it, you must either be a developer or hire someone with a technical background. Alternatively, you can use pre-built solutions created by Stripe partners and get started with the system without coding.

Comparing Stripe and PayPal

There are a lot of ‘Stripe vs PayPal’ debates today. Considering the numerous advantages of each payment processor, it’s quite challenging to identify the best fit for your business. Let’s compare their core features and point out key differences. Hopefully, this will help you make a more informed decision.

Fees

Stripe's fees differ by volume and country:

- transaction fee: 2.9% + $0.30 per online payment with discounts for large-volume businesses)

- international payments: 1% fee with multi-currency support

- volume discounts: allows lower fees to 2.2% + $0.30 per transaction or less ( this depends on the volume)

You can choose a customized model, which will be especially beneficial if you’re a high-volume business. In that case Stripe will offer you discounts to help you save more.

PayPal’s fees are a bit higher for international transactions:

- transaction fee: 2.9% + $0.30 per transaction

- international payments: 4.4% + a fixed fee

- volume discounts differ

Security

Both Stripe and PayPal are very stable platforms and take security seriously. If you use Stripe, customer credit card data is never sent to your server. Instead, all the information is transmitted directly to Stripe, so you don’t have to store sensitive data.

PayPal works the opposite way, putting a significant security burden on developers or customers. Using this system means card data goes through your server first. This adds responsibility to your business.

API

When it went public, Stripe's API was a difference-maker. It’s written in simple language, clean, and extremely easy to use. Stripe's documentation is excellent compared to other platforms' inconsistent and buggy APIs.

PayPal rethought its API approach due to fierce competition. Their updated RESTful API documentation now looks much improved, reminiscent of the Stipe’s.

Data Portability

Imagine that: PayPal prevents users from transferring credit card data to another payment processor. So, if you’ve developed a successful membership site powered with PayPal subscriptions, you risk losing your existing customers because some of them probably won’t sign up again.

In contrast, Stripe ensures successful data portability. If you switch from PayPal to Stripe, you can quickly and securely migrate your data. It will be PCI-compliant. Stripe users highly appreciate their obstacle-free right to choose.

Wrapping up

So, who is the winner in this ‘PayPal vs Stripe’ battle? Both of them have fair fees, simple API, and sufficient security. However, Stripe is the cheaper option, encouraging more secure practices and easy data migration.

Comparing Stripe and Square

Another popular platform for businesses looking to process payments is Square. Is it better than Stripe? Let’s make a quick comparison.

Fees

Square's pricing features a flat transaction fee, which is slightly lower than PayPal's:

- transaction fee: 2.6% + $0.10 per online payment

- international payments: 1% fee

- chargeback fee: $15 per transaction

With a chargeback fee also lower than PayPal's, Square’s rates are ideal for online payments.

Setup

Depending on your business needs and capabilities, you can choose simple or complex ways to set up Stripe. If you're not tech-savvy, you can install Stripe's built-in checkout. But if you want to build a custom payment platform with Stripe Elements, you'll need the help of a developer.

Square’s setup is similar to Stripe’s, providing a checkout option and a customizable API. However, its developer documentation is less thorough, which makes setting up more complicated.

Payment Methods

Your customers will have many more payment options if you use Stripe. This platform processes payment from all popular credit cards and digital wallets, which can significantly increase conversion rates. In this regard, Stripe definitely wins in the ‘Stripe vs Square’ battle.

Summing up

Although Square and Stripe have the same online transaction fees, the first offers more powerful in-person payment options. Its setup for e-commerce stores is also easier to complete. But if you are running an international business, Stripe would be a great option due to its fair fee and a long list of payment alternatives.

Payment System Integration into a Marketplace

Every startup begins with a great idea. But more is needed for ultimate success. Other factors come into play. For any marketplace, choosing the correct payment system is crucial. We’d like to briefly share our experience of Stripe integration into a marketplace app called ESOOKO.

Before working on integration, we had to choose the payment system. We reviewed 27 payment platforms, including the top ones, Stripe and PayPal.

Some payment systems only work in certain countries (e.g., the U.S.). Others have very high costs and fees.

Since Stripe has undeniable advantages, we chose it for our marketplace.

While working on this integration, we faced a series of challenges, which are described below. Yet, we overcame them and found solutions to every ambiguous situation. Now, we are confident in our ability to integrate any payment system into any project.

Registration and Verification Processes

This was our first big challenge, as the information required for registration and verification may vary by country. For example, it would be different for users from the EU and non-EU countries. It is also necessary to monitor for changes in laws or regulations that affect the info. Stripe's team tracks and applies these changes to their system. This lets businesses focus on the development and growth of their projects.

We chose Stripe Connect Custom Accounts and could still use Stripes flow for registration and verification. The process was set up ideally: we didn't have to check daily for law changes, and ESOOKO didn't have to worry about users’ security. Stripe processed all the sensitive info on their side.

Adding and Using Debit Cards

Now it’s time to explain how the backend and the frontend of ESOOKO’s iOS application work. (By the way, you can get more information on this case by following this link.)

The central part of all the data processing happens on the back end. We can save certain debit card information in the application and allow the user to choose which card to use for the payment. However, we don't have all the necessary permissions and certificates to save all the debit card information (we’re not a financial organization).

Stripe handles all inquiries with the bank. For example, it checks if 3-D secure verification is necessary before adding the card and allowing any actions. So when we need debit card information, the frontend requests the backend for the card info. Stripe gets a request from the backend and gives us some limited info (the last four digits of the card number).

At checkout, we get the items the user wants to buy. Then, we calculate the total (including all fees) and create the bill at the back end. After the app requests payment and Stripe approves it, the money is transferred to ESOOKO's account. Then, it is sent to the seller minus the fees.

Commissions

The process of transferring money seems effortless. If we only need to transfer a certain amount from one account to the other, then yes, it is pretty straightforward. But, if an intermediary receives a commission, it gets more complicated. This is true for any marketplace. This is why, in some countries, it takes a lot of work to set up the marketplace operation.

Fortunately, EU laws and regulations provide a legal basis for online shops and marketplaces. Stripe gets commissions for each transaction, but the fees differ for EU and non-EU countries. The app takes into account the type of card the user has.

There is a monthly fee per active user (around 2€/month). The user is active if they make at least one transaction a month. Otherwise, the account is deemed inactive, and Stripe won't charge the fee.

Different Currencies

If the buyer adds products with prices in different currencies to the basket, we divide the basket into several orders. There will thus be several transactions, and the exchange rate will depend on the buyer's bank rate.

Stripe Payout to Customer

The user must add account data to transfer the money from the system to the bank account. It was another challenge for us as the necessary account details vary from country to country. Most European countries use IBAN. Britain has two different codes. Chinese banks use 4 or 5 codes for account info.

We developed a solution on the front end so users from different countries can put the necessary information in a respective number of data input fields. During the user verification process, Stripe will identify the linked bank account. If verification is successful, the user gets automated payouts. It is possible to customize this process and get instant payouts.

Conclusion

Stripe is a perfect solution for international businesses. Diverse payment options make this platform a game-changer for your web store, as customers find it highly convenient. No matter where you are based, you can build your e-commerce presence and scale your business using Stripe.

At Impressit, we see every new challenge as an opportunity to learn and develop. This Stripe integration case posed a few challenges, which helped us learn as we resolved them. This priceless experience will come in handy for our future projects. We can now proudly state we can integrate Stripe into any solution.

Andriy Lekh

Other articles